A word on stock market prices and their nephew past performance. When investors pile into the S&P 500 the way so many do—automatically with their 401(k) contributions—there’s a tremendous amount of money riding on the same stuff. Investors, knowingly or unknowingly, get piled into the same boat, hoping and praying to get to their retirement island. They look at past performance, chart their course as if it’s written in stone, and bam! Get slammed by a storm.

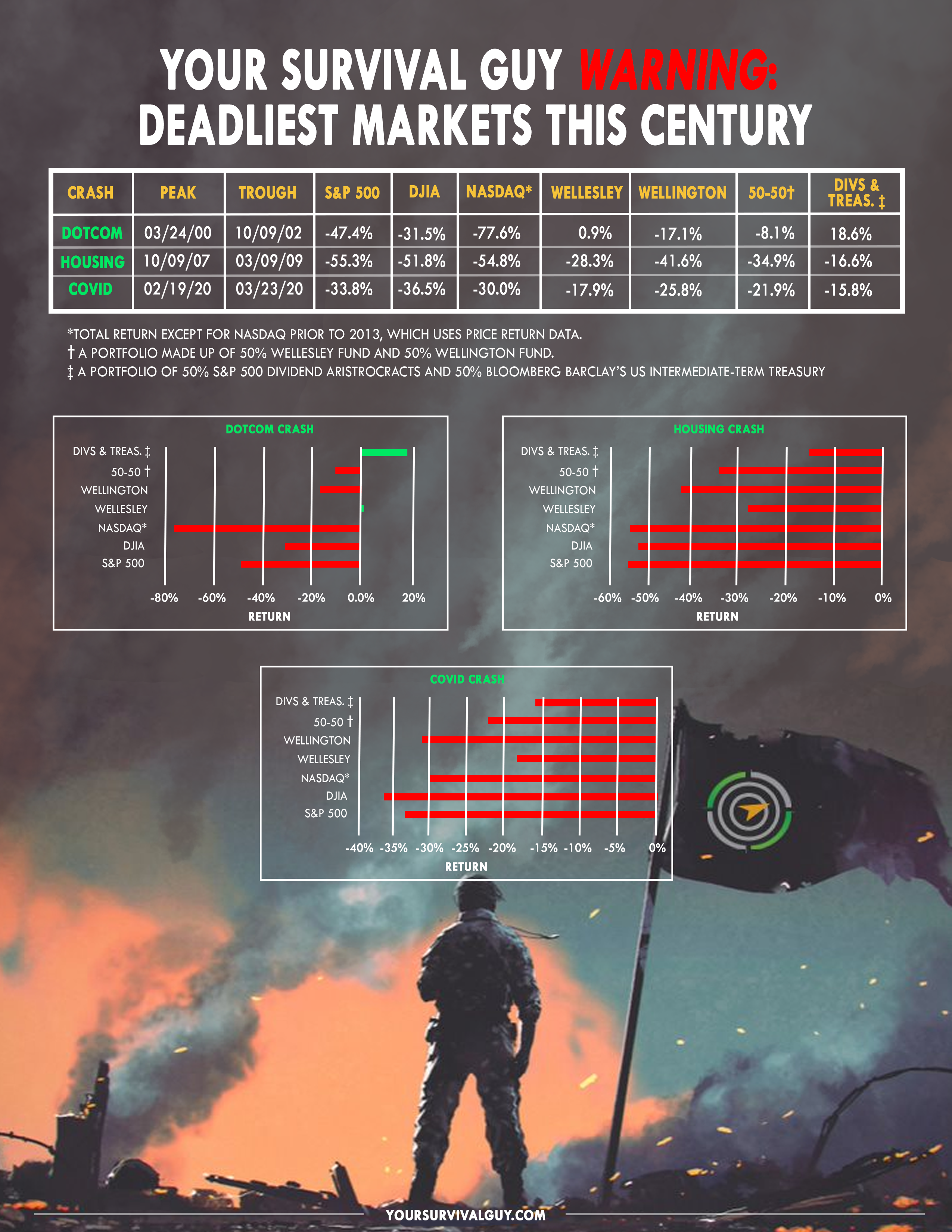

Look at the huge peak to trough of the worst markets so far this century. Remember, prices go down because investors/speculators are selling. Every investor has a breaking point, and they just don’t know what it is until they’re in the middle of the storm and their spouse asks, “How much did we lose today?” And then they’ll do whatever it takes to make it stop.

Instead of living and dying on prices, Your Survival Guy prefers a dividend-centric approach. The steady flow of money helps keep you afloat when prices flounder. And by investing in dividend payers, you’re going against the crowd, a crowd that is on autopilot.

When you look at the sector weighting of the S&P 500, you see the overweight in tech. It works well when prices are up but not so much when they’re not. And the dividend is basically invisible.

At the end of August, the ten largest constituents of the S&P 500 index accounted for around 35.6% of its market capitalization.

The current sector-weighted breakdown of the S&P 500 is:

- Information Technology 31.0%

- Financials 13.3%

- Health Care 12.2%

- Consumer Discretionary 9.7%

- Communication Services 8.8%

- Industrials 8.5%

- Consumer Staples 6.0%

- Energy 3.5%

- Utilities 2.4%

- Real Estate 2.4%

- Materials 2.2%

Time and time again, I’ve warned against sector weighting and leverage. And yet, there are big money ETFs loaded in one sector using borrowed money to juice performance. Just look at the daily movers in either direction, with names like 3X or some other indication of leverage.

For Your Retirement Life, the window may be closing on rates you can sink your teeth into. How quickly and by how much the Fed cuts is yet to be known even by them. We live in a world where big bets are made on just about anything, including and especially with retirement money. Avoid the temptation to participate in such a fool’s errand.

Action Line: When you’re ready to talk about Your Retirement Life, I’m here. But only if you’re serious.

Originally posted on Your Survival Guy.