You wouldn’t be wrong to think the world was coming to an end. The last few weeks have been a mini-size learning experience like a Happy Meal with a disappointing prize inside. Because you, dear reader, have been preparing for times like these. The times when markets can temporarily make dreams come true, then take it all away. This isn’t that time yet. But it’s not that simple.

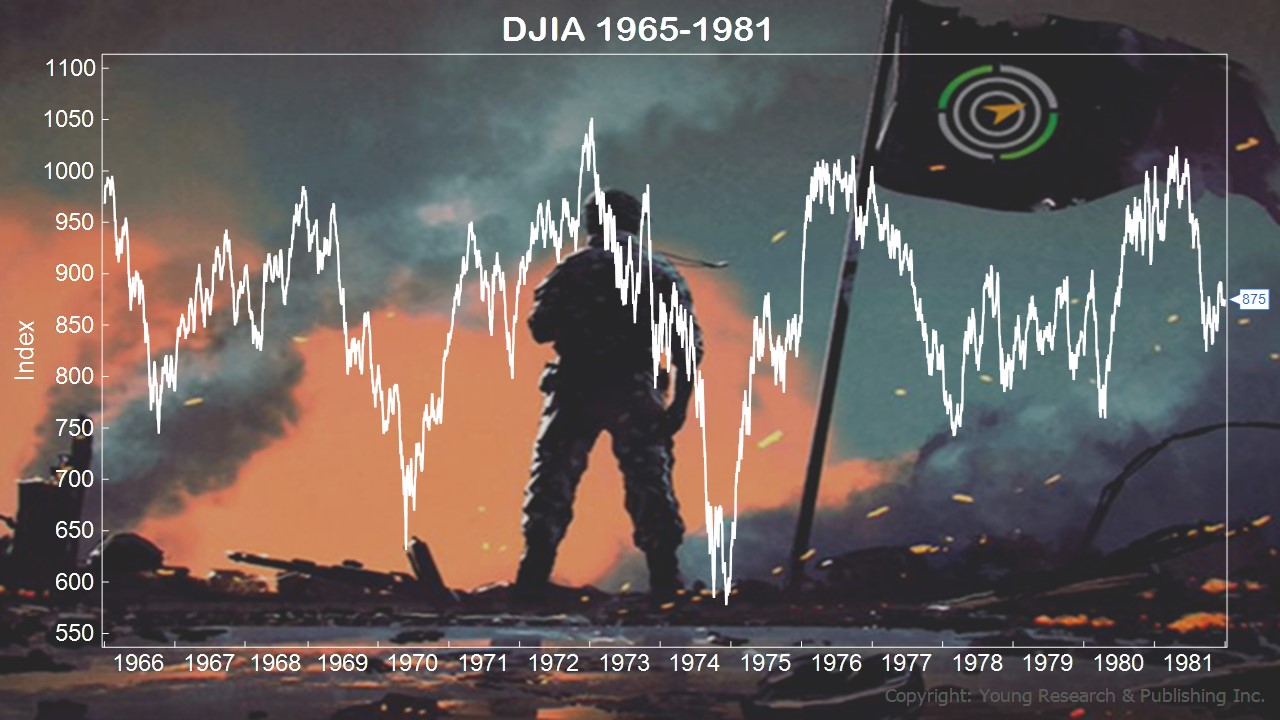

The lesson we can all learn from the stock market mini-selloff was how it made us feel. Imagine if the mini decline continued for a few years, never mind what felt like an eternity (so I’m told) during the 16 years during the late ’60s to early ‘80s where the price of the Dow was stagnant—a good chunk of a retirement life for many.

Imagine we’re at the beginning years of another similar stretch. Would you be so eager to buy the dip? Would you have enough income to “ride it out?” That’s a bit presumptuous: “Buying the dip” and “riding it out.” It amazes me how investors think they have the money or time to do either one. Yes, recent history supports the claim that stocks come back, like they did for the three busts so far this century: tech, real estate, Covid. But a lot of that was thanks to the Fed coming to the rescue.

I smile to myself when prospective clients tell me that “stocks have done 10% a year, so that’s what they expect.”

“Thanks for the history lesson,” I think.

Let’s not forget that “historically,” somewhere between a third and one-half of the return was from dividends. Today, dividends, a quantitative measure, are, for most investors, an afterthought with the crowd’s focus on the qualitative measure of prices.

Action Line: Prices are simply the emotion of the crowd. Sure, crowds can be right. But maybe not on your schedule. Don’t let emotions ruin what should be one of the best times of your life: Your Retirement Life. When you’re ready to talk, let’s talk. But only if you’re serious. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.