“Stocks always come back,” they say. “Just look at the history of the markets.”

OK, thinks Your Survival Guy. Let’s.

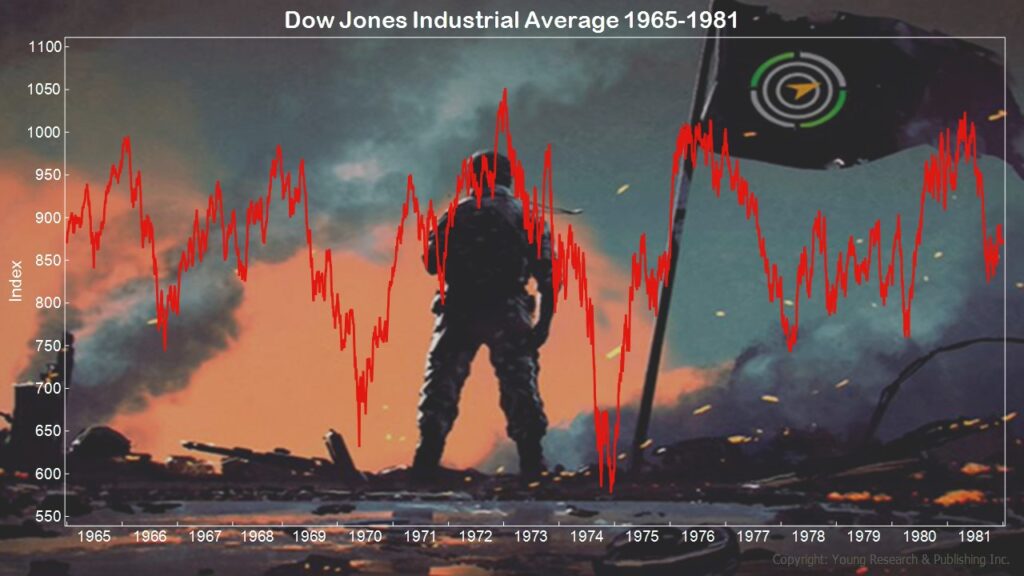

Take a look at how markets did from 1965 through the 70’s, a time not unlike today, where inflation soared, the country was in decline, and stocks did basically nothing good.

That’s a long time for markets to do nothing—a good chunk of retirement for those who were retired. That’s why building a margin of safety is so important for the retired investor. You need to have a line of defense in case stocks don’t save the day. You need to understand risk and know that it’s real, especially in times like these.

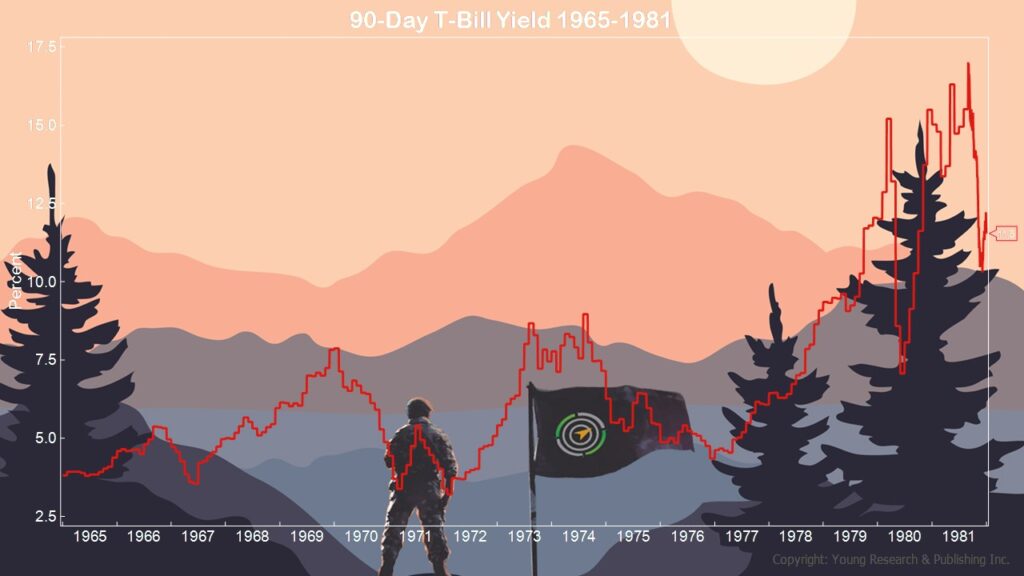

When constructing a portfolio for your retirement life, Your Survival Guy first and foremost looks for a stream of fixed income. You’re seeing a generational buying opportunity today, but remember there are two risks with bonds: default and/or maturity. I think we all know what default risk means and maturity risk—how long you need to wait for the bond to mature if it’s underwater and how different the world will be at that point. Everyone thinks they’re a patient, seasoned investor until they see prices go down.

It’s hard to be patient through thick and thin. Be careful with your money and do what is comfortable for you, not anyone else.

Your Survival Guy doesn’t buy stocks, hoping they’ll go up. No, I look at the income from dividends and the historical dividend increases. I want to see the money coming in. I want something tangible, not some pie-in-the-sky valuation based on overvalued prices.

Action Line: Much of retirement investing is about living to fight another day. Focusing on income, for example, is how I feel most comfortable. If you think you might too, then let’s talk.

Originally posted on Your Survival Guy.