In Part I of this series I explained the risks that investors are compensated for when they invest in Ginnie Mae mortgage backed securities. Since GNMAs are backed by the full faith and credit pledge of the United States government, the primary risks that investors in GNMA securities should be concerned with are pre-payment risk and extension risk.

Some of the major factors that influence pre-payment risk and extension risk include the level of interest rates, the historical path of interest rates, housing turnover, the aging of loans, seasonality, and consumer credit conditions. I’ll focus on a few of these factors.

With interest rates having been so low for so long, investors in GNMA securities should be focused on extension risk today. If interest rates rise, fewer homeowners are likely to refinance their mortgages at higher interest rates. This will extend the average maturity of GNMA securities. So the maturity of GNMAs have the potential increase just as interest rates are rising. Neither factor is bullish for GNMAs.

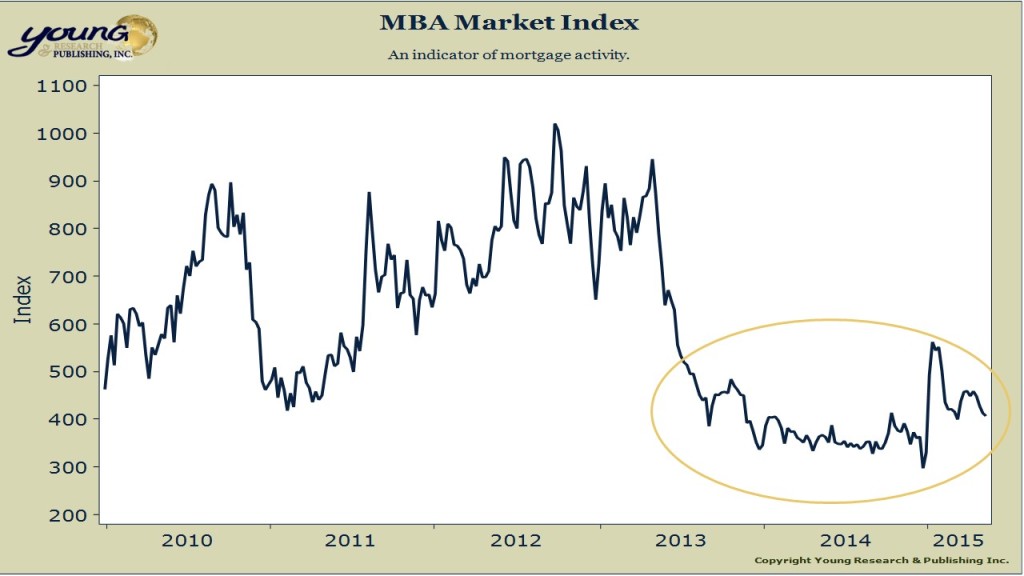

Offsetting the potential headwind from rising rates is the fact that housing turnover remains depressed and credit conditions in the mortgage market have been tight. Even with the Fed holding interest rates at zero for years and buying trillions-of-dollars-worth of long-bonds, tighter underwriting standards have kept mortgage originations below what would have historically been expected based on the interest rate environment. If rising rates are accompanied by an improving economy, we might expect housing turnover to pick up and mortgage originations to accelerate. These factors would tend to offset the negative effect that rising interest rates might have on the pre-payment rate of GNMA securities.

Don’t get me wrong, rising rates would still be a headwind for GNMA securities, but maybe not to the extent that they would be if housing turnover and mortgage originations were already booming.

With the risk of rising interest rates uncertain the question, as always, is how are investors in GNMA securities being compensated for the potential risk of an increase in interest rates? According to the Merrill Lynch GNMA index, GNMA securities offer a yield of 2.53% today. Nothing to brag about, but compared to Treasury securities they offer a fair yield advantage. As a component in a well-diversified fixed income portfolio, Vanguard GNMA has a role to play.