Kit Norton of Investor’s Business Daily writes that hydrogen has finally gotten a price tag. The U.S. Treasury has finalized rules for the clean hydrogen production tax credit, offering up to $3 per kilogram for producers meeting specific carbon emissions criteria. The update clarifies eligibility, allowing nuclear and natural gas producers to qualify for billions in credits. This move aims to reduce clean hydrogen production costs and encourage investment in infrastructure. Norton writes:

A number of new energy stocks, including S&P 500 nuclear stocks Constellation Energy (CEG) and Vistra (VST), along with Amazon.com (AMZN) supplier Plug Power (PLUG), moved higher following the Treasury Department and Internal Revenue Service revising its rules for hydrogen production tax credits.

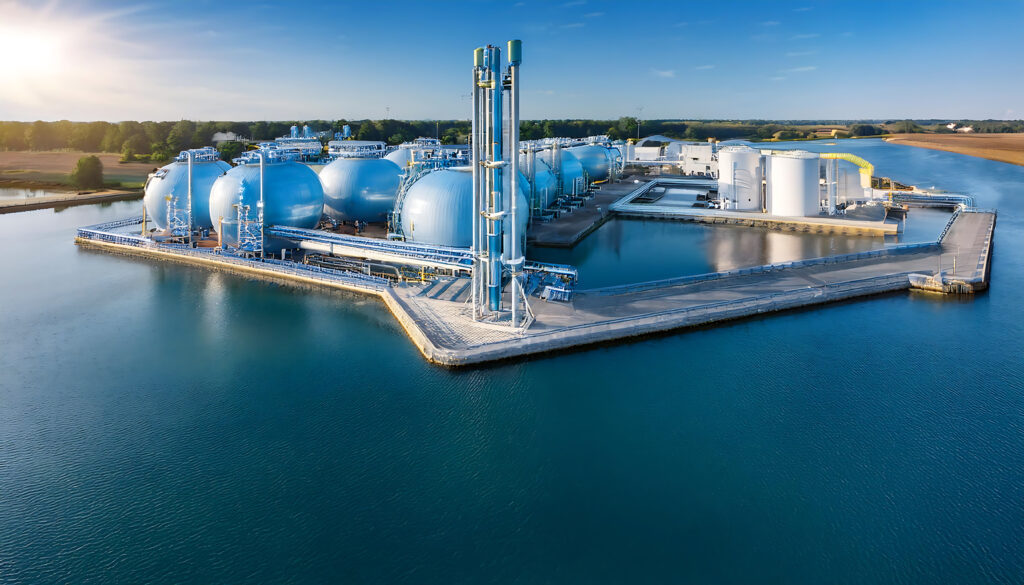

The U.S. Treasury on Friday published its final rules on clean hydrogen production, with guidelines producers must meet to qualify for the clean hydrogen production tax credit of up to $3 per kilogram. The move broadly gave companies clarification on whether they could take advantage of the tax credit, as many were unwilling to make investments in hydrogen production projects until the rules were clarified, according to industry observers.

The hydrogen tax credit, which ranges from $0.60-$3 per kilogram based on the level of carbon emissions from the project, is part of the Inflation Reduction Act, or the IRA, signed by President Biden in 2022.

The Treasury on Friday made it so nuclear power along with natural gas producers could qualify for billions of dollars worth of credits to make hydrogen.

Clean hydrogen, produced through renewable energy sources, has been historically much more expensive to produce compared to conventional hydrogen production methods. The new tax credit attempts to bring down the price, incentivizing companies to scale up clean hydrogen infrastructure. […]

The Nuclear Effect

The government’s decision to allow nuclear power providers to qualify for the hydrogen tax credit sent numerous nuclear stocks higher.

S&P 500 nuclear stock Constellation Energy edged up 1.1% to 255.15 on Monday after climbing 4% higher on Friday. Meanwhile, Vistra surged 8.5% to 162.36 to end last week. The S&P 500 stock advanced 1.3% early Monday.

Companies focused on small modular reactors, or SMRs, also took off. No operating SMRs now exist, but a number of outfits are developing the technology. […]

The company added it is reviewing the impact of the final rules on its proposed clean hydrogen project at the LaSalle Clean Energy Center and its role in the Midwest Alliance For Clean Hydrogen hub.

Read more here.