Diversification and patience are essential to long-term investment success. Put all your chips on one stock and you risk financial ruin if that stock ends up being the next Enron or AIG. Buy without providing time for the investments you select to work out and you may experience the same outcome.

A diversified portfolio that includes stocks and bonds is ideal for retired investors and those approaching retirement. Balanced portfolios are less volatile and less risky than all-stock portfolios. Balanced portfolios also help those investors who no longer have the safety net of a regular paycheck stay the course in times of turmoil. In return for lower risk comes lower return. That’s the trade-off every investor knows going in.

But during long-bull markets, even those who favor steadier returns may abandon a balanced approach. If stocks rise year after year with little downside why not favor an all-stock portfolio?

Just because you didn’t see the risk in stocks over recent years, doesn’t mean it wasn’t there.

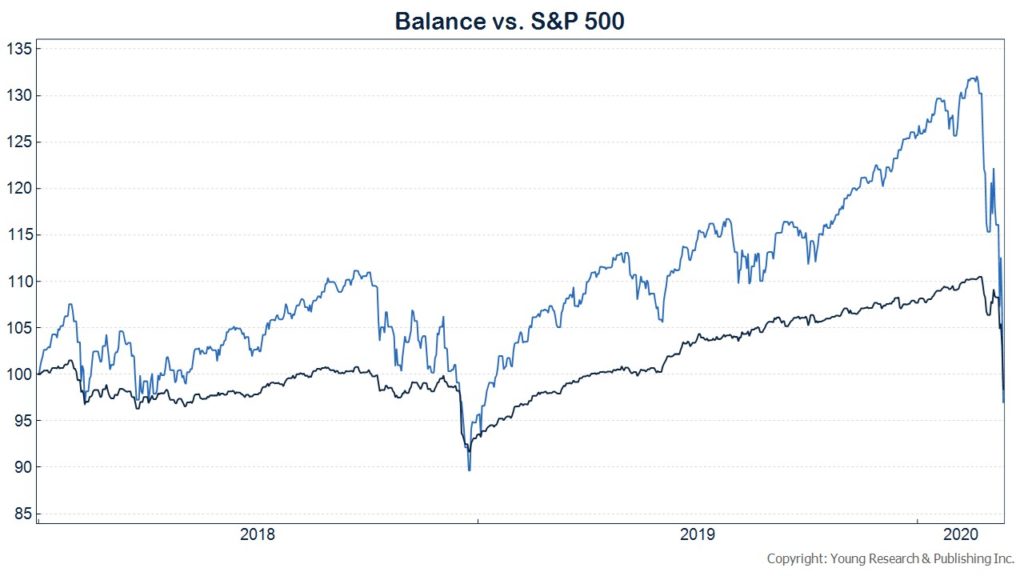

The chart below compares the performance of a balanced strategy to that of the S&P 500 (as a proxy for an all-stock policy). Balanced is measured here by the Vanguard Wellesley Income Fund. The all-stock strategy was the clear winner up until a couple of weeks ago. During the bear market, both portfolios fell in value, but the balanced portfolio fell much less and now has a higher return for the more than two-year period shown on the chart.

Unless you have the willingness and ability to sustain a 50% loss without recovery for a number of years, be sure to include some bonds in your portfolio.