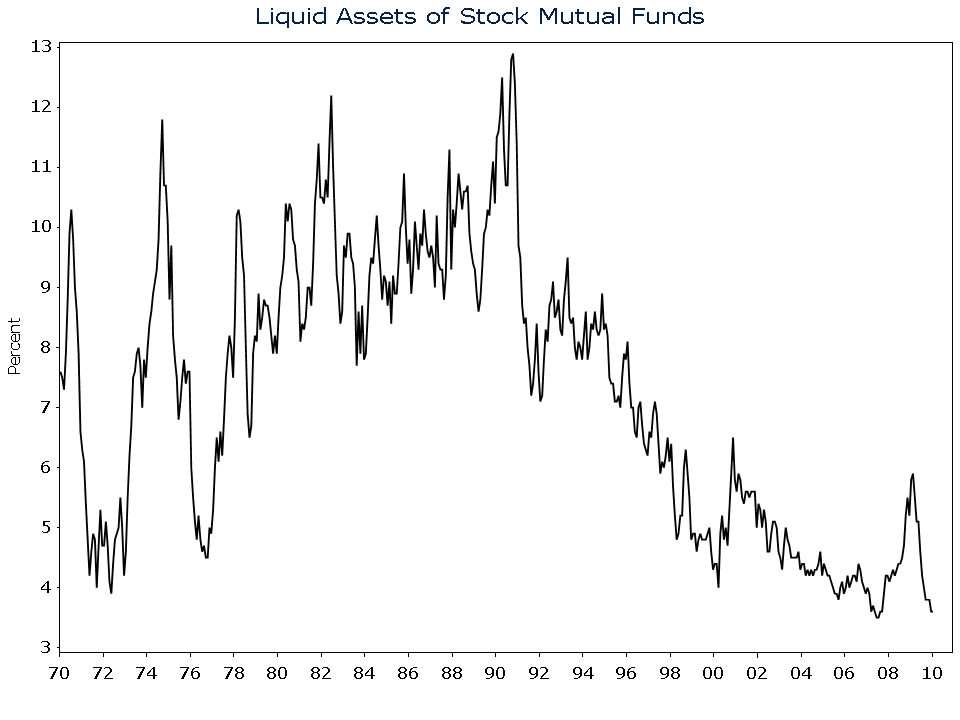

Cash levels as a percentage of total assets in stock mutual funds is bordering on an all-time low. When was that low hit? It was July 2007 – three months prior to the last bull market high. The dry powder in stock mutual funds that helped fuel a 72% rise in the S&P 500 from the March 2009 lows is spent. Individual investors still have dry powder, but they’re flocking to bonds and hoarding cash. Two vicious bear markets in 10 years’ time will do that. Stocks could move higher if individuals move aggressively back into the market, but if you are forming a long-term investment plan on the basis of what others may do, you are speculating, not investing.