Ahhhh, cash, money, green. Sounds so nice. More money, less work. We all want it, and we all say we need it, but when it comes to investing, why do investors ignore it? I’m talking about dividends. In a “What have you done for me lately?” world, investors live or die on prices. Don’t be a price hog. Don’t be a hog, period.

The minute you ignore prices, you become Your Survival Guy’s kind of investor. You become eccentric. Unique. Even contrarian in today’s price-focused world. You focus on being paid. You imagine yourself living in a cave, ignoring the chaotic world outside. And I can tell you right now most investors would become better investors the minute they tuck themselves into that humble abode.

Because I’m not writing to the guy who talks me up about A.I. and how it’s different this time. No, it’s not different this time. I spoke with this same type of “investor” who was partying in 1999 in tech stocks. Today? Same old song, different tune.

What should be on every investor’s fridge or iPhone home screen is this question: “But at what price?” Because we’re all human, and unfortunately, humans believe they can invest based on gut. They place bets on it. But what does that even mean to feel it in your gut? This isn’t a spiritual event. It’s investing.

If you’re like me, you’ve chosen a path of cash dividends and dividend increases. But it takes discipline. “Do or do not. There is no try,” advised Yoda. Because it might be a hard path to take. It might take some time and be boring. But one day, you might wake up and realize, “Hey, I’m worth a lot of money. That Survival Guy was right.”

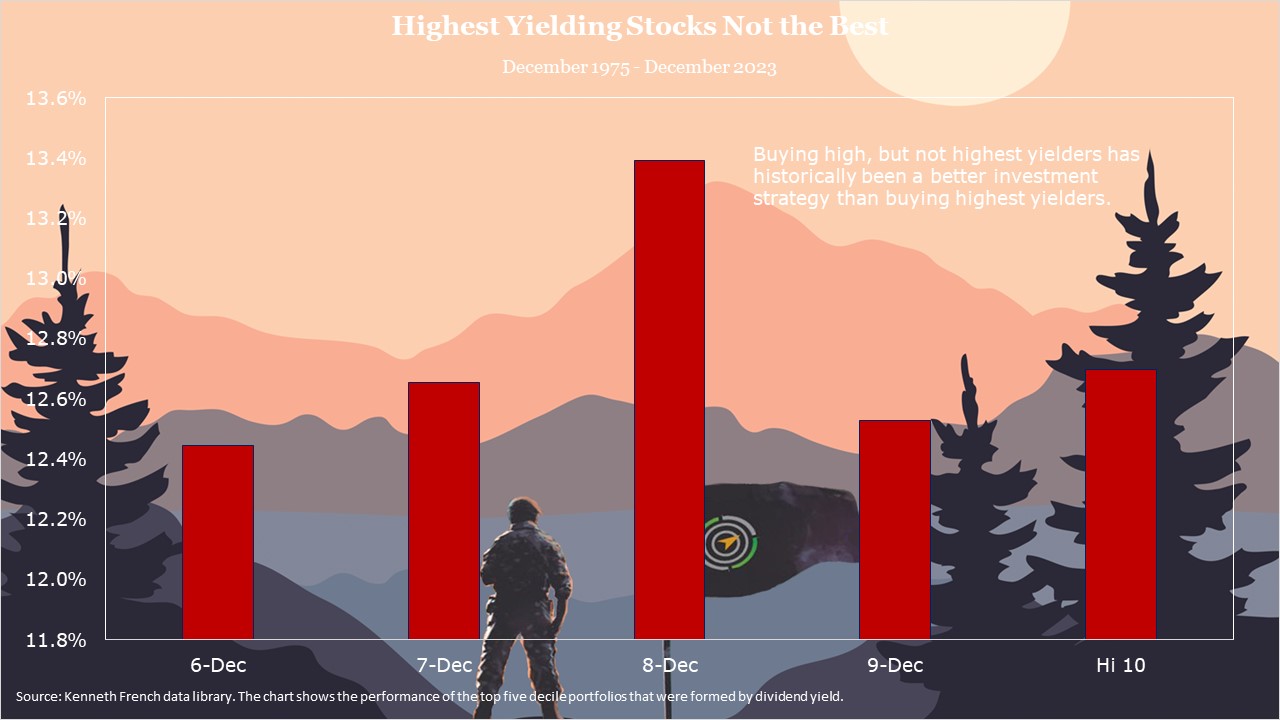

Action Line: Don’t let greed infect your portfolio. When seeking dividend payers, look at history and recognize that the highest yielders, the dividend hogs, may not necessarily be the best ones. When you’re ready to talk, let’s talk.

May the force be with you.

Originally posted on Your Survival Guy.