With the Fed hiking short-term interest rates for the first time in almost a decade in December, and signaling to investors that additional interest rate hikes are going to come at a gradual pace, the fixed-income landscape has the potential to change profoundly over coming months, quarters, and years.

Is your portfolio prepared for such a change?

If you have been reaching for yield in long maturity bonds or low-quality securities, because let’s face it, the Fed has deprived Americans of yield for far too long, now is the time to reexamine your fixed-income portfolio.

If interest rates rise sharply, some bonds will take it in the neck while others will retain their value and put investors in the catbird seat for a higher interest rate environment.

But what if interest rates don’t rise. Bonds that are less susceptible to interest rate moves offer crumbs in interest income.

What is an income investor to do?

Outlook for GNMA Bonds

One of our favored positions over recent years has been GNMA securities. Are GNMAs still a buy if the Fed continues to hike interest rates?

The key to GNMA securities is to understand what drives their returns.

GNMA securities are mortgage-backed securities. Mortgage-backed securities are bonds backed by payments on mortgage loans. The loans are pooled and then out of those pools securities are issued that entitle holders to a share of interest and principal. GNMA’s are the only mortgage-backed securities that are explicitly backed by the full-faith and credit pledge of the United States government.

GNMA Securities vs. Conventional Bonds

Mortgage-backed securities are not like conventional bonds. Conventional bonds pay interest during the life of the bond and all principal at maturity. Mortgages pay principal and interest every month in varying amounts. Most investors intuitively understand this. When you take out a mortgage, you make a payment each month that includes interest and principal. When you refinance your mortgage, you are making what is called a pre-payment.

Pre-Payment Risk

Because GNMA securities are backed by the U.S. government, they are free of credit risk, but they do carry pre-payment risk and extension risk. Pre-payment risk is the risk that your principal will be repaid before maturity. Why is getting paid early a risk?

Let’s say you invest in a GNMA security and every mortgage backing that security has a 6% rate. Fast-forward one year and assume that mortgage rates have fallen to 4%. Further assume that every mortgage backing the GNMA security is refinanced to lock in that lower 4% rate. As the investor in this GNMA security, the entire balance of your principal is returned to you. You can reinvest in another GNMA security, but the prevailing rate on GNMA securities is now only 4%. Instead of earning 6% on your money, you now earn 4%.

Extension Risk

Extension risk is the opposite of pre-payment risk. When interest rates rise, the rate of pre-payments on GNMA securities slows, which effectively extends the maturity of a GNMA security. You now have a longer maturity bond than you originally invested in just as interest rates are rising. The combination of higher rates and a longer maturity results in a lower price.

While interest rates are the big factor that determines the percentage of a pool of mortgage backed securities that is paid back ahead of maturity, it is not the only factor. The rate of pre-payments on a pool of mortgages also depends on the historical path of interest rates, housing turnover, the aging of loans, seasonality, and credit conditions among other factors.

In return for taking on pre-payment risk and extension risk, investors in GNMA securities are compensated with yields that are greater than the yields on Treasury securities. How much greater varies over time and by measurement.

Focus on These Risks

Some of the major factors that influence pre-payment risk and extension risk include the level of interest rates, the historical path of interest rates, housing turnover, the aging of loans, seasonality, and consumer credit conditions. I’ll focus on a few of these factors.

With interest rates having been so low for so long, investors in GNMA securities should be focused on extension risk today. If long-term interest rates rise, fewer homeowners are likely to refinance their mortgages at higher interest rates. This will extend the average maturity of GNMA securities. So the maturity of GNMAs have the potential to increase just as interest rates are rising. Neither factor is bullish for GNMAs.

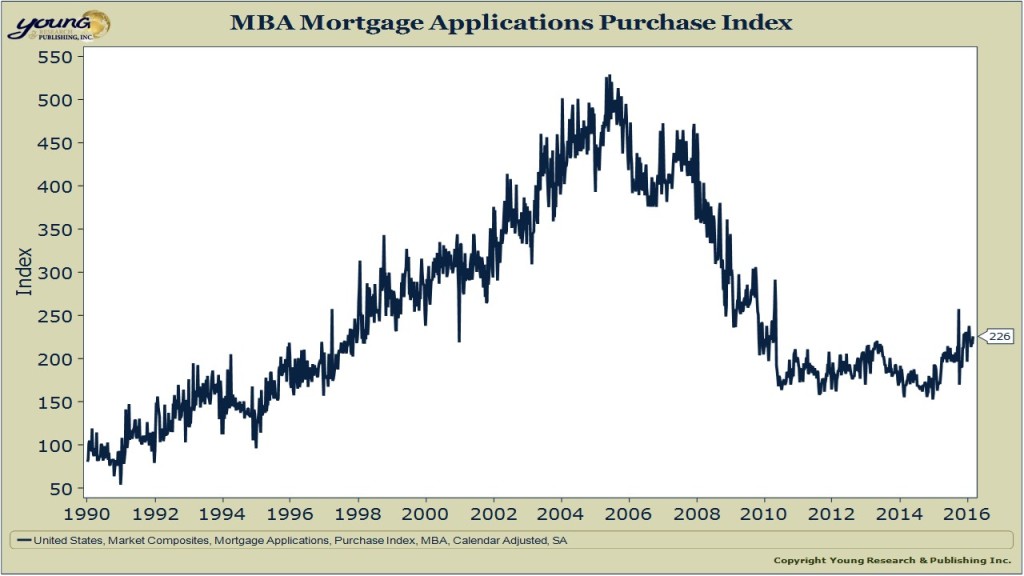

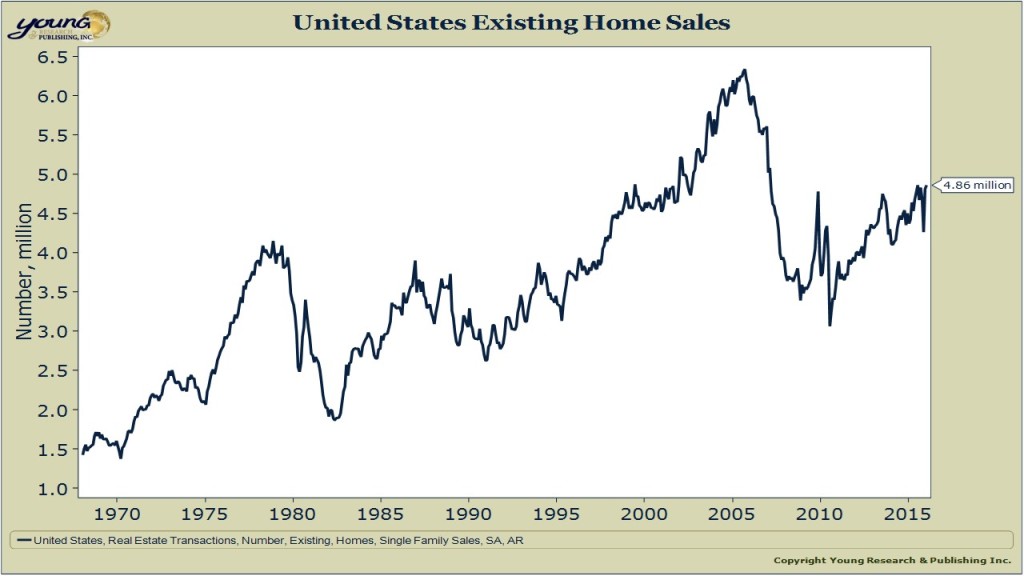

Offsetting the potential headwind from rising rates is the fact that housing turnover remains depressed and credit conditions in the mortgage market still aren’t back to normal (See the two charts below). Even with the Fed holding interest rates at zero for years and buying trillions-of-dollars-worth of long-bonds, tighter underwriting standards have kept mortgage originations below what would have historically been expected based on the interest rate environment. If rising rates are accompanied by an improving economy, housing turnover should pick up and mortgage originations should accelerate. These factors would tend to offset, to some extent, the negative effect that rising interest rates might have on the pre-payment rate of GNMA securities.

Don’t get me wrong, rising rates would still be a headwind for GNMA securities, but maybe not to the extent that they would be if housing turnover and mortgage originations were already booming.

Even if the Fed continues to hike short-term interest rates there is no guarantee that longer-term interest rates, the ones that mortgage rates are most sensitive to, will rise. Long-term rates are down significantly over the last four months even as the Fed has hiked short-term rates. So the question with GNMA securities, as always, is how are investors in GNMA securities being compensated for the potential risk of an increase in long-term interest rates? According to the Merrill Lynch GNMA index, GNMA securities offer a yield of 2.4% today. That’s not going spin your straw into gold, but compared to Treasury securities, GNMA investors are getting a fair shake. In this environment of negative interest rates, rising short-term interest rates and falling long-term interest rates, GNMA has an important role to play in a well-diversified fixed-income portfolio. Vanguard GNMA is your play here.