After shortages of sand supplies slowed down Permian Basin oil production two years ago, so many companies have begun efforts to mine sand that the Texas oil patch may soon be overwhelmed with sand supplies. At The Wall Street Journal, Christopher Matthews explains the possible over-investment in the dunes of the West Texas desert. He writes:

Now, around 20 sand mines are set to be active in the Permian Basin, America’s most active oil field, by year’s end, and even some of those who put hundreds of millions of dollars behind these startups predict they won’t all survive.

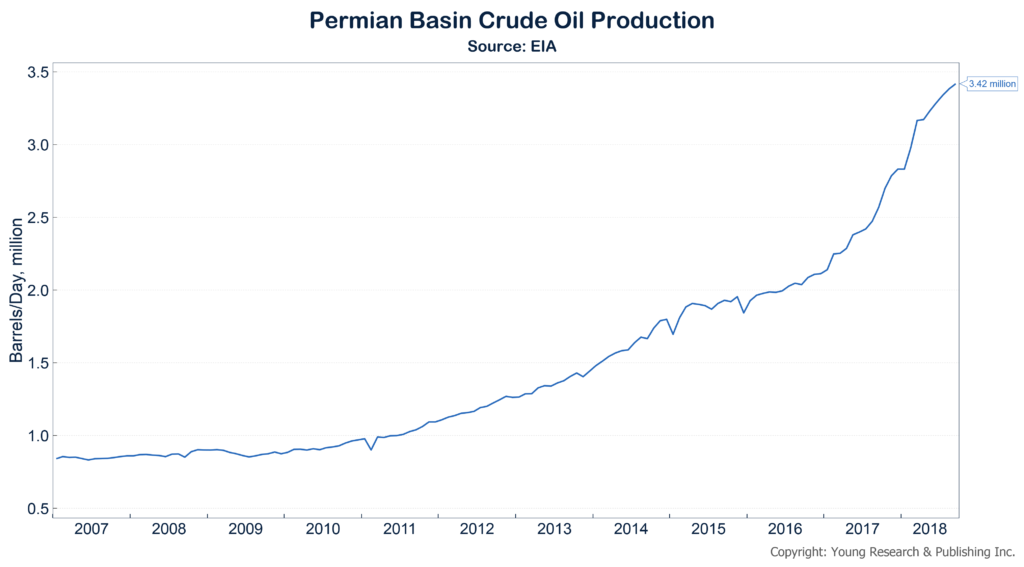

Sand is a key ingredient for shale drillers, who use a mixture of sand, water and chemicals to fracture rock formations deep underground and release the oil and gas trapped inside. But the flood of sand is hitting the market just as growth has begun to slow in the Permian Basin because of pipeline and labor constraints that make oil and gas more difficult to produce in the region, which straddles Texas and New Mexico.

There are also questions about the quality of Texas sand, compared with the sands from Wisconsin and other regions that frackers have traditionally favored, and whether using the cheaper local substitute crimps a well’s long-term production.

All of this has contributed to a quickly oversupplied sand market, a little more than a year since the first mine opened in West Texas. The 13 mines already active in West Texas have sufficient capacity to meet the basin’s 2018 demand for sand, around 39 million tons, according to energy research firm Infill Thinking LLC.

Read more here.