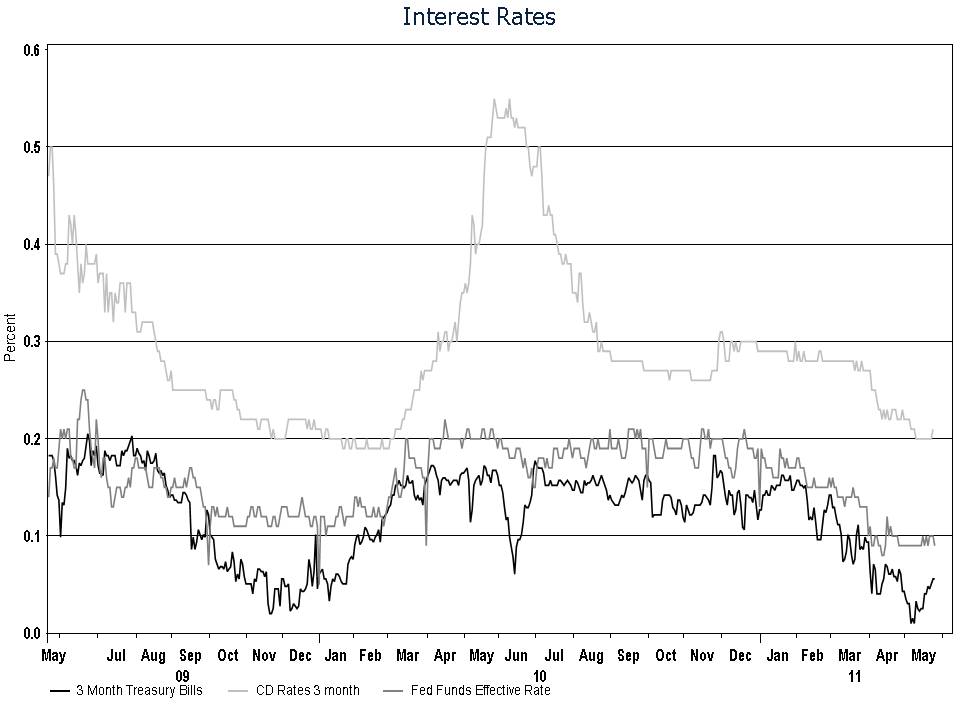

Just over thirty years ago, the 3-Month Treasury-bill yielded 16.3% in the secondary market. At the beginning of this month, as you can see in the chart above, it yielded only 0.01%. That’s 1 basis point, or a difference of 16.29%. It can’t possibly go below zero. Though the yield is already negative when accounting for inflation, as investors line up to pay to lend the government money.

Investors are in a real predicament, especially those living on a fixed income. How many investors built their retirement savings plans using such low rates as inputs in their models? Not many to be sure. After all, when you use such low rates of expected return like those on the T-Bill, your computer model might spit out: “Keep on working” or “You better save a lot more.” Or you might be saying “Welcome to Wal-Mart,” during your “retirement.”

Retirees tend to spend way too much in the early years of retirement. This is anecdotal evidence, but I’ve seen it done over and over again. It’s party-time once the lock to the treasure chest is finally pried open. And, it’s a lot of money to have available at your fingertips. But it has to last you a long, long time.

With rates so low, and investors using expected returns that are far too optimistic, it’s crucial to be realistic. This is certainly not the time to be expecting anything great from the market. At the end of the day, the market doesn’t care if your retirement goals are met or not. And if you’re not prudent, you may outlive your money.