Market volatility and a weaker dollar have pushed the demand for gold higher. Investors are driving up the price for the safe-haven precious metal. Neil Hume reports at the Financial Times:

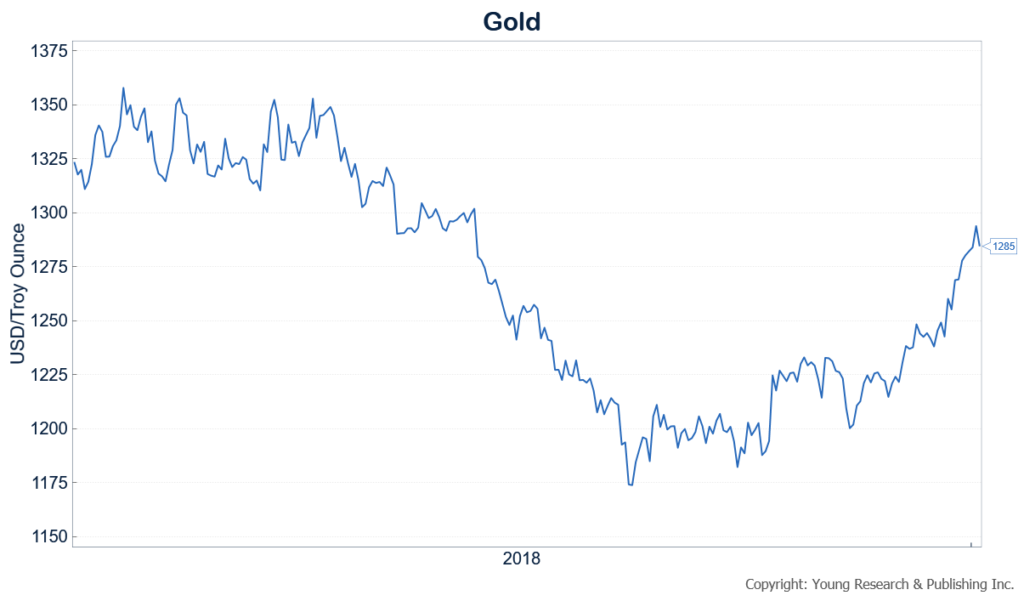

For much of 2018 gold was out of favour, hit by the strength of the dollar and interest rate rises in the US, which dented the appeal of assets such as the precious metal that offer no yield. That saw gold trade as low as $1,174 in August in spite of rising geopolitical tensions and the fallout from US-China trade war.

Sentiment towards gold began to improve towards the end of the year as US stock markets fell and volatility increased. That has continued into 2019 amid speculation a slowing US economy will ultimately force the Federal Reserve to stop raising interest rates.

Analysts say gold can continue to shine as long as markets remain volatile — a fact underlined late last week after a better than expected US jobs report saw equity markets bounce.

Read more here.