I was on the phone with a client Wednesday morning when another line lit up indicating someone was being buzzed into my office from the locked foyer area. I was surprised not only to have a visitor but to see that it was my mother. She and my dad just got back from a trip to Europe and I wasn’t expecting to see them until Thanksgiving, which we’ll spend up in the White Mountains of New Hampshire. She was in town for an appointment and stopped by afterwards and we grabbed some coffee at Starbucks. If you’ve ever been inside our Newport office then you’ll know what my mom is talking about when she commented “E.J. it’s so quiet in your office”.

One of the many benefits of working off of the beaten path on a tree –lined street in beautiful Newport, RI is peace of mind. I live less than a mile away. I can walk down to the harbor at lunch or take a break with a drive around Ocean Drive or take a Power Yoga class at the studio next door. There are simply not a lot of stressful distractions taking me away from my work.

If you’re ever in the area I hope you’ll stop by so you can see for yourself what I’m talking about.

The Destructive Federal Reserve

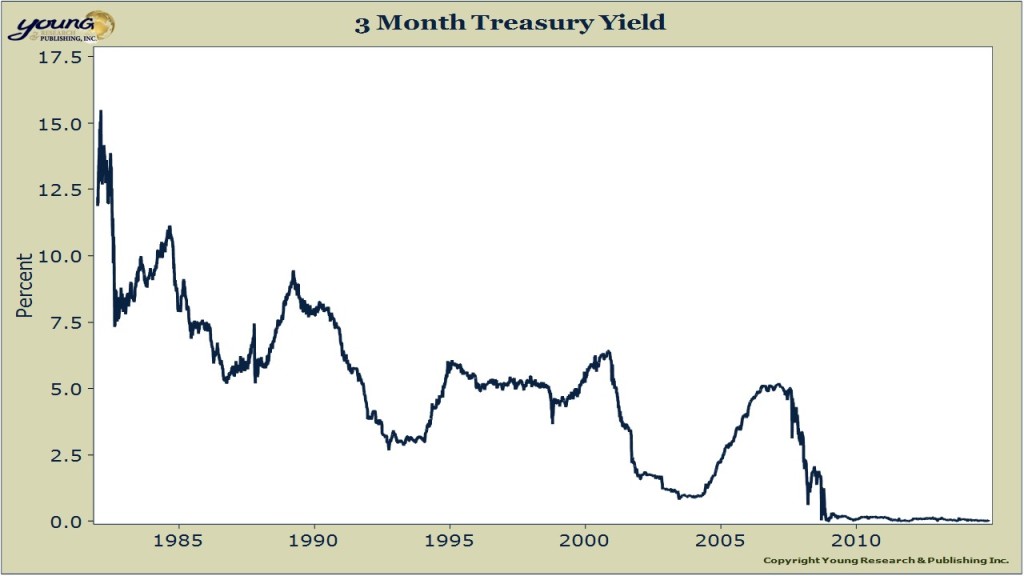

One of the topics my mom and I talked about is how low interest rates are. Has there ever been a more misguided group than the high priests at the Federal Reserve today? What they have done to the savings of successful Americans is criminal. Zero percent rates and money printing has done nothing for retirees, a group that historically could consider T-Bills as a cornerstone of their retirement portfolio. Now you can’t even buy a loaf of bread with the interest.

The Fed’s low rates have juiced the value of stocks and it certainly appears to me that investors are not reading the tea leaves. A 10% return is not a stock investor’s birthright. Stocks do go down. Since graduating from Babson College 20 years ago I’ve been through some nasty markets and lived to write about them. I want you to think of this environment as one where return of principal must be your primary goal because too-big-to-fail doesn’t apply to you.

With the Fed creating money out of thin air, real estate prices such as commercial and condos are going up like crazy especially in places like New York City and Miami. My family was in Key West for a long weekend earlier this month and I can tell you restaurants aren’t lowering their prices. And there’s a ton of money in certain pockets. I’ll use the boat racing teams in Key West as an example. There’s no shortage of spending power on toys here. Check out Miss Geico, which won the event.

Miss Geico 213mph World Champion Offshore Turbine Boat from UpDown Productions on Vimeo.

But again there’s deflation too. For retirees it’s a brutal deflationary environment for interest bearing savings accounts. That’s why it’s crucial that you get out of debt. The buying power of the dollars I used in Paris in the Spring was pitiful. It’s hard to believe that in a fiat currency world any currency, including the dollar, can be a store of value.

You need to maintain your dividend religion. The dividend paying companies we own for clients pay well above the miniature dividend of the average S&P 500 stock. Make sure you’re getting paid to invest in this market. Investors that bank on capital appreciation alone are going to be in for a rude awakening.

Down on Main Street

Remember, not every advisor has the back bone to stand there and not try to beat the market or to not be distracted by the noise on Wall Street. I am under no pressure to meet the demands of the market or fall prey to the distractions of Wall Street. I work on a tree-line street in Newport and on occasion have the pleasure of meeting with clients or as was the case on Wednesday, my mother. I take great pride in working with the real people of America like you.