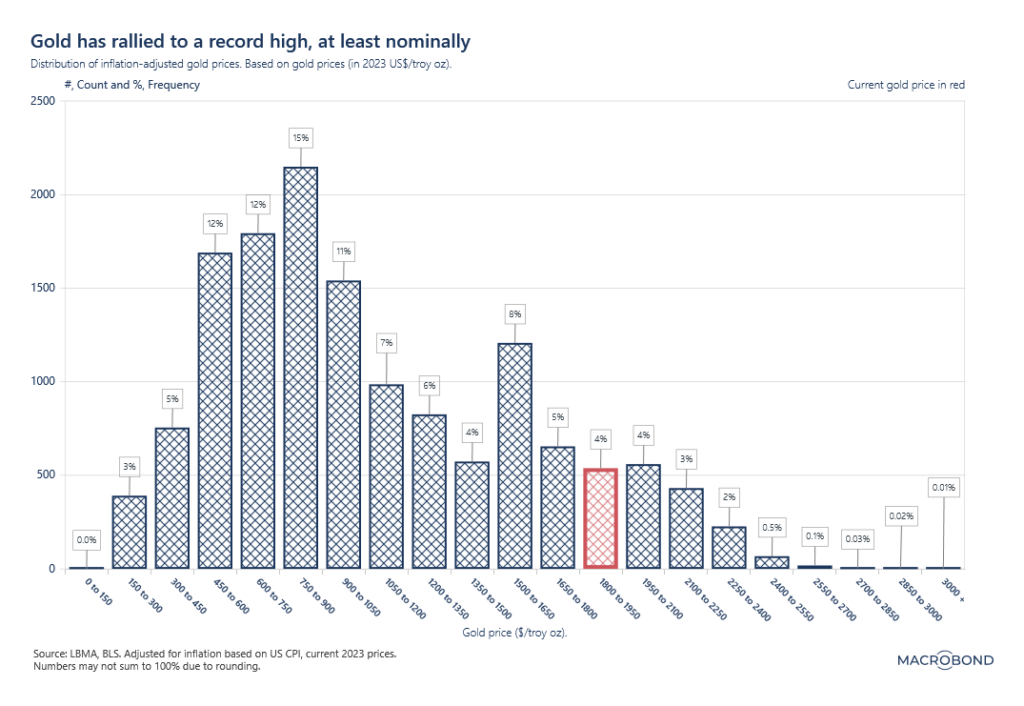

Gold prices have reached nominal highs, but is it expensive? In inflation-adjusted terms, the price of gold is higher than statistically normal but not at its highest. Take a look at the inflation-adjusted gold price distribution chart from Macrobond below to see that while gold is expensive in nominal terms, it still hasn’t reached its inflation-adjusted peak.

Gold prices have climbed on dollar weakness and inflation data, reports Reuters’s Arundhati Sarkar:

Gold prices scaled a near three-week high on Tuesday, drawing support from a weaker dollar, while investors positioned for U.S. inflation data that could have a bearing on the Federal Reserve’s rate hike path.

Spot gold was up 0.7% to $1,937.70 per ounce at 1011 GMT, set for a third consecutive session of gains. U.S. gold futures climbed 0.7% to $1,943.60.

“The reaction to the US inflation data is dependent on how fast it is slowing down… only if inflation surprises on the downside gold would benefit, as it would indicate a sooner end in the Fed hiking cycle,” UBS analyst Giovanni Staunovo said.

Safe-haven gold tends to gain during times of economic or financial uncertainty, while lower rates also lift the appeal of the zero-yielding asset.

Bullion is being supported by a weaker dollar as the Fed seems to imply that it’s at the end of the tightening cycle, “but gold bugs appear hesitant to over-commit ahead of Wednesday’s U.S. inflation report,” said Matt Simpson, senior market analyst at City Index.

Read more here.