If you’ve been with me, it’s been a good year, and the future looks just as good. As Your Survival Guy, I’m focused on you keeping what’s yours—what you’ve made during a lifetime of work and saving. If everyone could remember how hard it was to get to where they are and lock it in their brains there’d be a lot less heartbreak when it comes to money.

Remember, I’m Your Survival Guy. I’m just fine living in a cave as the world passes by. Let it. I’m focused on return of assets first, then, and only then, the focus is on return on assets. And let’s get this out of the way. If you’re concerned about prices on bonds, remember, unlike stocks, there’s a maturity date or a finish line (slow and steady wins this race). You’re way ahead of the line compared to stockholders regarding the return of your assets.

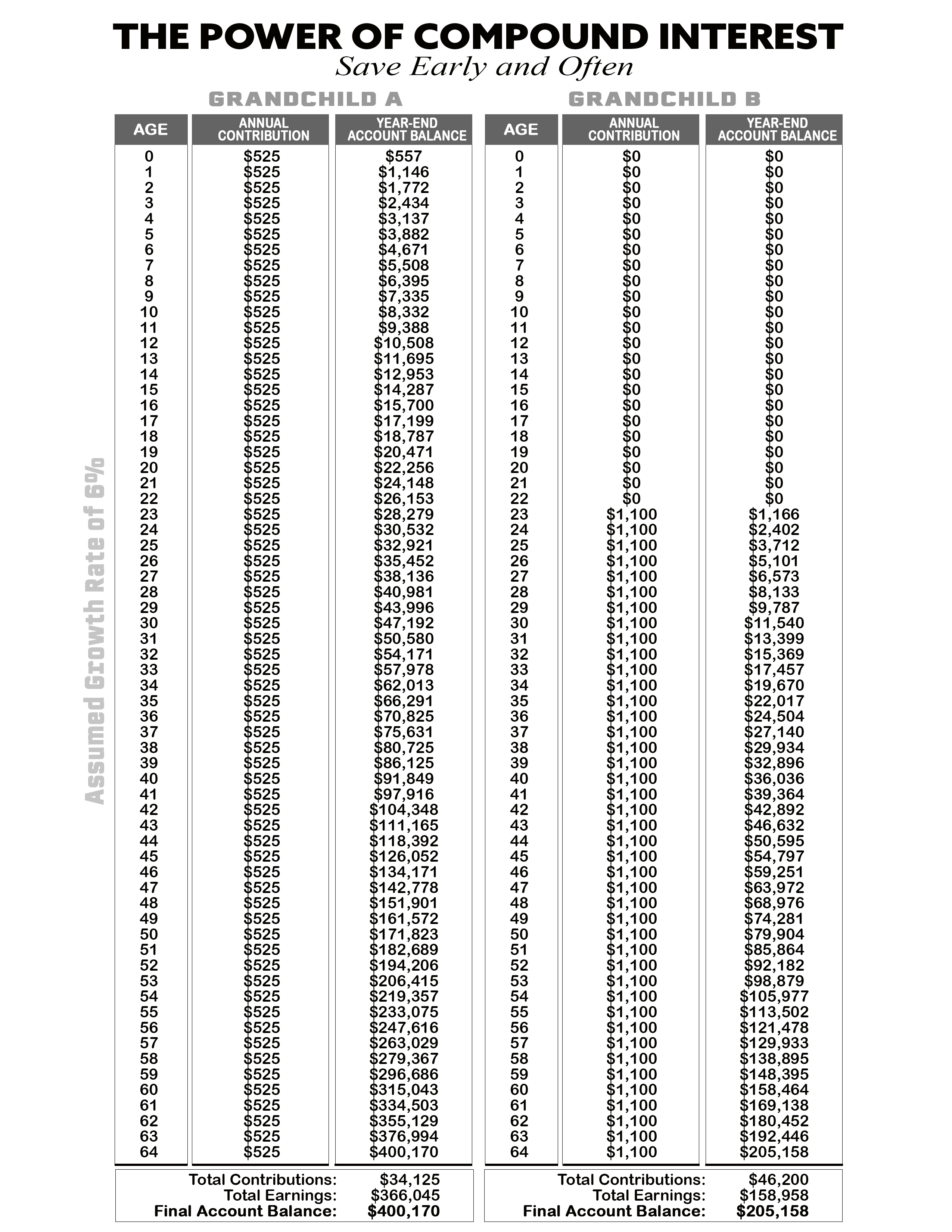

And I feel the same way about stocks. Like bonds, I don’t get caught up in prices. I do not worry about daily quotes. I’m concerned about dividends and the increase of said dividends. This is how you compound money. Look at my rich grandchild, poor grandchild below. Now imagine your savings are reinvested dividends. Let the math do the heavy lifting for your portfolio. I’m here to help.

Action Line: The power of time can work miracles, but it can’t if you’re prone to making knee-jerk decisions. Investing is a lifelong endeavor, much like raising your family is forever. Even when you’re recent empty nesters the kids still come home for the holidays, make a mess of the house, eat all the food and ask questions like “what’s for dinner?” Think about your stocks like your kids, and you’ll do a lot less buying and selling. Stick with me. We’re in this together.

Originally posted on Your Survival Guy.