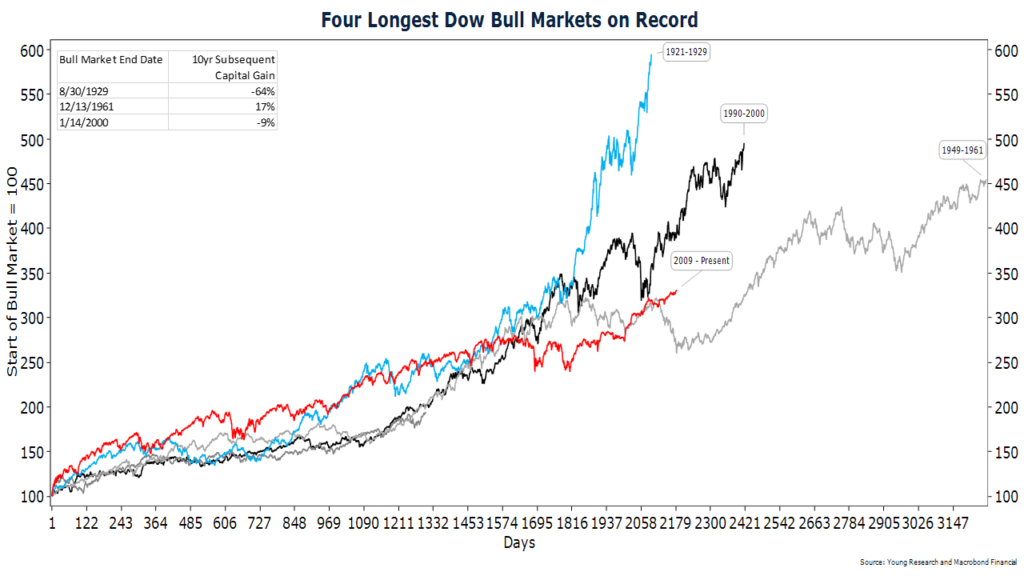

The current bull market which started in March of 2009 is now the third longest bull market on record. I’m using the Dow as the yardstick for bull and bear markets. Bear markets are defined as a 20% drop from a prior peak.

The fuel that has kept this bull running is of course the most aggressive and prolonged use of monetary stimulus in U.S., and probably world, history.

How do stocks perform following historic bull markets?

The chart below shows the four longest Dow bull markets on record. The table on the chart shows the subsequent ten year capital gain performance from the day prior to the end of the bull market.

In two of these three periods, ten years later the Dow was lower than its bull market peak, and in one period it had only produced a scant 17% gain. Think about it, over a ten year period—17% is a 1.6% compounded annual return.

What is the investment implication for you?

If history repeats, investors who tie their retirement futures to capital gains are in for a difficult 10 years. The solution to a potentially long dry spell for stocks is dividends. A dividend-focused investment strategy can help position your portfolio to ride out what may be a decade or so of low capital gains for stocks. And if the capital gains continue? Well, you’ll have some extra dividend income to spend.