Emerging market stocks have had a solid bull run YTD with the benchmark MSCI emerging markets index up 34%. Good news follows good performance (yes you read that right) so the pundits are out promoting emerging market shares. The story being offered to the investment public is that growth is improving in emerging markets, emerging markets are cheap, and the U.S. is expensive. That is more or less right, though valuations could be debated, but the real story behind the boom in emerging markets shares has much more to do with Tech stocks than it does with growth and valuations in emerging economies.

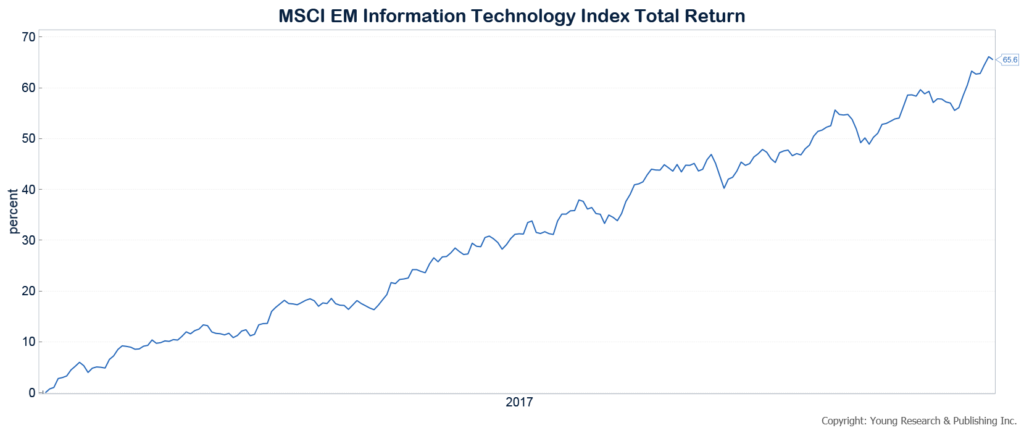

Like its S&P 500 counterpart, the MSCI Emerging Markets index is a tech heavy index. Information technology accounts for almost 30% of EM today. YTD, the MSCI EM Technology index is up over 65%. Some of the stocks driving the MSCI EM Tech index higher are Tencent, Samsung, Alibaba, Taiwan Semi, and Baidu. Like the FAANG stocks driving the S&P higher, all five are highly priced and speculative. Back out tech and the emerging markets index looks much more like the performance developed market stocks.