Dear Survivor,

If you’ve been breathing, then you’ve heard about bitcoin. Your Survival Guy is asked all the time, “What do you think of bitcoin?” Years ago, I was getting my hair cut and was asked about it. I said, “I don’t like it. I don’t see the value. I like the distributed ledger or blockchain technology, limited supply, blah, blah, blah.” It was trading at around $5,000. This week it hit $108,000. Thanks, Survival Guy.

I was asked the same question this week, and my answer was the same. I don’t like it. As I’ve written to you before, I don’t like the prediction business. I like being in the business of investing in stuff I understand. I’m fine if others make money faster than me. I know that gate swings both ways. I’ll remind everyone about the tortoise and the hare.

For you, my concern is in the power of time and money or compounding. Earning interest, being paid to invest. That’s quantitative. You can see the money coming into your account. Living and dying on prices is qualitative. Hoping someone will buy at a higher price isn’t investing. And when someone does buy, you no longer have your investment.

What I do like when it comes to tangible money is gold. Yes, I understand it doesn’t pay interest. But it has a track record as a truth teller about the malfeasance of government. It also brings smiles to the faces of loved ones who receive it as a gift this time of year. For as long as I’ve been working, I know I need to work to afford it. I don’t have that peace of mind with bitcoin.

There may be a case for bitcoin in portfolios. I know BlackRock is on board with an ETF offering via its iShares platform. Others are selling them, too. I also know they can charge fat fees, which is typically where the faith is placed, not necessarily in bitcoin. It’s all about fees, just like ESG was. Follow the money. I just don’t know about bitcoin’s value to you, the investor. I’ll pass, thank you.

Dear President Trump, Protect the Dollar with Gold

You know that for the last few years of the Biden administration, Americans have been hammered by the inflation tax. Biden and his friends in Washington, D.C., borrow dollars today, inflate the money supply, and pay the debt back with less valuable dollars later. That’s not good for savers and retirees who work their tails off and build wealth only to see the value of that wealth erode over time.

Incoming President-elect Donald Trump has a chance to protect American savers by protecting the value of the dollar. Trump has even brought on former congressman and presidential candidate Dr. Ron Paul as an advisor to the new Department of Government Efficiency. The most efficient way to protect the dollar would be to eliminate the Federal Reserve, and back it with gold.

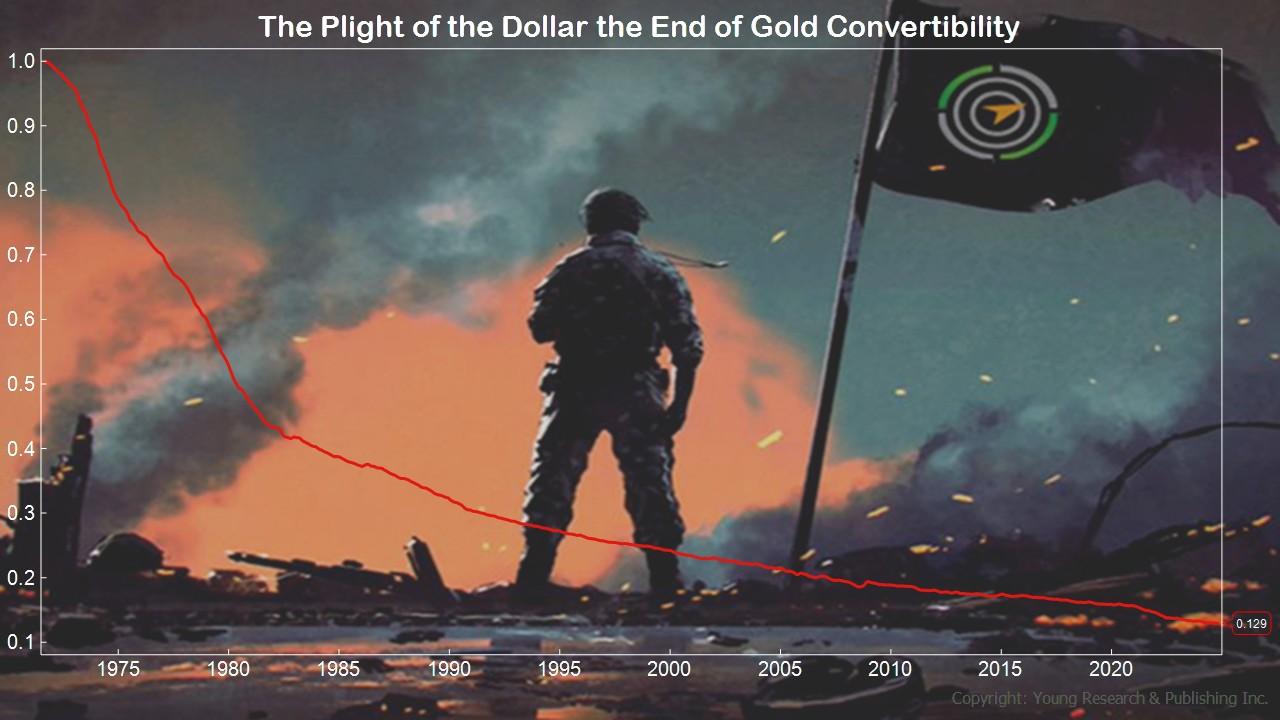

You know Your Survival Guy thinks America needs a gold standard. The value of the dollar has plummeted since gold convertibility was ended in 1971. Take a look at my chart, which shows the plight of the dollar.

That chart generously measures inflation using CPI, which many economists believe undercounts inflation. So the damage could be far worse.

But the idea of returning to the gold standard isn’t a new one. Here in the October 2015 issue of Richard C. Young’s Intelligence Report, Dick Young recounted a story shared by Richard Russell about President Ronald Reagan’s response to Congressman Ron Paul when the latter brought up the plight of the dollar. Dick wrote:

Richard Russell is now 91 years old. In a recent Dow Theory Letters, Russell wrote, “I spend most of my time in bed, which gives me plenty of time to think,” an activity that, over the decades, few in the investment industry have done in greater depth than has RR. Russell has been writing Dow Theory Letters since 1958. For decades, Russell, Ben Graham, J. Anthony Boeckh, and Harry D. Schultz have been primary sources of investing wisdom for me. Russell recently wrote about 12-term Congressman Ron Paul, who tells the story of once riding alongside President Ronald Reagan on his helicopter. When the subject of what was happening to our money came up, here’s what Mr. Reagan said: “Ron, no great nation that abandoned the gold standard has remained a great nation.”

Is America still a great nation? Is there time left to save the dollar with a return to a gold standard? Your Survival Guy will be watching.

“Walking Back to the House from 5 Brothers”

Walking back to the house recently from 5 Brothers, Cuban coffees in hand, it was hard to believe how well stocks were doing. “Remember, Survival Guy,” Dick said, “Study the historical performance of a balanced fund like Wellington and understand the value of counterbalancing.” That was back in 2007 when a certain candidate was running on “Hope and Change.”

How quickly life changes.

That same message was told to me by Dick Young back in 1998. “Survival Guy, it’s not about return on assets it’s about return of assets.”

Your Survival Guy studied the counterbalancing approach he had made famous through Richard C. Young’s Intelligence Report, holding on to every word like it was the gospel. Would you want to go head-to-head with him? I didn’t think so.

Here we are today, with immense anticipation for a bright future. And yet, here we are again talking about the principles of a balanced portfolio. You have read, like I did, about the death of balanced portfolios. Don’t believe it. The articles write themselves, and like clockwork, history proves them wrong.

Hope is not a strategy. History has proven that good times don’t last forever. Invest accordingly. When you’re ready to talk, let’s talk. But only if you’re serious. Email me at ejsmith@yoursurvivalguy.com.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. You read here recently about a couple of Your Survival Guy’s conversations through the years with Dick Young. Over Thanksgiving in Key West, we had plenty more to talk about, especially his favorite investment tool, the yield curve.

“Survival Guy,” he said. “There’s a reason the yield curve is my favorite investment tool. In a matter of seconds, I have the lay of the land. No punching in symbols for quotes. The truth is right there in an instant. Remind your clients of that.”

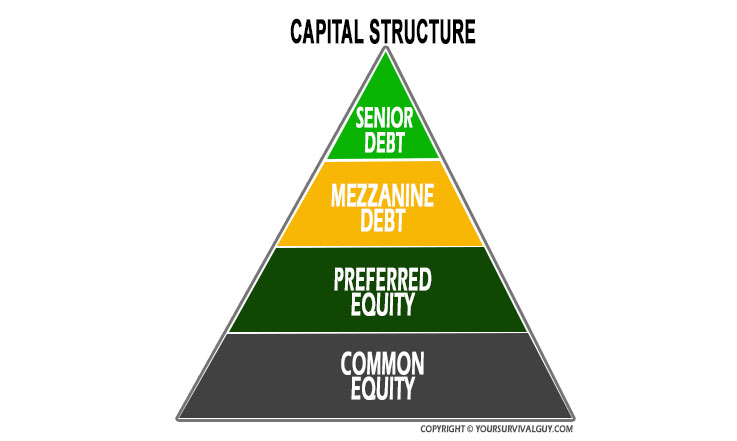

In times like these, when speculation runs rampant, remember the yield curve and the safety of Treasurys. Understand the role bonds play in the corporate capital structure.

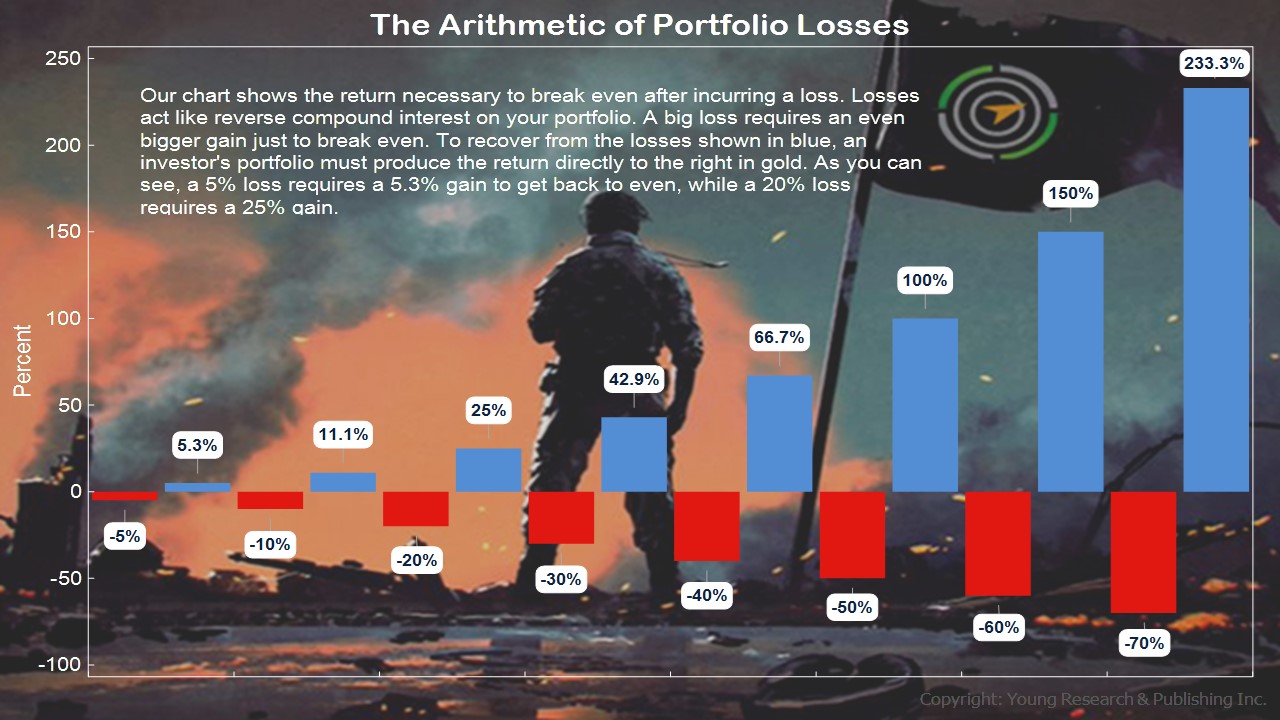

Do not be concerned about others making more money faster than you, because that gate swings both ways, and losing hurts a lot more than the joy of winning. Remind your loved ones about the arithmetic of losses.

P.P.S. The Tax Foundation has rebranded its State Business Tax Climate Index into the State Tax Competitiveness Index. Every year, the release gives Americans a view into which states are best at respecting residents’ money and which are the worst. Here’s the summary of the 2025 Index results:

The Tax Foundation’s State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

The 10 best states in this year’s Index are:

- Wyoming

- South Dakota

- Alaska

- Florida

- Montana

- New Hampshire

- Texas

- Tennessee

- North Dakota

- Indiana

The absence of a major tax is a common factor among many of the top 10 states. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. South Dakota and Wyoming have no corporate or individual income tax; Alaska has no individual income or state-level sales tax; Florida and Texas have no individual income tax; and New Hampshire and Montana have no sales tax, with New Hampshire also only imposing a narrow tax on interest and dividend income.

The lowest ranked states are the usual suspects.

The 10 lowest-ranked, or worst, states in this year’s Index are:

- Massachusetts

- Hawaii

- Vermont

- Minnesota

- Washington

- Maryland

- Connecticut

- California

- New Jersey

- New York

The states in the bottom 10 tend to have a number of issues in common: complex, nonneutral taxes with comparatively high rates. New Jersey, for example, is hampered by some of the highest property tax burdens in the country, has the highest-rate corporate income tax in the country, and has one of the highest-rate individual income taxes. Additionally, the state has a particularly aggressive treatment of international income, levies an inheritance tax, and maintains some of the nation’s worst-structured individual income taxes.

If you’re looking to relocate to a better America, start your search for a new home with Your Survival Guy’s 2024 Super States. I take taxation into account, as well as many other factors that concern Americans looking for freedom.

P.P.P.S. Only you know how much income you need to retire comfortably. You can run all the models and projections you want, but it’s up to you to make sure you’re good. CNBC reports that Fidelity Investments’s rule of thumb is that if you want to retire by 67, you need to save ten times your income. They write:

According to retirement plan provider Fidelity Investments, the rule of thumb is to save 10 times your income if you want to retire by age 67 — including anything in a retirement account and investments. Here’s how that breaks down by each decade along the way:

- Savings by age 30: the equivalent of your annual salary saved; if you earn $55,000 per year, by your 30th birthday you should have $55,000 saved

- Savings by age 40: three times your income

- Savings by age 50: six times your income

- Savings by age 60: eight times your income

- Savings by age 67: ten times your income

When you plan to retire matters. Those retiring at 62 (the earliest you can claim Social Security) will need to save more to compensate for an additional five years without income. On the other hand, those retiring at 70 probably won’t need the full amount of 10 times their income, as they will have worked an additional three years and presumably have fewer years left to spend their savings.

The type of lifestyle you want to have in retirement also plays a role. These age-based savings milestones are estimated to provide enough income for you to continue your current lifestyle in retirement, rather than planning to downsize or spend more.

The reality is, you need to save til it hurts. Then if you can, save a bit more. When you want to develop your retirement income plan, I’m here. Email me at ejsmith@yoursurvivalguy.com.

Download this post as a PDF by clicking here.

Originally posted on Your Survival Guy.