Look, sometimes life just goes your way. You wake up one morning and see interest rates you can sink your teeth into. It’s been years of zero-percent drudgery. Somehow, we got through it, and for many of you, your patience paid off. Today, dear fixed-income investors, you have a cornucopia of products paying yields one could only dream of not too long ago.

How about those of us holding onto fixed-income positions purchased through the drought years that began after the financial crisis? You know what? If you have a diversified portfolio with laddered maturities, you might be pleasantly surprised when you calculate the yield to cost. And, instead of looking at the lowest yielder (as we are apt to do), may I suggest looking at the whole, then consider where we’ve been, and understand we can’t invest through the rearview mirror.

But it’s foggy looking through the windshield.

Will interest rates go up from here?

Not my concern.

Look, I’m Your Survival Guy. I look at the lay of the land, not what I hope it to be.

I look at what the market’s giving today compared to what it was giving yesterday.

Am I trying to predict the future? No.

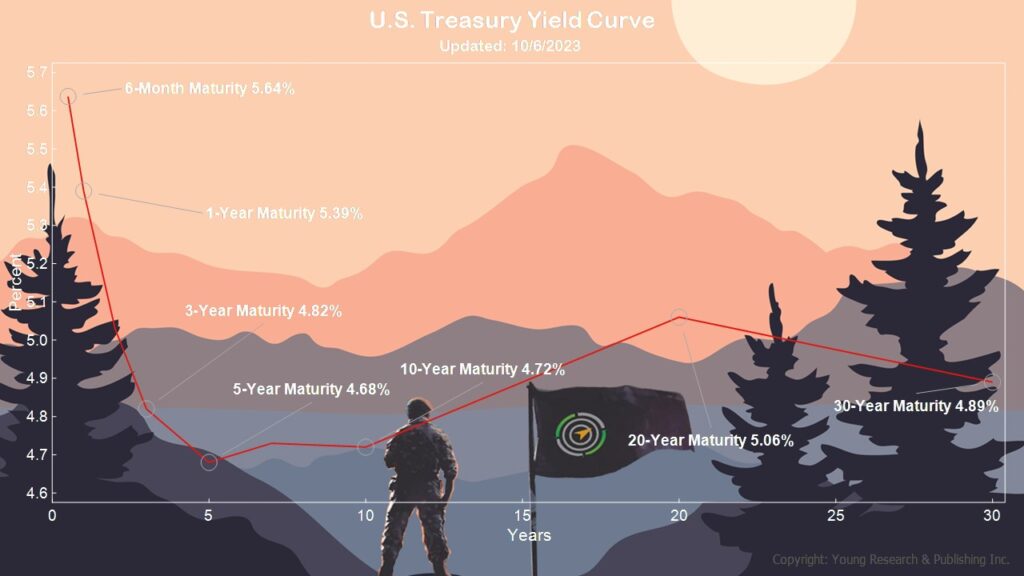

It’s hard enough to understand where we’ve been. Everyone’s wondering if the Fed will raise rates this year or next. Maybe. Don’t forget the Fed controls a tiny sliver of the yield curve.

My concern is getting paid today, understanding that fixed income is quantitative. Guessing where rates will be, or prices is qualitative. Thinking too much is just that—thinking. Taking action, beating inertia is hard, but it is necessary to be an investor as opposed to a talking head.

Action Line: Diversification and patience allow me to be an investor at all times. If you’d like to join me, let’s talk.

Originally posted on Your Survival Guy.