The Wall Street Journal explains that the energy production landscape has changed for the majors.

World-wide, oil-exploration spending last year was the lowest since 2007. There’s been less conventional oil and gas (as opposed to resources contained in shale or oil sands) discovered in the past 2½ years than in 2012 alone, according to Edinburgh-based consultancy Wood Mackenzie.

Some in the industry say the decline in exploration spending will eventually contribute to an oil drought—and spiking crude prices. Saudi Arabia’s energy minister Khalid al-Falih told an oil conference in London this month that the underinvestment caused by weak oil prices over the past two years will result in “a period of shortage of supply.”

Others say it is the new normal, in which giants like BP and Royal Dutch Shell PLC will increasingly focus their exploration on less risky and more easily accessible reserves—and spend some of the money they used to use for exploration to buy already-discovered resources from smaller companies.

It is a major shift for big oil companies that designed their exploration strategies to find enough conventional oil and gas to replace all the barrels they pump every year, says Andrew Latham, Wood Mackenzie’s vice president of exploration research.

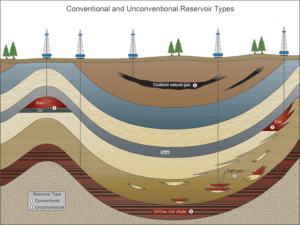

Now, their conventional exploration seems “designed to add about 50%” of what they produce, forcing them to rely on unconventional resources like shale and acquisitions of other companies’ resources to maintain output, Mr. Latham said.