With everyone talking about inflation, here’s a good question: What if they’re wrong? What if the Federal Reserve’s intention to keep rates higher for longer turns out to be a hope, and not a reality?

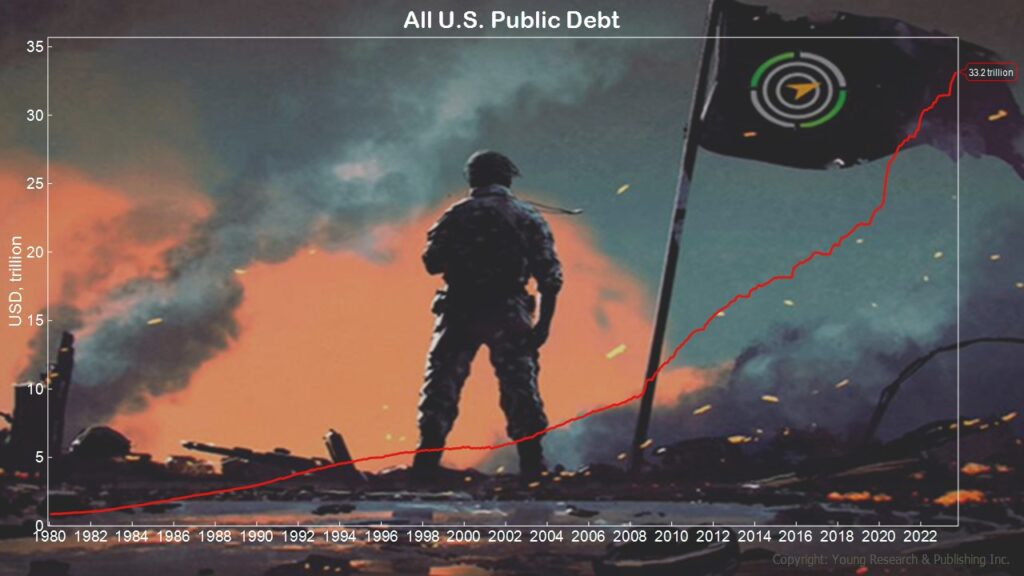

What if the dollar runs into trouble? With the record debt, America’s current standing as the nicest house in a bad neighborhood may get overrun by a zombie apocalypse.

What about deflation? With all this talk about rising prices, let’s not forget to stop and smell the roses in your neck of the woods. You can’t go into most cities after dark without being on high alert. As one friend writes, at night, the city lights are gone. It’s a ghost town. Will they ever be relit? Look at China, where real estate is in a deflationary death spiral. Why can’t it happen, or has it already?

Oh, but real estate always goes up. Does it? Maybe not on our schedules. Look at residential real estate where basement-level mortgage rates lock residents in their homes like a prison cell. Lower real estate brokerage commissions may remove the motivation to move the goods/people.

These are tectonic shifts. Interest rates higher than we’ve seen in a generation are juicy for the savers I write to like you. Where are rates headed? I’m not in the prediction business. Predictions are cheap. What I am interested in is for you to recognize the environment we’re in and that the stock market does not look healthy to me.

Does that mean I’m selling? No, of course not. I’m Your Survival Guy. I invest for times like these, and I do it with a keen eye on being paid in the form of dividends and dividend increases. I look for bonds that pay a decent yield, not the best, but decent. Looking for “the best” is a form of market timing, and that’s not my concern.

Action Line: Don’t look for Mr. Market and Mrs. Bond to do something for you. Keep what you make. Be patient. Breathe in, breathe out, move on. When you’re ready for help, let’s talk.

Originally posted on Your Survival Guy.