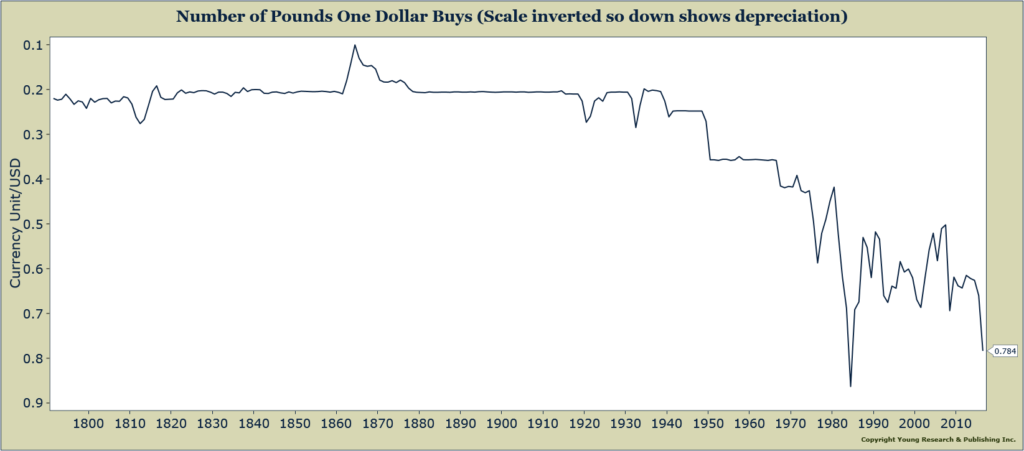

The biggest casualty of the Brexit vote thus far has not been the stock market or the bond market as many predicted, but the market for British pounds. The pound sold-off yesterday and is now trading at a more than two-decade low. Technical analysts would likely tell you that charts don’t offer much in the way of support for the world’s former premier reserve currency. Based on the charts, a move toward parity looks possible, though we wouldn’t say probable.

For some perspective, I’ve included a long-term chart (yes really, really, long) on the pound / dollar exchange rate. The pound is cheap today, but it has been cheaper. With an ugly technical picture and a still significant amount of uncertainty over the terms of Britain’s exit from the EU, it may be early to take an aggressive position in pound denominated assets, but the U.K. is a country that should be on every serious long-term investor’s radar.