You hear it all the time today. “I’m getting an incredible rate on my money,” or “I can get you this on your money.” And so on and so forth. Yes, Your Survival Guy can see it, too, especially with rates at levels we haven’t seen in around 22 years. Opportunities are everywhere for the fixed-income investor. But that doesn’t mean you dump all your existing positions. That’s throwing the baby out with the bathwater.

Because when you sell an existing bond for pennies on the dollar, just to buy a higher yielding one, you’re making more interest on less dollars than what you initially started with. In other words, you’re spinning your wheels. That’s the math of it. But when emotions run high, it’s hard not to think about getting more when the full-court selling pressure is on. I understand.

Trying to get the “best” yields is a form of market timing. It is driven by price. Yes, if you have lazy cash sitting around doing nothing, this might be a good time to put it to work. But understand what you’re doing before selling into this market. There are plenty of buyers looking to separate you from your hard-earned savings.

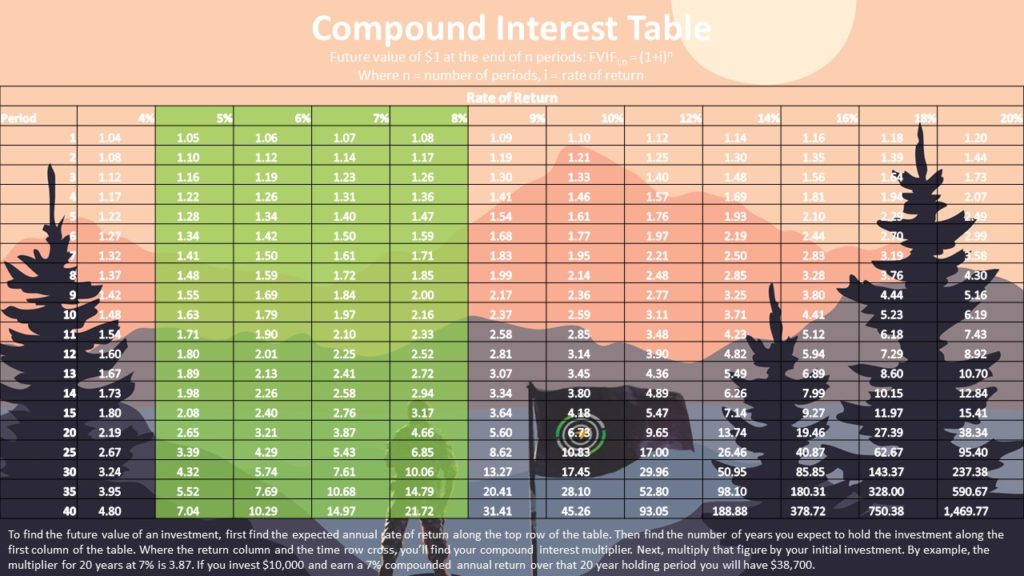

You don’t need to have the highest yielders to compound money into something worth having. Being a successful investor is simple, yet hard to do.

Action Line: Keep up with good habits, and good things tend to happen.

Originally posted on Your Survival Guy.