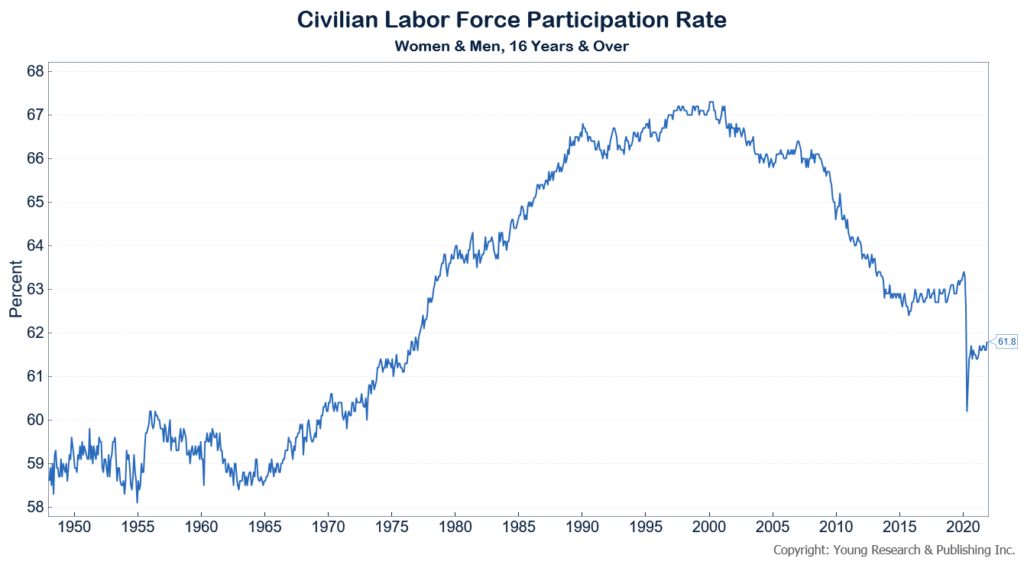

Where do we start? Joe Biden’s been a complete disaster. When you pay people not to work, what do you think happens? The labor participation rate stays where it is because why work when you don’t have to?

Meanwhile, “Successful Americans” like you who worked for a living and saved ‘til it hurt are penalized as inflation eats away at your fixed income. What’s the solution, more stocks? Please. Leadership talks about ESG investing like it’s the Holy Grail, taking your money, and pushing high-cost renewable energy on Americans. How long will it last? And not a word about the pollution going on in China.

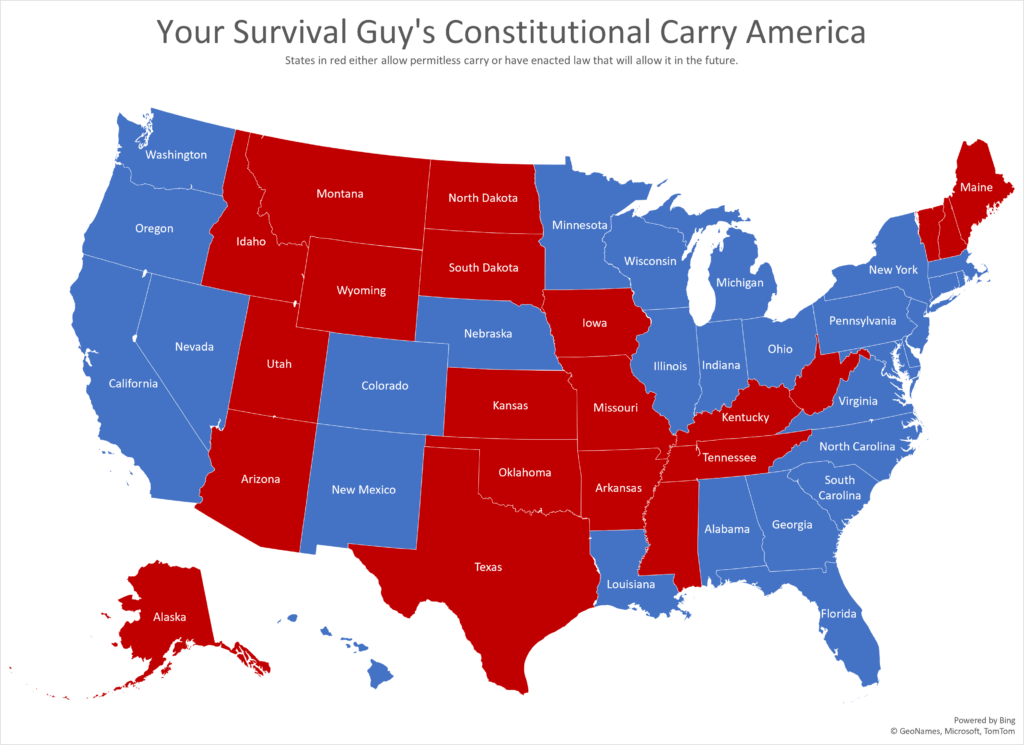

Your Constitutional rights are no longer a natural-born right, according to leadership (see my map of Constitutional Carry states below). It’s a privilege they feel they control.

Action Line: Pay attention to prices because if you’re not getting paid to be in this market, you need to figure out why not. Markets can ruin investors, which sounds exactly like what some sick leaders might want for you.

P.S. Wholesale prices measure rises at the fasted pace on record. Jeff Cox reports at CNBC:

Wholesale prices increased at their quickest pace ever in November in the latest sign that the inflation pressures bedeviling the economy are still present, the Labor Department reported Tuesday.

The producer price index for final demand products increased 9.6% over the previous 12 months after rising another 0.8% in November. Economists had been looking for an annual gain of 9.2%, according to FactSet.

Excluding food and energy, prices rose 0.7% for the month, putting core PPI at 6.9%, also the largest gain on record. Estimates were for respective gains of 0.4% and 7.2%, meaning the monthly gain was faster than estimates but the year-over-year measure was a bit slower.

The Labor Department’s record keeping for the headline number goes back to November 2010, while the core calculation dates to August 2014.

Those numbers come with headline consumer prices running at their fastest pace in nearly 40 years and core inflation the hottest since in about 30 years.

Demand for goods continued to be the bigger driver for producer prices, rising 1.2% for the month, a touch slower than the 1.3% October increase. Final demand services inflation ran at a 0.7% monthly rate, much faster than the 0.2% October rate and a sign that the services side could be catching up in prices after lagging through much of the recovery.

Stock market futures added to losses following the release, as investors see inflation and the strong potential for a Federal Reserve policy response as threats to what has been a boom year for equities.

The Fed begins its two-day meeting Tuesday, with expectations running high that it will remove its economic help more quickly and start raising interest rates around the middle part of 2022.

Constitutional Carry States

Read more about the damage being done by Bidenomics here:

- BIDENOMICS: Shortages of Gas at Highest Prices Since 2014

- BIDENOMICS: Inflation, COVID Failure, Drive Plunge in Consumer Confidence

- BIDENOMICS: Relentless Inflation Destroys Americans’ Savings

- PRICE SURGE: Bidenomics Is Ruining Your Summer Vacation

- Prices Surge as Bidenomics Takes its Toll

Originally posted on Your Survival Guy.