OK, let’s get right into this. I’m not a huge fan of goals when it comes to money. I don’t like the pressure a goal can have on investors trying to reach a certain “number.”

“Well, if we can make it to $2 million, we’ll be all set. That’s our goal,” says a 55-year-old with less than a million in savings.

That type of goal, in his most important earnings years—the last ten before retirement—is a loaded gun. The pressure to push, push, push and reach, reach, reach for the “goal” borders on reckless. It’s why Your Survival Guy eschews financial engines where you plug in your financial vitals, and then it spits out what you need to do to reach “your goal.” That’s when the pressure cooker begins boiling. That’s not cool.

What’s cool is living a life centered on compounding what you can control. In your life (not your neighbor’s or friend’s), you can control how much you spend, how much you work, how much you save, how much you eat, and how much you exercise. You can control how much sleep you get and how much rest your body needs. These are about you. You can compound most of these goals. They’re in your wheelhouse, not “Mr. Market’s.”

The good news is you don’t need to hit home runs to be a compounding machine. You do need to make sure you protect yourself—protect your base—have a foundation to build upon. Permanent loss is simply that—the opposite of compounding—it’s gone. Forever. I believe you want to be a compounding machine with what you can control to keep you in the race.

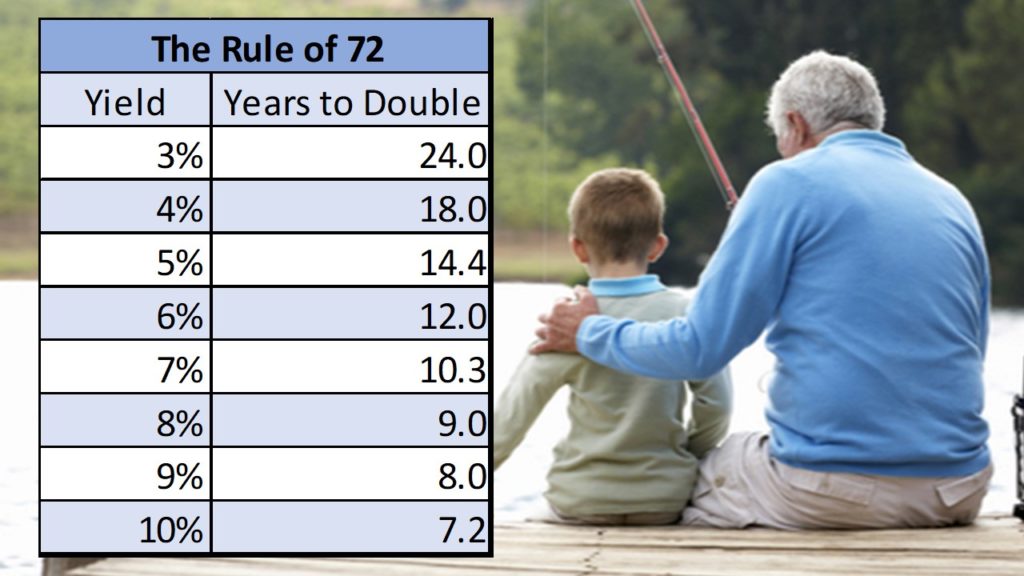

Action Line: Follow the “Rule of 72” in your slow and steady life. Understand what compounding small numbers looks like. Envision how to double your base. Think about the dangers of reverse compounding—the cost of servicing debt like credit cards, and you soon appreciate the slow and steady way of life. If you could use a little help, let’s talk.

Originally posted on Your Survival Guy.