If you tune into to the financial news networks regularly, you might get the mistaken impression that capital gains are the most important form of return for stocks. The focus of these programs tends to be oriented toward traders and speculators. Which stock is going to rise the most over the next 1, 3 or 6 month period is the topic of conversation. You hear little about dividends.

Focusing solely on capital gains is a big mistake. Dividends and the reinvestment of dividends accounts for a majority of the return on stocks.

Stock prices can remain depressed for agonizingly long periods of time. This is especially true if you’ve had the unfortunate luck of investing at market tops.

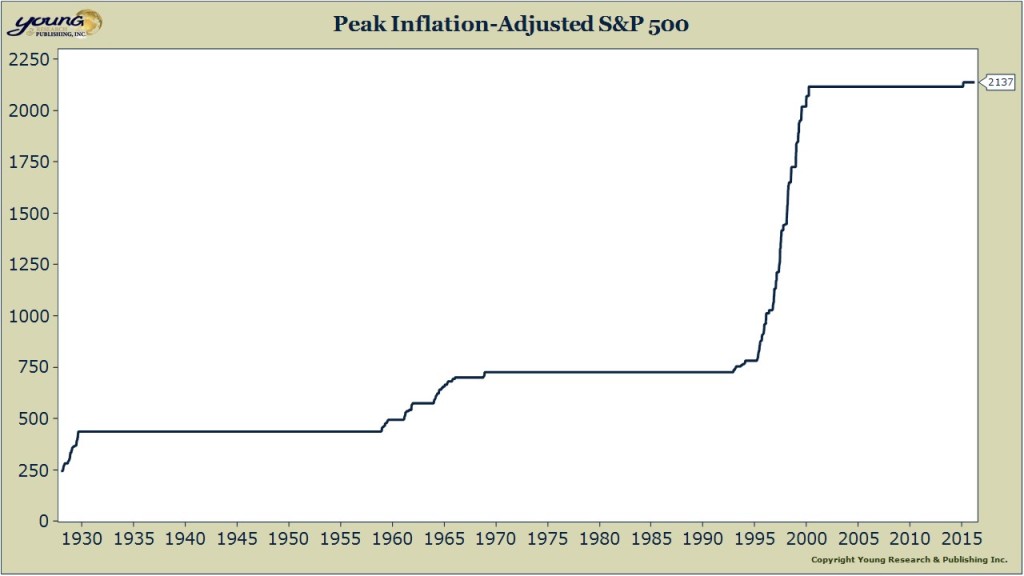

Check out the chart below. Here you are looking at the peak price of the inflation-adjusted S&P 500 index. Those long straight lines are the periods when stock prices never made a new inflation-adjusted high. If you had invested in 1929, it took 30 years before the capital gains on your portfolio surpassed inflation. If you invested in 1966, it also took 30 years for stock prices to again meaningfully surpass inflation. And if you invested in the Spring of 2000, 16 years ago, you are basically flat in terms of capital gains.

What is the lesson here? Isn’t it obvious, don’t invest at market tops! Okay, that might be impractical unless you have perfect foresight, in which case you surely don’t need suggestions on managing your portfolio.

The more practical and actionable lesson here is to make dividends a major component of your stock portfolio. Dividends help investors overcome long dry spells for stock prices.