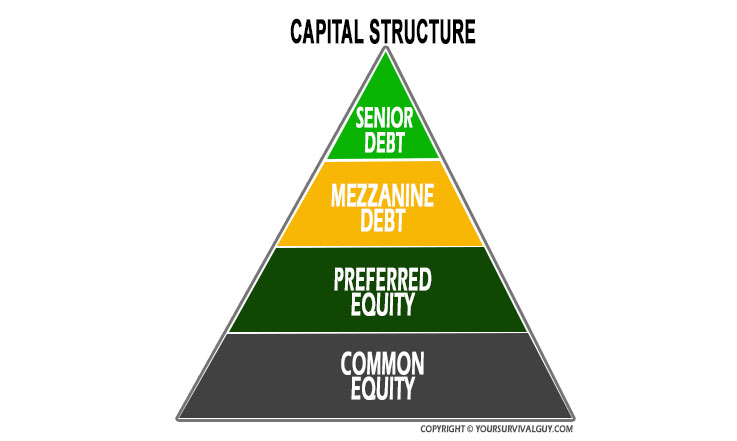

When you’re a serious investor, you create a plan and evaluate it regularly. It’s what I talk about in my conversation with you. With the volatility in the markets, pay more attention to return of assets than the return on them. A key example is the capital structure and how bonds are higher up than stocks.

In The Wall Street Journal, Jon Sindreu explains that the world is against bonds right now, but according to him, it may be time to buy some. He explains some reasons the weakness in bond prices might be counterintuitive, writing:

For one, the fiscal doomsayers are probably wrong: Countries that print their own currency can’t truly be pushed to default. More important, inflation-linked Treasurys have sold off too, belying the idea that markets see a hot economy and tariffs as a serious inflationary problem.

It might all have to do with interest rates after all. Since December, the Fed has squashed expectations of a prolonged rate-cutting cycle. As a result, the whole middle part of the Treasury yield curve—from two to five-year maturities—has become positively sloped for the first time since 2022. Only the very short end, from three months to one year, remains inverted, reflecting the one or two cuts that markets suggest might still happen this year.

The reason alarm bells are ringing is that longer-term bonds have sold off even more—a “bear steepening” trade, in Wall Street lingo. Three out of four times, yield curves steepen for the opposite reason, historical data shows: A fall in short-term yields driven by central banks cutting rates very fast. Bear steepenings following a period of inverted yield curves are rare, and mostly are reminiscent of the “stagflation” periods of the 1970s and 1980s.

SHARE YOUR THOUGHTS

Are you buying or selling bonds right now? Join the conversation below.But this gets to the core of the matter. Today’s situation, in which central banks have been able to aggressively raise rates without harming the economy, then slowly cut them while launching hawkish messages, is nearly unprecedented.

Keeping this in mind, what is happening to bonds makes sense. Fixed-income investors have ruled out a “hard landing” for the economy, and have been persuaded by officials that returns on cash probably won’t dip below 3.5% for the foreseeable future. They have thus started demanding a larger reward to lock up their money for longer.

This term premium still isn’t huge: It is reportedly adding 0.6 percentage point to 10-year yields, when the historical average is 1.5 percentage points. The steepness of most of the yield curve remains mild by historical standards.

Action Line: When you’re ready to talk, let’s talk. But only if you’re serious. Email me at ejsmith@yoursurvivalguy.com.

Originally posted on Your Survival Guy.