Prior to 1913, the federal government was constrained from directly taxing personal income. Along came the 16th Amendment and the concept of limited government was thrown out the door. In 1913 the highest marginal rate was 7% on income over $500,000 ($10,495,000 in 2004 dollars). Compare that to today’s highest marginal rate of 35% on income above $319,100. It’s an utter disgrace.

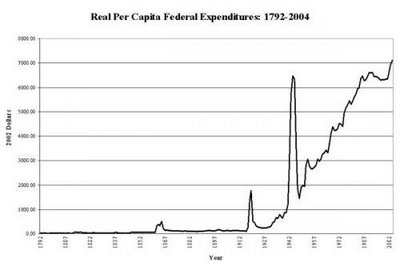

And why, you may ask, have our elected officials confiscated a growing portion of our income? Why else? To increase government spending on unneeded federal programs. Look at the chart below – prior to the passage of the 16th amendment government spending was very low and very stable. After the 16th amendment was passed expenditures went through the roof. We gave them an inch and they took a mile.