The global economy is in recovery mode. Europe is on the mend. China is improving. Economic growth in the U.S. is accelerating.

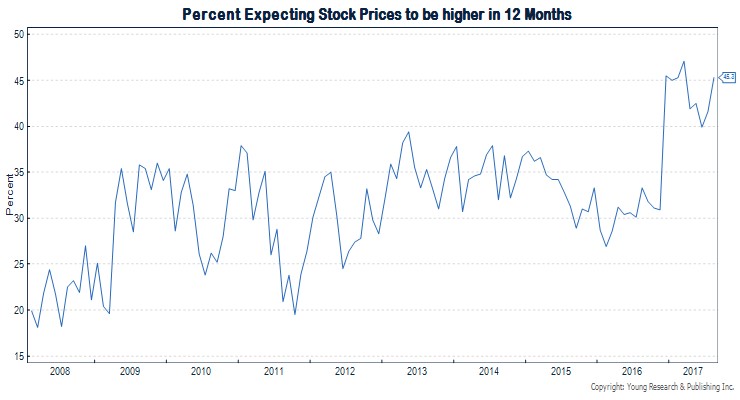

It’s all clear for the economy and stock market then, right? That seems to be the opinion of the average investor. The Conference Board’s consumer expectations survey for stocks shows that investor sentiment is near its highest level of the bull market.

So what’s the rub?

The bond market, the gold market, and stock market internals tell a different story.

The 30-year bond ended yesterday at a yield of 2.66%–giving up almost all of its post-election gains. If the outlook for growth is so bright, why are bond yields at their lowest levels of the year?

And if the economy is so strong, why is the SPDR GoldShares ETF on a tear? Gold is up 16% YTD compared to a 10% gain for the S&P 500.

A weaker dollar may explain some of the strength in gold, but a weaker dollar doesn’t explain falling bond yields, nor does it explain the recent strength in the defensive sectors of the market and the recent weakness in the more cyclical sectors of the market.

Market divergences are no reason to make wholesale changes to your portfolio, but they should make you think twice about increasing the risk in your portfolio because the outlook is so bright.