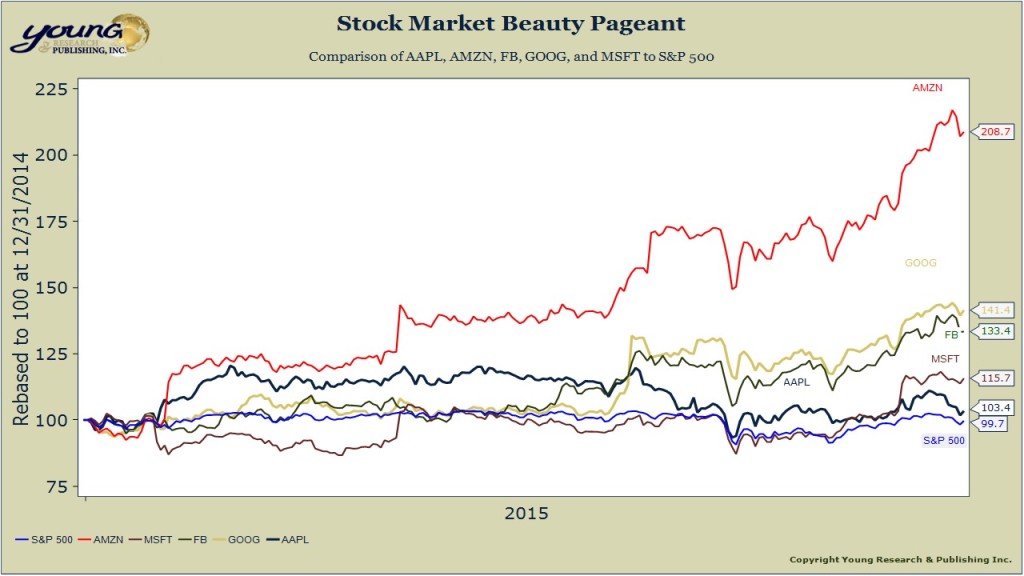

You know from Part I that this stock market is a beauty contest. Five companies account for two-thirds of the returns year-to-date for the S&P 500 Index. They are: Apple, Google, Microsoft, Facebook, and Amazon.

It has been my experience that investors make the grave mistake of confusing index investing with diversification.

Owning the S&P 500 does not mean you’re diversified.

Owning the S&P 500 means you own a market-cap weighted index of stocks where the companies with the largest market-cap have the most influence over its direction.

Like sheep heading to slaughter, investors continue to pile into index funds with false confidence: “Hey, Jack Bogle and Warren Buffet recommended it, what could go wrong?”

The Vanguard Group is the largest provider of index-tracking products. I love Vanguard. It has pulled in $196 billion of investor cash through October. It is on pace to beat last year’s record haul of $216 billion. But, right now, I would never own the Vaunguard 500 Index.

Life is good while the money train keeps chugging along. But let’s not confuse indexing with diversification. This stock market is a beauty contest and the bulk of this train consists of only five cars.