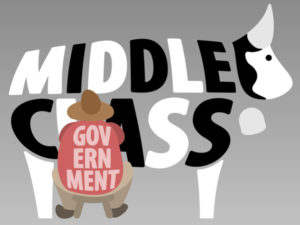

Now that Connecticut has raised taxes on the wealthy so high many of them are fleeing the state, Ned Lamont, the state’s governor, and its legislature, are setting their sites on the middle class to fund state government.

The state is overloaded with debt. After a borrowing binge, the state raised taxes, but it still can’t pay its bills. So, rather than making the hard choices by cutting spending, the government is coming after middle class families with taxes on things like soda and electronic cigarettes.

In the CT Mirror, Thomas Aiello, a policy and government affairs associate with the National Taxpayers Union, explains the governor’s folly, writing:

Overburdened taxpayers anxiously awaited Gov. Ned Lamont’s first budget proposal recently, hoping to see meaningful tax relief for job creators and middle-class families. Much like his predecessor, Gov. Lamont promised not to raise taxes; however, his budget will leave taxpayers gravely disappointed. Tax hikes on the most vulnerable, increased borrowing, and a kick-the-can approach to state finances is the same path that has led Connecticut to its current precarious situation, and is certainly the last thing the Constitution State needs now.

The central theme of the $43.1 billion budget is recovery through tax changes — or in other words, the same failed reliance on tax hikes. Due to ballooning pension obligations and economically damaging tax and spend policies, Lamont is looking for creative ways to plug a $3.7 billion budget deficit. This is a critical year for Connecticut, as Hartford’s anti-business agenda has resulted in two consecutive years of GDP contraction, and shrunk the labor force by tens of thousands. Equally troubling, five income tax hikes in 15 years have forced thousands to flee – mainly to other states with more favorable tax climates.

How many more years of stagnation will elected officials need to witness before they realize Connecticut needs real tax reform, not more tax increases?

Probably the most egregious scheme in Lamont’s budget is to promote what he calls a “healthier future” for Nutmeggers through a $163 million, first-in-the-nation statewide tax on sugary beverages. Years of research finds such punitive, regressive taxes are not the budgetary windfall proponents claim to be, nor do they improve health outcomes. In fact, evidence shows sugary beverage taxes devastate small businesses and hurt middle class workers. In Philadelphia, their tax cost the city thousands of jobs, many of which were union-held, $80 million in lost GDP, and $54 million less labor income, according to an Oxford University study. In Chicago, a similar tax threatened to eliminate 6,100 lost jobs, $321 million in lost wages, and $1.3 billion in lost economic activity.

Sugary beverage taxes are also extremely unpopular with the people who live in jurisdictions where these taxes are in place. In Chicago, voters initially were supportive of the tax, but after feeling the adverse economic effects, 87 percent of voters were united in calling for its repeal. After only 71 days, city lawmakers voted to roll back their tax. It’s a similar story in Philadelphia, where 70 percent of people now oppose the tax.

Read more from Aiello here.

Originally posted on Your Survival Guy.