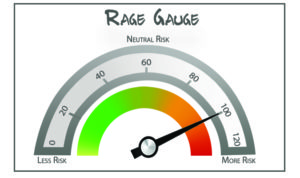

My March Rage Gauge is in, and it feels like the calm before the storm. Does that mean the market will have a huge downward correction this year? Like I’ve written to you in the past, I’m not in the prediction business. Because for you to be a great investor, you need to put together multiple seasons of investing and then maybe you’ll be able to look back and say: “Well, I wouldn’t want to do that again, but we made it.”

My March Rage Gauge is in, and it feels like the calm before the storm. Does that mean the market will have a huge downward correction this year? Like I’ve written to you in the past, I’m not in the prediction business. Because for you to be a great investor, you need to put together multiple seasons of investing and then maybe you’ll be able to look back and say: “Well, I wouldn’t want to do that again, but we made it.”

Let me explain. All of us have a pretty good feel for what’s going on today. Interest rates aren’t moving, the Trump economy is OK (It could be great again if the socialists don’t get their way), and the trade tension with China is easing. This is what I would refer to as a weatherman’s three-day forecast. We all know it. We all talk about it. It’s not worth much of anything.

What concerns me, and hopefully you, is that at some point there will be a price to pay for the mountain of U.S. debt, sustained rock bottom interest rates, an expensive stock market, low inflation, pension debt, and incompetent government, just to name a few. Because there are more than a handful of threats facing investors today.

And so, I ask? What is the downside of you being self-reliant as an investor and maintaining a survival guy investing mentality? The answer: there is none. There is no downside for you being on the safe side. It’s why now, this year, is a good time for you to take inventory of your investment life, including estate planning. It’s time to get your house in order while you can.

Tops on my list is thinking real hard about where you want to spend your retirement years. As we’ve seen in states like New York, New Jersey, Connecticut, and Rhode Island, money is mobile and will go where it’s well treated. For most of the year that is. Then, you can come back home. And trust me, your loved ones will visit you in Florida when the polar vortex descends upon them in January and February in New England or the upper Mid-West. There’s plenty of posts for you to read from me here, here, here, and here.

Just as important to your investment future is where you keep your investments. Consolidate your investments at Fidelity. It is #1A on my list of great ideas. Just yesterday, Fidelity posted record revenue and profit for last year as investors added $309 billion in new money in 2018. (I’m not a paid endorser of Fidelity, it’s just the best product I have found for investors like you and me).

But you don’t need me to tell you about my March Rage Gauge. Yes, it’s flashing warnings signs. But you see it every day in your car on your way to anywhere in America. The tension is right in front of your eyes. Actually, it’s in your rearview mirror. It’s the car jammed up to your bumper creating needless tension to push you out of your comfort zone. The fight is on. And to everyone else, you’re in the way. Not exactly pleasant.

Here’s what I want you to do.

If you felt upset at any point at the end of last year, now is the time to look yourself in the mirror and ask if you’re doing everything you can to make sure your family survives the next financial crisis. Because I don’t know if the big one is coming, but I do know you’ll be much more comfortable if you face the facts head-on and make the appropriate adjustments. Because the storm clouds will form again. And the calm before a storm is a terrible thing to waste. Get your financial house in order.

Originally posted on Your Survival Guy.