Fidelity Investments, the nation’s top provider of retirement savings plans, reported that the average 401(k) balance reached a record high at the end of the first quarter. A record high—that sounds impressive. What was the average 401(k) balance? $74,900. When you consider that the median age of American workers is about 41, $75,000 is inadequate.

The average American is unprepared for retirement. He has too little saved, and he isn’t saving enough from current income to make up for the shortfall. USA Today reports that most employees enrolled in 401(k) plans have opted for a 3% savings rate when nearly everyone should be socking away at least 10% for retirement.

The best way to guarantee a financially secure retirement is to save as much as you can as early as you can. Save until it hurts. Money you save today is high-powered money. The key here is compound interest. Albert Einstein described compound interest as the greatest mathematical discovery of all time. Compound interest can turn a modest investment into a small fortune. As Ben Franklin said, “tis the stone that will turn your lead into gold.”

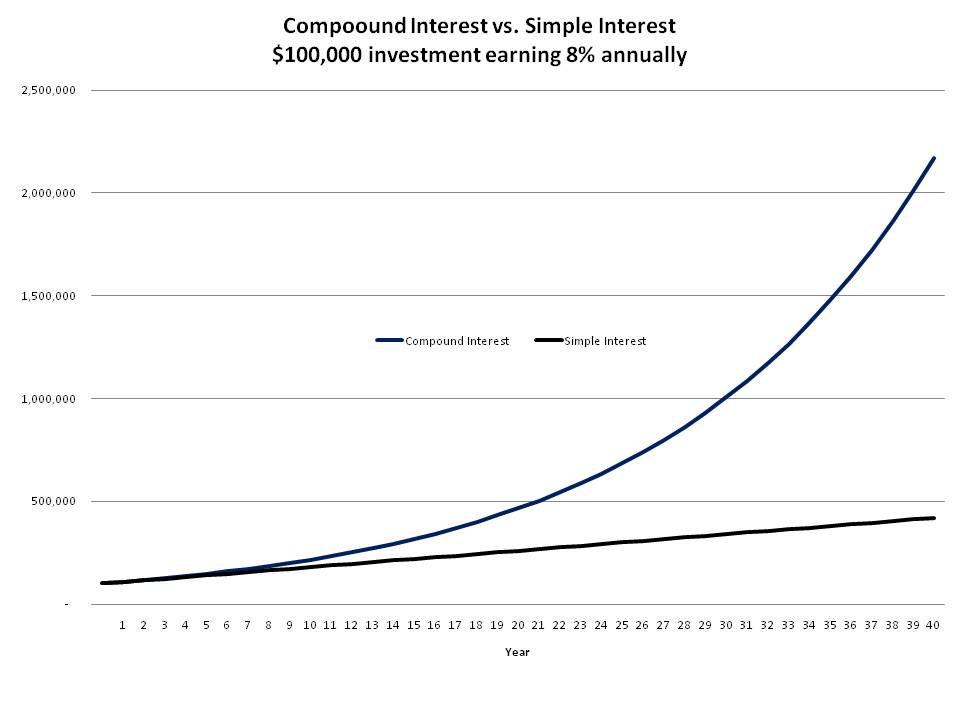

Many investors don’t fully understand or appreciate the power of compound interest. You can’t blame them. Compounding is an abstract concept, and its benefits are only realized over long periods of time. To really get a feel for the power of compounding, it is useful to compare an investment that earns compound interest to one that doesn’t. I’ve done that for you in the chart below. The blue line is the value of a $100,000 investment compounded at 8% annually, and the black line is the same $100,000 investment earning simple interest of 8% each year.

The difference between compounding and not compounding is barely noticeable after five years, but that difference grows exponentially as time passes. After 20 years, compound interest earns you an additional $206,000 on your initial $100,000 investment. After 30 years, that figure jumps to $666,000. And after 40 years, compounding earns you an additional $1,750,000 compared to an investment earning simple interest.

The takeaway here should be clear. To reap the full rewards of compound interest, save early and often. The longer you wait to start saving for retirement, the harder it gets. Take another look at my compound interest chart. A $100,000 investment compounded at 8% annually turns into $1 million after 30 years, but only $466,000 after 20 years. Those who put off saving will either have to work longer or save much more of their income to make up the difference.