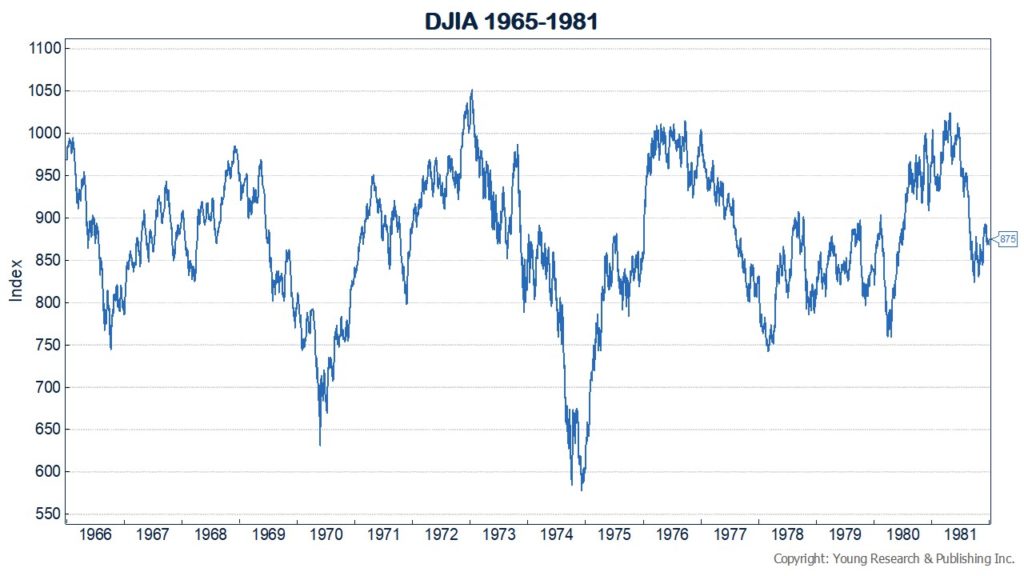

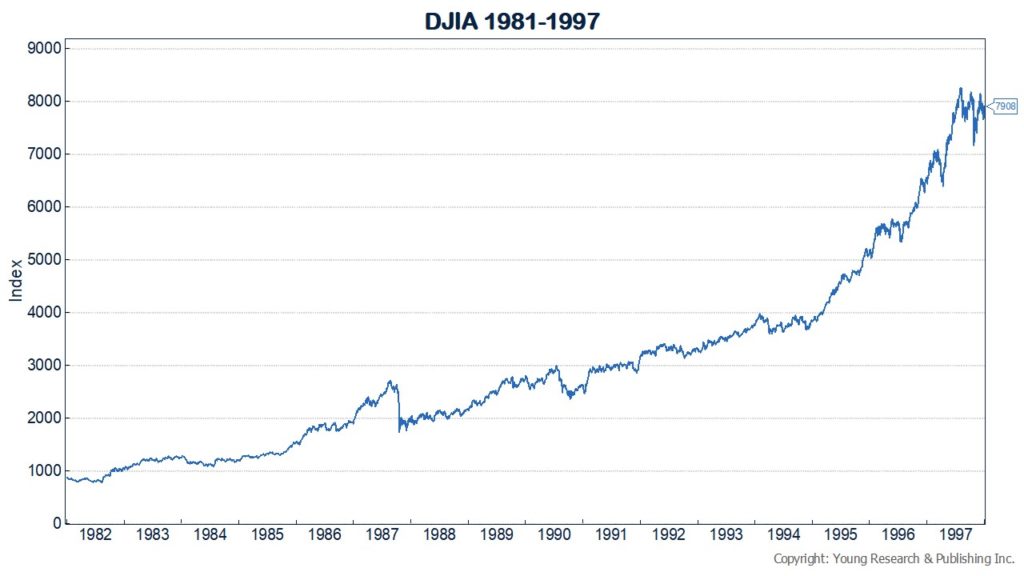

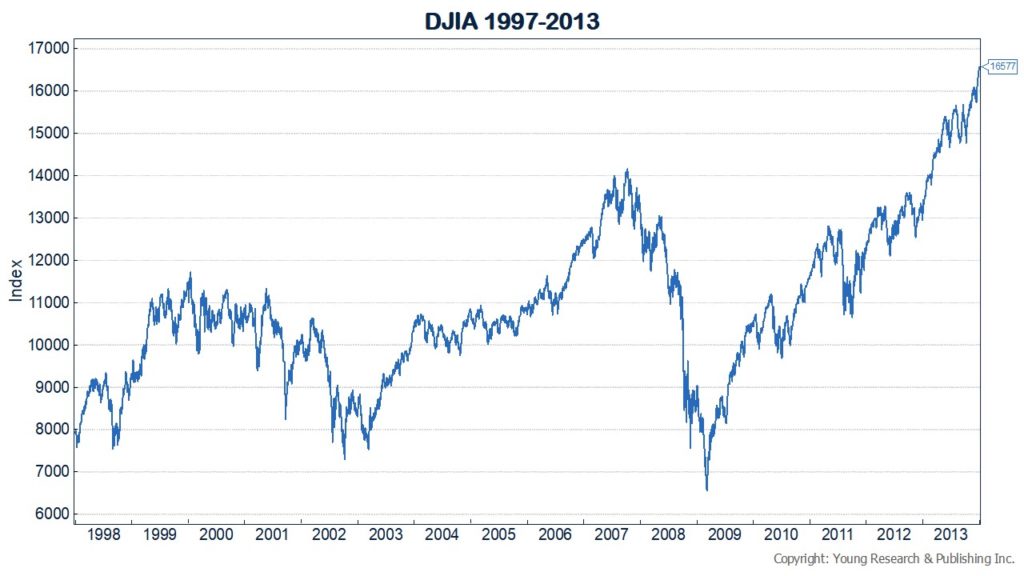

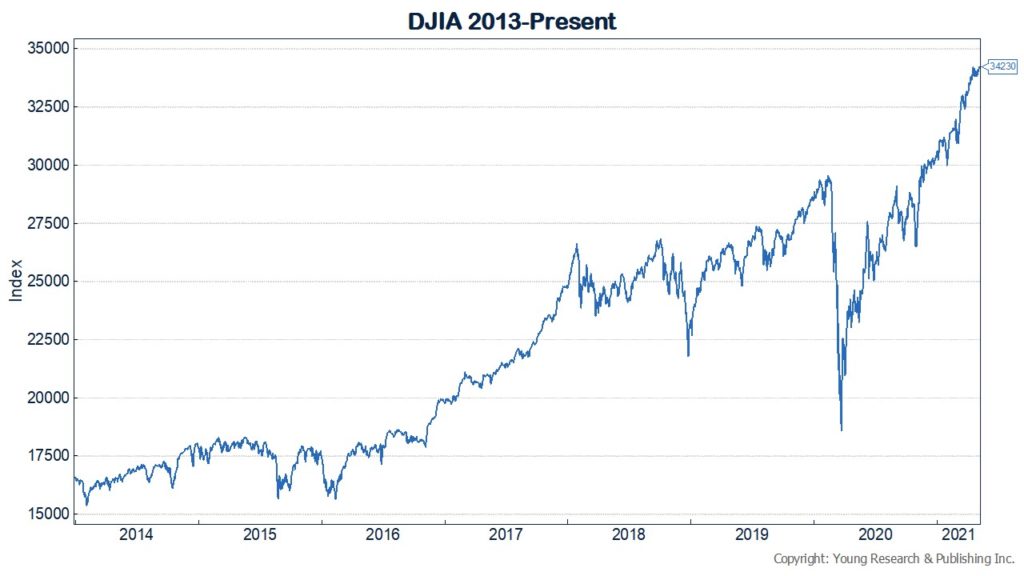

You and I are in uncharted waters as we look ahead. The next sixteen years are unknown—but those years will make up a good chunk of your pre-retirement savings or retirement years. Let’s look at the past, in sixteen-year groupings, shall we? (Note: Chart four is only halfway there).

As you can see, if you had your choice, you’d want to retire in 1981. But since you can’t do that, there’s plenty to worry about—especially when you start socking away serious money. Why risk it on an all-stocks strategy in your 50s?

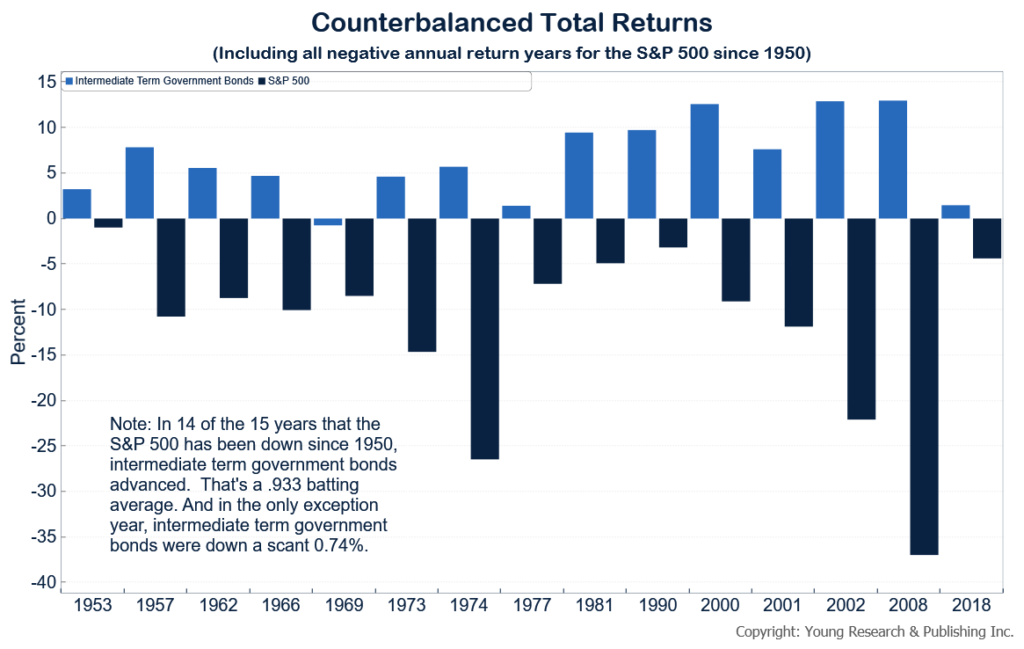

Your 50s are when you need to be dead serious about smoothing out your returns. It’s when you need to consider counterbalancing your portfolio with some bonds. How much, and which ones, are up to you. As I’ve explained before, I like you owning bonds individually (not through mutual funds or ETFs) where, if all goes according to plan, you receive interest along the way and principal at maturity, much like a CD. How about stocks?

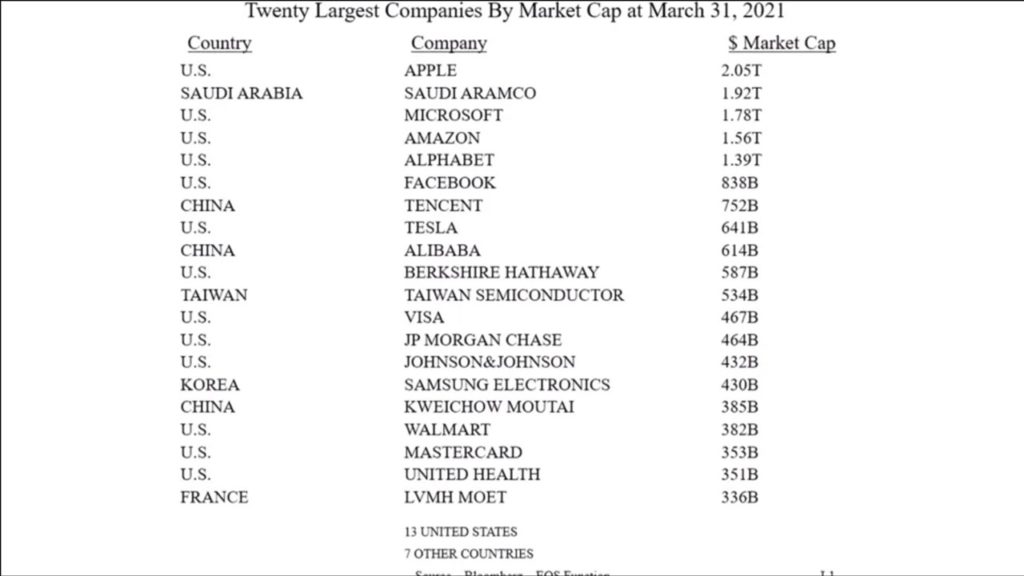

Individual holdings are my preference too when it comes to equities. Again, not mutual funds or ETFs, because too often, you end up owning stuff you don’t want. The days of buying an index fund, setting it and forgetting it, are gone. Why? For one, the S&P 500’s five largest companies, by market cap, make up 25% of the index. That’s a quarter of your equity money riding on a group of stocks you can count on one hand. Is that supposed to be diversification?

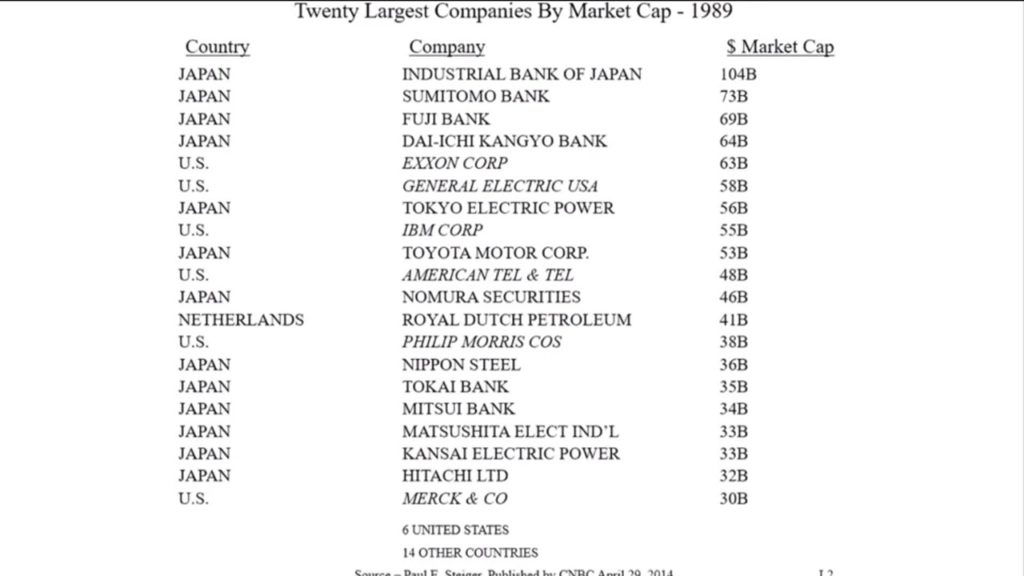

As I pointed out to you yesterday, as explained by Warren Buffett, not one of the twenty largest companies from 1989 appears on the list today. And, no, I’m not comparing myself to Mr. Buffett—we don’t share the same politics.

So how many stocks should you own? Well, the first question is, how many stocks are you an expert on—where you know each one like a member of your family? You don’t get to know a stock by simply scanning a statement to see if it went up or down last month.

Two’s not enough. Double that to four? No. Eight? No. How about 16, 32, 64? You get the point. You probably don’t need 500. In other words, you probably aren’t going to be an expert on thousands of stocks. And that’s not even the biggest part of stock investing. That would be knowing when to sell.

Action Line: Once you reach the back nine of your savings years, you can’t afford to make a mistake. You can’t get a mulligan. I understand the pressure you’re under. I’d love to talk with you. But only if you’re serious.

Originally posted on Your Survival Guy.