The global bond market is broken. Years of zero interest rates and trillions spent buying everything from government bonds to corporate bonds by the world’s central banks should have made that clear long ago. The world’s monetary authorities have sucked liquidity out of global bond markets.

And now we have the scourge of negative interest rates to deal with. Negative rates and a continued ramping in central bank bond buying activity has made the situation even more disturbing.

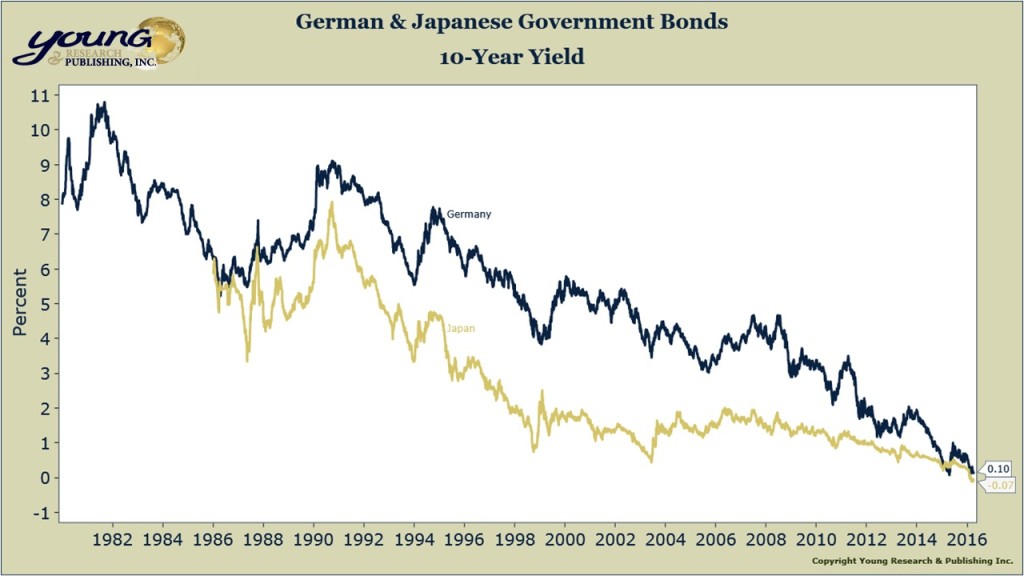

Two of the world’s largest central banks have cut short-term interest rates into negative territory, igniting a mad dash for longer-term government bonds. Yields on German 10-year government bonds are now 0.10%. Yes, a tenth of a percent is what investors are paid to lend the German government money for ten years.

Do you know how long it would take the power of compound interest to double your money at 0.10%?

About 700 years. And you thought the long-run was a mere decade or two.

In Japan, 10-year government bonds yield -0.07%. Investors are actually paying the Japanese government to lend them money for 10 years.

What kind of an investor does that? There is no sensible investment case that can be made for German or Japanese government bonds at these yields.

The folk buying these bonds today aren’t investors. They can’t be. If you are buying a Japanese 10-year bond at a -0.07% interest rate, you are buying risk without the return. The only way to profit on a 10-year bond with a negative yield is to find a greater fool to sell your bond to at a higher price. That means a more negative yield than you paid. Where I come from, they call that speculation.

What do German and Japanese government bonds have to do with your portfolio? You are investing in an age of freely-flowing investment capital (well, mostly). Today’s disturbingly low government bond yields are bleeding into the pricing of all global asset prices and setting the stage for a nasty period of financial instability should bond yields reverse. Stay cautious and value conscious.