The Shanghai A-share stock index is up 79% YTD, making it the second-best-performing stock market in the world. What is driving the resurgence in Chinese shares? China is a command economy. When the government wants to get something done, it happens.

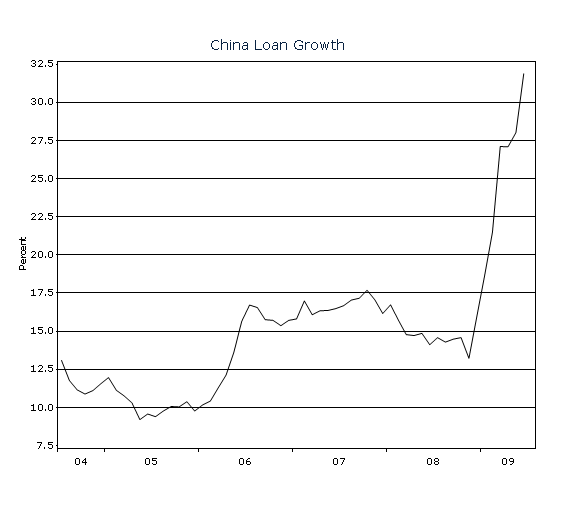

Want to implement a monetary stimulus plan? Just encourage banks to start lending. To combat the credit crisis, China implemented the conventional monetary stimulus measures that all central banks resort to when they want to stimulate the economy. The country’s main policy rate was cut, and reserve requirements were reduced, but China’s most powerful monetary stimulus was simply “encouraging” banks to lend. And lend they did. My chart shows that China’s annual loan growth surged to 32% in June from 13% last November. The pace of monetary expansion has been breathtaking. China’s M2 money supply is up 28% over the last year. Liquidity is abundant and spilling into the stock market.

Speculation is running rampant in China. The Shanghai A-share stock index is now trading at 35X earnings. IPOs are oversubscribed and doubling and tripling on their first day of trading. Is there a bubble in Chinese stocks? There are certainly signs of one. But in a command economy, bubbles can last until the governing class decides it is time for them to end. I’m not willing to commit capital on the basis of the whims of Chinese bureaucrats, and I advise the same for you.