The FAANG stocks have dominated market headlines and driven a significant portion of the return on the S&P 500 over the last five years.

But the sheen finally appears to be wearing off. The first signs of a change in sentiment started with smaller growth firms or the ARK Innovation ETF type stocks. Think Zoom, Docusign, Teledoc, Roku, etc. The ARK Innovation ETF peaked in February of last year. It fell sharply in the second quarter of last year and today it sits 67% below its all-time high.

The FAANGs were spared in the early stages of the technology / high growth bust and some investors even viewed them as safe-haven stocks, but that didn’t last.

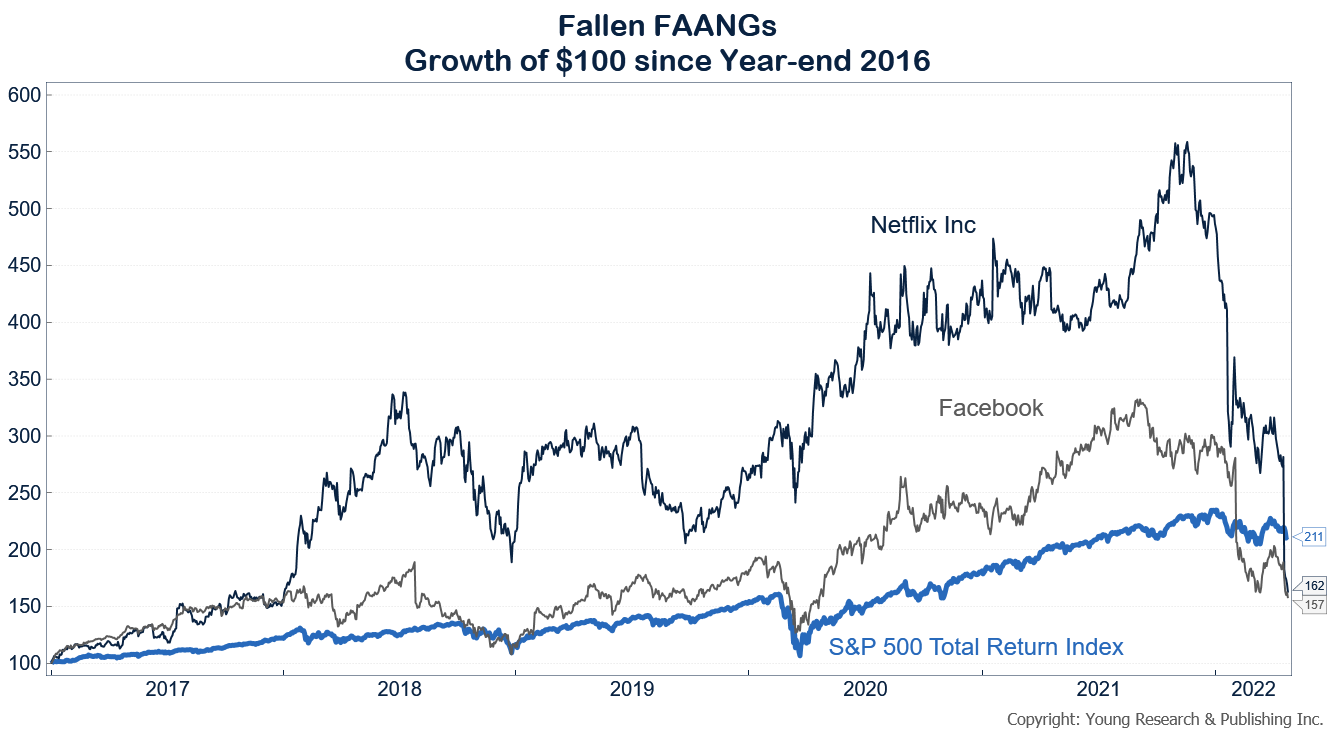

Facebook was the first FAANG to fall. Facebook peaked in September of last year and the shares are down 53% from their all-time high. Then it was Netflix turn. Netflix shares peaked in November of last year. They fell almost 50% over the ensuing two months and then took a second major leg down last week (-40%) after reporting weak subscriber numbers. Netflix shares are now down 70% from their all-time high. If you bought Netflix at its high, you need the stock to gain 233% just to get back to even.

These weren’t small companies whose share prices cratered. Facebook was among the five largest companies in the U.S. by market value and Netflix was in the top 20 at its peak. Those in or nearing retirement who took their eye off of the dividend and compounding ball to chase performance got the guillotine treatment.

Almost five years of outperforming the broader market by a wide margin was lost over the course of about six months. The chart below shows the carnage.

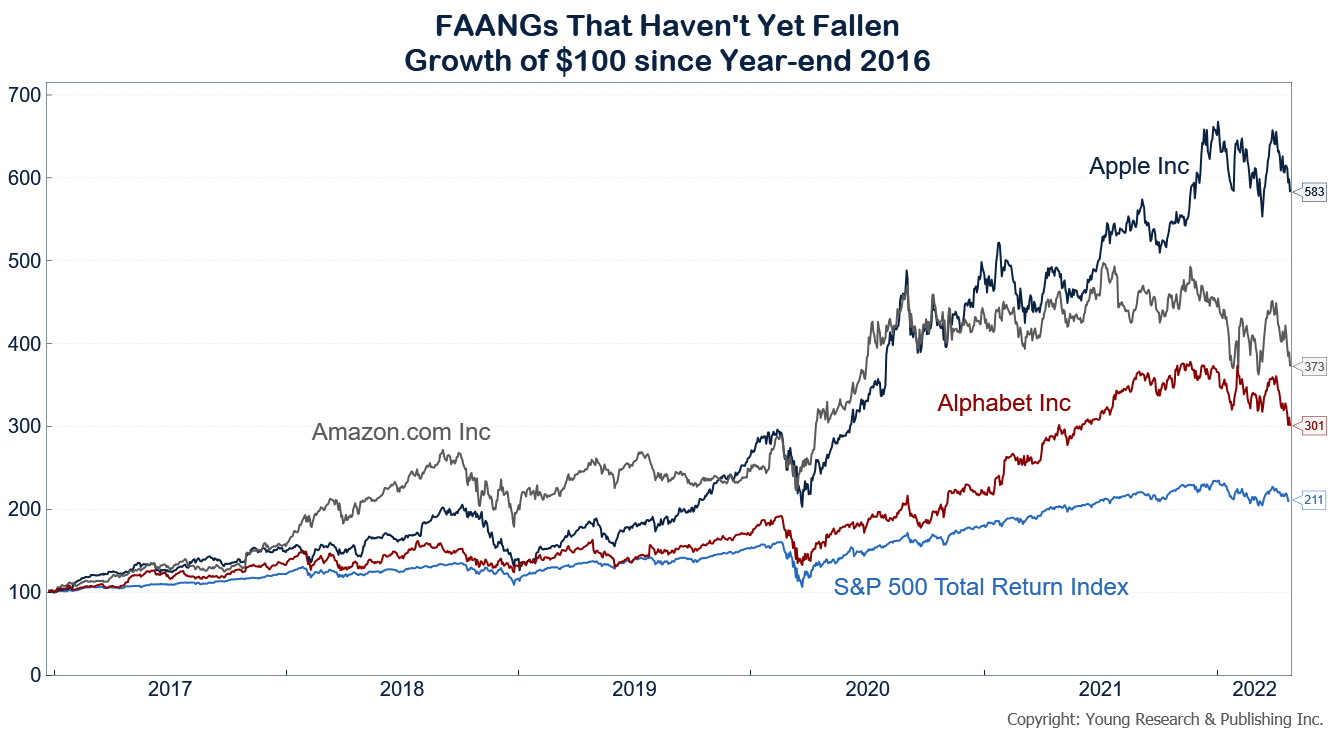

Thus far, three of the FAANGs are still standing. They include Apple, Amazon, and Google. All three maintain a significant five-year return advantage over the broader market (see chart below), but would you stake your retirement future on their ability to avoid the fate of Facebook, Netflix, and an entire sector of smaller high growth firms?

If you are a conservative investor or if you are in or nearing retirement, a value conscious strategy focused on dividends today and higher dividends tomorrow may suit you better.