Although the stock market is basically flat YTD, there is rampant speculation bubbling under the surface. The bubble conditions in the stock market are evident in the flood of junk IPOs the investment banks are unloading on the public, the ridiculous valuations of the social networking stocks, the bidding wars for start-ups without a viable business plan, and the massive buildup in margin debt.

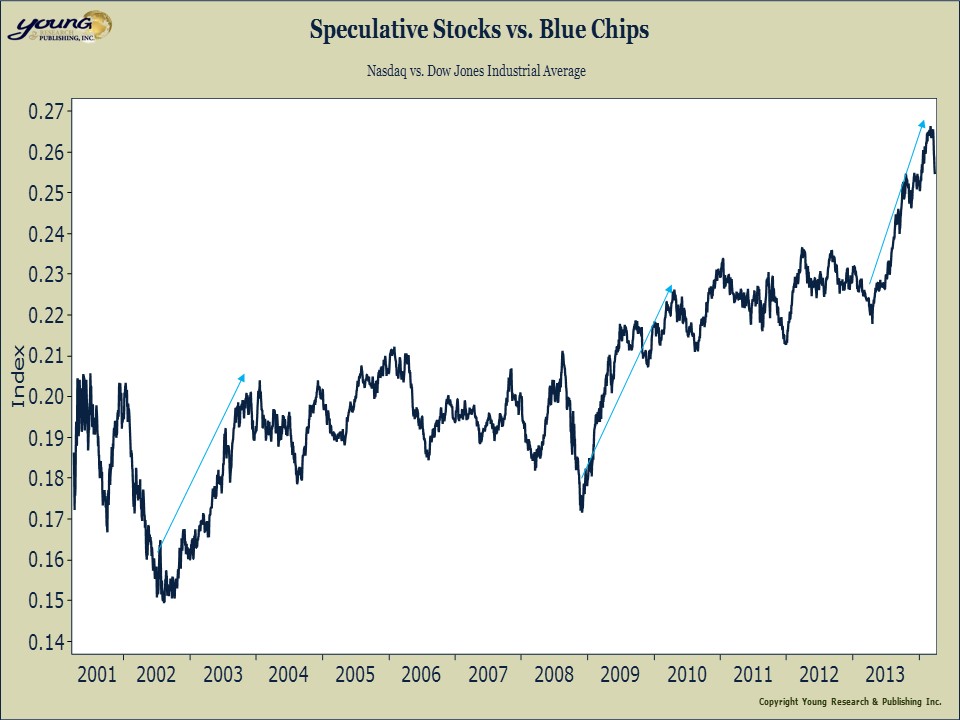

The speculative conditions in the market are best captured by the ratio of the NASDAQ to the blue-chip Dow Jones Industrial Average. When NASDAQ stocks are beating the blue-chips by such a large margin, you can be sure there is speculative froth in the market. Today, we are looking at one of the most speculative markets in over a decade.

Unless you are taking a reckless amount of risk, chances are the hot money crowd is leaving you in the dust. That’s fine, if temporarily unpleasant. You don’t want to chase performance in a speculation-driven market. Enduring periodic bouts of lagging performance is what enables savvy investors to generate the long-term returns that trump those of the average investor.

What is a long-term investor to do today? At Young Research, we are advising investors to craft portfolios focused on dividend payers that are out of favor.

What securities are out of favor? Anything related to precious metals is viewed as ghastly and grizzly by institutions and individuals alike. Precious metals shares have taken a savage beating, both on an absolute basis and relative to gold. The Market Vectors Gold Miners index is down over 60% from its highs in 2011 and almost 50% since year-end 2012. You would be hard pressed to find a more out of favor sector in the market.

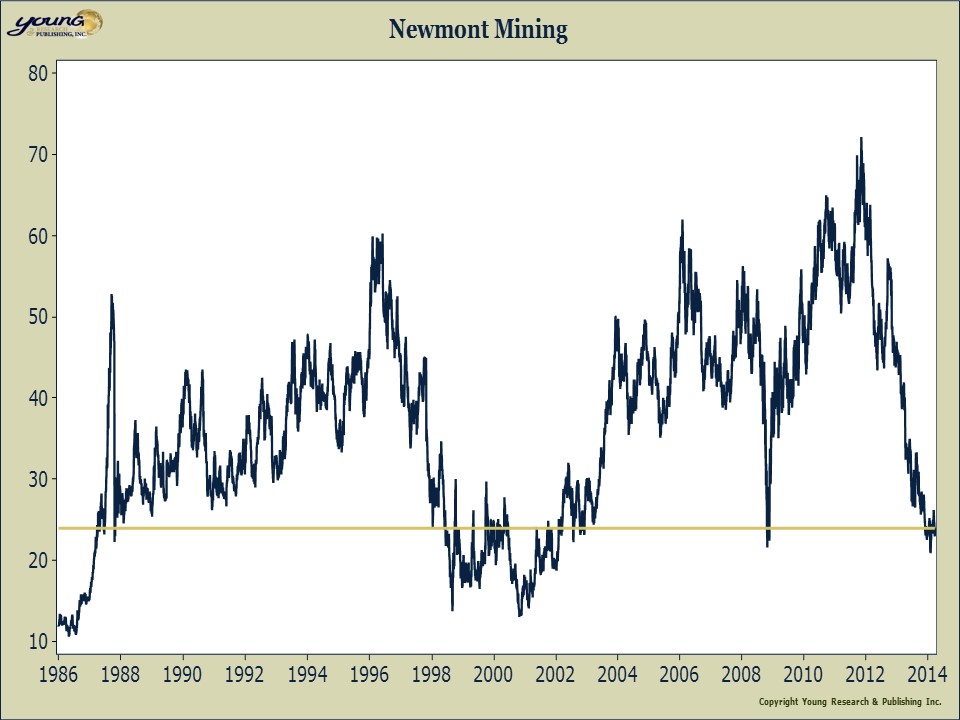

In our premium strategy reports, we have recommended a range of dividend paying precious metals shares. One of our favored gold names today is Newmont Mining.

Founded in 1921, Newmont Mining is one of the largest Gold Producers in the world. Newmont has significant assets in the United States, Australia, Peru, Indonesia, Ghana, New Zealand and Mexico. Founded in 1921 and publicly traded since 1925, Newmont is the only gold producer included in the S&P 500. Like many of the precious metals miners, Newmont is deeply out of favor with the investing public. Newmont shares are trading no higher than they were in the first quarter of 1987 when gold was trading for a third of what it changes hands for today.

Anytime you buy something as out of favor as Newmont, you should be prepared to hold, not for weeks or months, but for years. Patience is the mandate when you invest in out of favor names. You trade short-term profits for the prospect of substantial long-term gain.