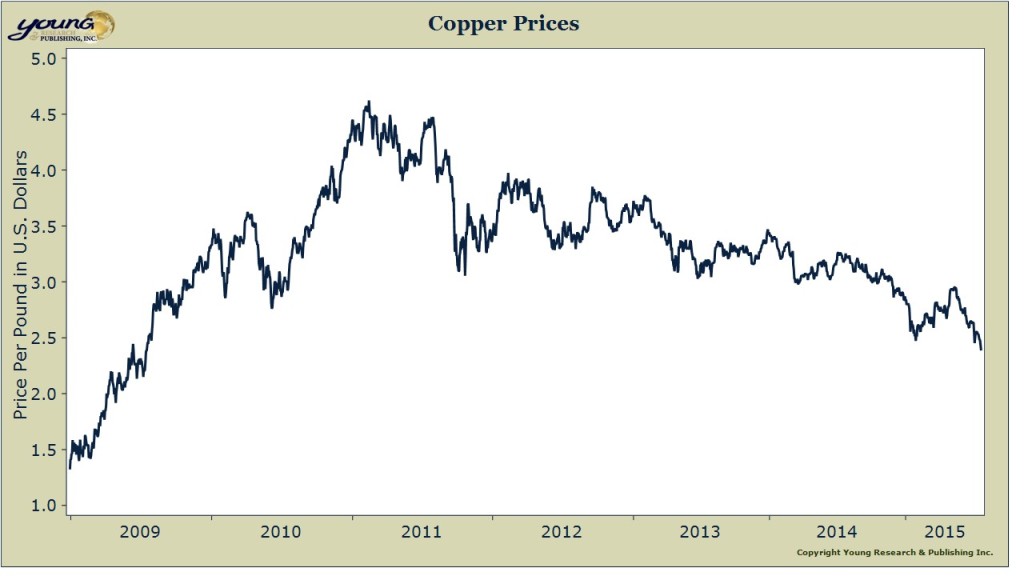

Copper is said to have a PhD in economics because it’s price tends to be correlated with global economic growth. Unless Dr. Copper has lost its relevance, there is reason to be concerned about global growth. The continuing rout in commodity prices has pushed copper below a key long-term support level. Technical analysts would tell you the next support level for copper is at least another 15% away from the current price. But copper isn’t the only indicator sending a signal of caution.

Oil prices are in the tank. The media paints this as a supply story and there is no doubt an excess of oil supply, but is it only excess production to blame, or is the market signaling that demand is going to be weaker than expected? The broader commodities markets are also selling off sharply. The CRB commodities index is now only a few points above the lows reached during the financial crisis.

Rail stocks are selling off hard as is the broader transportation average. The Chinese stock market is up recently, but everybody knows the gains are phony—generated by extreme government intervention. Volume and money-flow tell the story in China. The Shanghai composite is up more than 20% from its recent low, but volume has been light, and money flow extremely weak.

The only thing that seems to be working in this market is stocks whose earnings potential is so far into the future that nobody can slap a reasonable value on them. So we have bio-tech stocks that trade on hope and the promise of a future blockbuster drug, and glamour stocks like Netflix and Amazon trading at valuations that beg for long-term disaster, leading the market.

What is a long-term investor with serious money to invest left to do? Fixed income, despite the historically low yields doesn’t sound so terrible today.