The BEA today released its report on the trade of goods and services into and out of the United States in the month of December. The trade deficit that has plagued America for decades shrank last month to $38.5 billion worth of goods and services. Optimists have pointed out, and correctly so, that the unexpectedly small deficit will likely cause a revision to fourth quarter GDP estimates that erase the modest reported decline. That’s the optimists’ view.

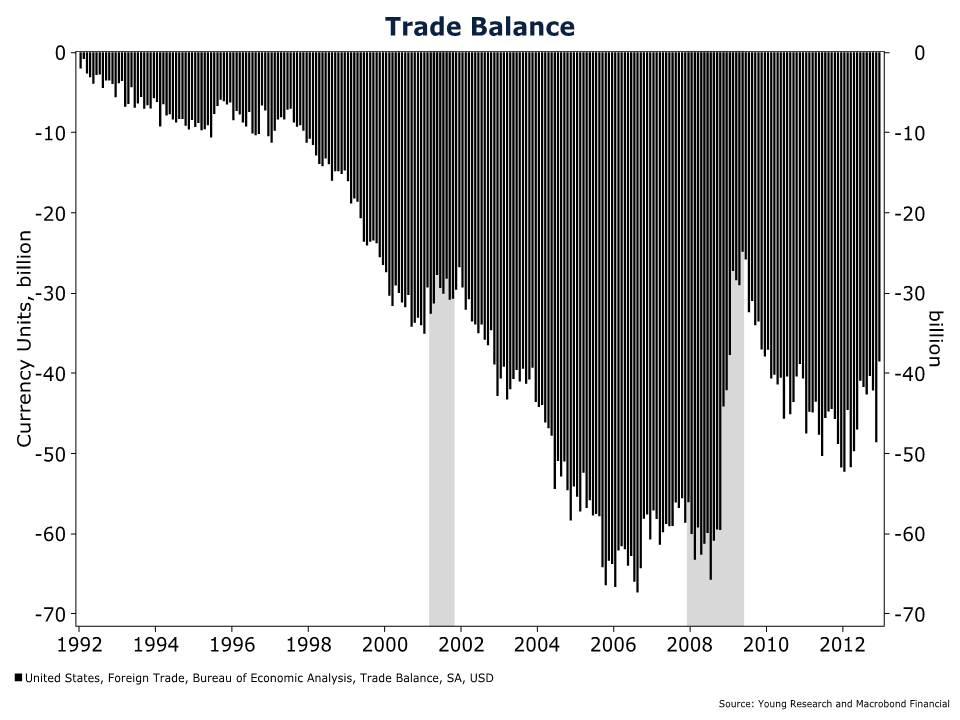

However, there are two ways to read the recent trade release by the BEA. Yes, a revision will likely increase estimated GDP in the fourth quarter. But the trend of recent reports on the trade deficit may indicate the U.S. is already in recession. The largest part of the decline in the deficit was a $6.1 billion reduction in the amount of goods imported. Of that decrease, $3.7 billion was a reduction in the amount of oil imported. At first blush you may love idea of importing less oil, but what does that mean for the economy as a whole? It’s not just that domestic production is replacing imported crude. Oil consumption is decreasing. Additionally, imports of nonpetroleum goods fell by $2.3 billion (rounding errors account for the other $0.1 billion in reduced imports). That’s not a good sign. For perspective, take a look at 2009 on the Trade Balance chart. Nobody considers that year a boom time for the economy, but the trade deficit shrank considerably.

The bottom line is that a shrinking trade deficit can be a good or bad sign, and we will have to wait and see. Rushing to the conclusion that America is shrugging off one of its famed structural deficits makes for a great storyline on cable news, but the reality is more complex and deserves a finer level of attention.