Dear Survivor,

As my nephew asked me the other day, home from college and all the stuff one learns: “Uncle E, how you livin’?”

“How I’m livin’?” I thought to myself. I haven’t thought about it. But it gets right to the point, doesn’t it? Which brings me to my conversations with you. I know how you’re livin’—quite well—because you tell me.

Here’s what you’re doing. Fly fishing the Keys, catching some rays in St. Somewhere, hitting the powder out West, spending plenty of time relaxing on the beach, paying exorbitant prices for boat drinks, building houses and dreams, planning more trips, and seeing family.

“Send reinforcements, Survival Guy,” are words I’m accustomed to hearing. Hey, you gotta eat, right? I’m with you. But it’s not all fun and games. You’re working, too. Working on stuff you want to do, not actually working. Work? That’s in your rearview mirror.

You’re developing your skills. In one conversation this week, you told me about a recent excursion to Sig Sauer in Epping, New Hampshire, with your son and how you both signed up for a class at my favored academy (Read more about Sig Sauer Academy here, here, and here). Word on the range is that classes are filling up fast, so beat inertia and get out there. As they say, you don’t rise to the occasion, but instead, you fall to your level of training.

How’s the skiing? If you’re anywhere out West, it’s excellent. From the Silicon Slopes in Utah to Copper, Vail, Aspen, and Steamboat in Colorado, up to Jackson Hole, Wyoming, and the private powder in Montana, the snow has been abundant. Just try to ski during the week because the lines at some can be crazy on the weekends. As a side note, if you’re going off-piste, make sure you know where you’re going. There have been too many avoidable “accidents” (a dozen or so lost their way at Killington, VT), and watch your back. You’re not alone.

And me? Glad you asked. After a couple of weeks at my southernmost outpost in Key West, I’m back on the frozen tundra. Feels like negative eight this morning. Your Survival Guy will be making an Atlantic crossing later this spring on the Queen Mary 2 to London (then Paris). Did you know the Captain of the Titanic was named E.J. Smith? I’ll suffer through any anxiety up in the Queen’s Grille since it’s a longer voyage than my favored Global Express 7500, but I’ll survive.

Managing Your 401(k) Can Feel Like Time Standing Still

When Your Survival Guy graduated from Babson College in 1994, I got right to work. Right to work traveling, that is. I hit the road that summer, backpacking through Europe beginning with a trip to a Greek isle to visit a fraternity brother at his family’s summer place. That went so well that when I got home, I decided to be a ski instructor for the winter. Then, finally, I made my parents proud, and I got a “real” job at Fidelity Investments. That was March ’95. What’s the rush?

One of my tasks at Fidelity Investments was to jump on the phones when call volume was high. The other part of my day was handling back-office paperwork for 401(k) withdrawals. Sounds crazy, right? 401(k) withdrawals? How about additions? Isn’t investing all about adding to your savings like a 401(k)? Well, not exactly. Time and time again, I’d talk to folks who needed their money before retirement.

All these years later, the 401(k) still gets no respect. It gets thrown to the ground, and dirt kicked into its eyes when times are tough. Personally, I think it’s one of the greatest savings vehicles in town as long as you avoid owning too much company stock (don’t have all your eggs in one basket) and get away from the target maturities that have too much overlap.

But back to withdrawals, where I cut my teeth with 401(k)s. Yes, there are hardships that require taking money out of one’s savings, but if you can trick yourself into not knowing you have it (play along with me), you might not touch it. Here’s the deal. Investing is a psychological endeavor. You want to tell yourself, “Self, I don’t even consider that my money until I’m over 65.” That way, you can put your most precious asset, time, to work for you.

Investing isn’t easy. If you have a 401(k), try to set it and forget it. Simple to say. Harder to do. Often it feels like time standing still.

Your Retirement Life: Traveling the Efficient Frontier

Are you familiar with the efficient frontier? More on this in a minute. First, let’s talk about risk.

One of the more helpful exercises in understanding your own risk tolerance is imagining how you will react if your stock portfolio declines by 30% or so. You can do a historical review of how you reacted in times when markets took a beating. How did you feel? And how did you react?

Where you are in your stage of life is crucial, too. If you’re soon to be retired or newly retired, this is most likely uncharted water for you in terms of stock investing and your emotions. When you no longer have a paycheck and you’re in your 60s, that lifeline isn’t what it used to be.

That’s OK. You deserve to have the retirement you dreamed about. But as Your Survival Guy, I wonder about downside protection.

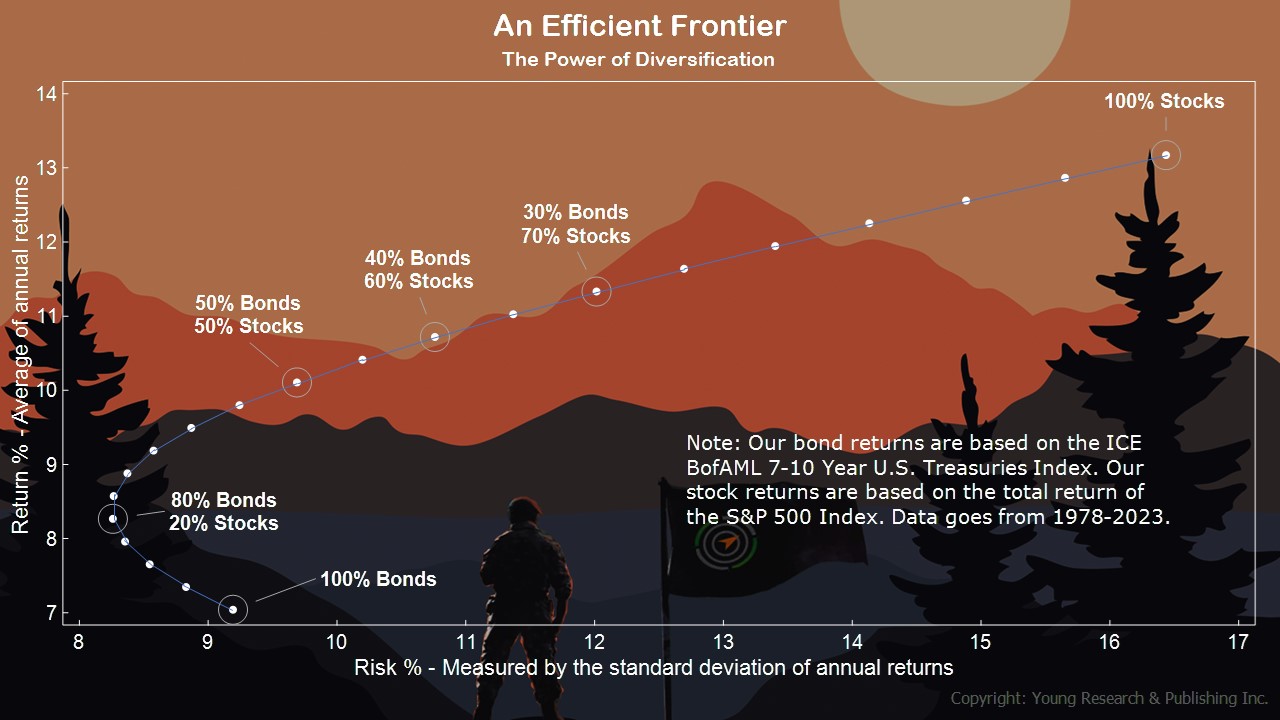

When you get your fixed-income house in order, a lot of good can happen. What I’m thinking about specifically is getting a handle on your stock market exposure. Look at my efficient frontier and see how you might want to be allocated.

The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Investors must consider the trade-offs between risk and reward in their portfolios. You can see on the chart above an efficient frontier line representing risk vs. reward for a portfolio allocated between different proportions of stocks and bonds using data back to 1978.

On the vertical axis is the return earned by the portfolios, and along the horizontal axis is a measure of how much risk was taken to earn those returns. As you can see by comparing the portfolio of 80% bonds and 20% stocks to the portfolio of just bonds, as portfolios take on a small number of stocks, the benefit of diversification lowers risk and increases reward. Anything above the line is unachievable because no portfolios earning those returns are available at the corresponding risk levels. And any portfolios that fall below the line can be outperformed with the same amount of risk or have their returns matched with less risk.

But to achieve higher returns along the line, investors adding more stocks to their portfolios are taking on ever greater amounts of risk. A portfolio of 100% stocks boasts a standard deviation of over 13%. Be aware of the risk in your portfolio and manage it wisely.

When you’re ready to talk, let’s talk.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Your Survival Guy’s been reading “My Effin’ Life,” by Geddy Lee of the band Rush. To understand Lee, one needs to know where he came from: the suburbs of Toronto, Canada, a child of holocaust surviving parents. His father died when Lee was only 12, and as such, Lee knew about loss at a young age. His mother, grief-stricken, made it hard for Lee to realize his own pain from the loss of his dad.

When Lee looks back, writing “My Effin’ Life” at age 69, he realizes he, too, was a survivor and not just a quiet kid. He was determined. He had calloused fingers from playing, he was hardened emotionally from being kicked out of one of his early bands, and he quit high school to become a full-time musician, much to his mother’s dismay (“Oy vey!).

And it took a long time for the band Rush to be known as well as they are today. Playing 200 gigs a year and still not making it was a grind and then some. It’s a hard life, Lee notes, being a musician, and it is not for the faint of heart. They didn’t have many breaks, but there were a couple. One was that the drinking age in Canada was lowered to 18 years, expanding the band’s bar audience overnight. Another was the explosion of punk rock’s three-chords-and-a-scream sound, which created a niche for a bigger group of fans looking for a more nuanced sound like Rush’s.

Then there is the talent. The talent was there. You know about drummer Neil Peart, but how about guitarist Alex Lifeson? “I know I’m biased,” Lee writes, “but I do think he’s the most underrated guitarist in the rock pantheon. Rush fans appreciate him, naturally, but I don’t believe he’s gotten his due from the mainstream or critical rock world.”

After a UK gig, Rush’s producer Terry Brown found a residential recording studio called Rockfield Studios, a rustic spot in Monmouthshire just over the Welsh border. It was the band’s first recording session abroad and resulted in the 1977 album “A Farewell to Kings.” On the song “Xanadu,” you can hear the birds outside while Neil Peart plays his wood blocks. You can also hear the sensitivity in their playing. A rock symphony by three kids from Canada.

We all have our own journey. Explaining how you “made it” cannot be captured in “I worked hard.” You forget the day-to-day grind. But you did it. Understanding that keeping what you make is a different skill than actually making it is not intuitive.

P.P.S. Looking over your shoulder is no way to live. Wondering who’s behind you. Wondering if you’re safe. Feeling uncertain. Uncomfortable. It’s scary.

Instead, walking with your head up, eyes forward, and shoulders back is the stride of the modern-day warrior. You never tire. You have the same confidence tomorrow as you do today. You’re comfortable with who you are. You don’t worry about the other guy. You stick to your game.

We make enough tough decisions in a day to keep our lives too busy. Take figuring out “what to watch tonight?” for example. It can shake one’s confidence. Then, finding where it’s streaming can be another issue. Makes one want to go to bed or read a book (remember those?). We live in a complicated world where decisions have consequences. Good and bad.

In the song “Tom Sawyer” by Rush, drummer Neil Peart explained in an interview how hard it was to play. Explaining that yes, it’s a slow-tempo song, but for him, playing sixteenth notes (16 hits per measure) on the hi-hat or ride cymbal was a workout. It drives the bus.

I want you to listen to Peart’s cymbal playing and relate it to your asset allocation. How you invest can be as important to your retirement success as anything else. Asset allocation can drive it forward.

Be a modern-day warrior. Have the stride to walk confidently into the future. Look at my efficient frontier above. Learn from it. Understand how asset allocation can drive your portfolio.

P.P.P.S. Your Survival Guy recently made a six-figure addition to my dividend-centric portfolio. Does that mean every single position pays a dividend? Not necessarily. It just means I favor dividend-payers over non-dividend-payers.

On the fixed income front, I have plenty for my age (52 years), with some gold as part of the mix. When you’re in your 50s, you want to build in some stability with bonds. As you get closer to retirement, I like the idea of gradually increasing that percentage. You need to figure out the right mix for you as you build your retirement plan.

In my conversations with you, we don’t talk about asset allocation every single time we talk. It’s more of a gradual understanding we figure out together. When you’re ready, let’s talk.

Download this post as a PDF by clicking here.