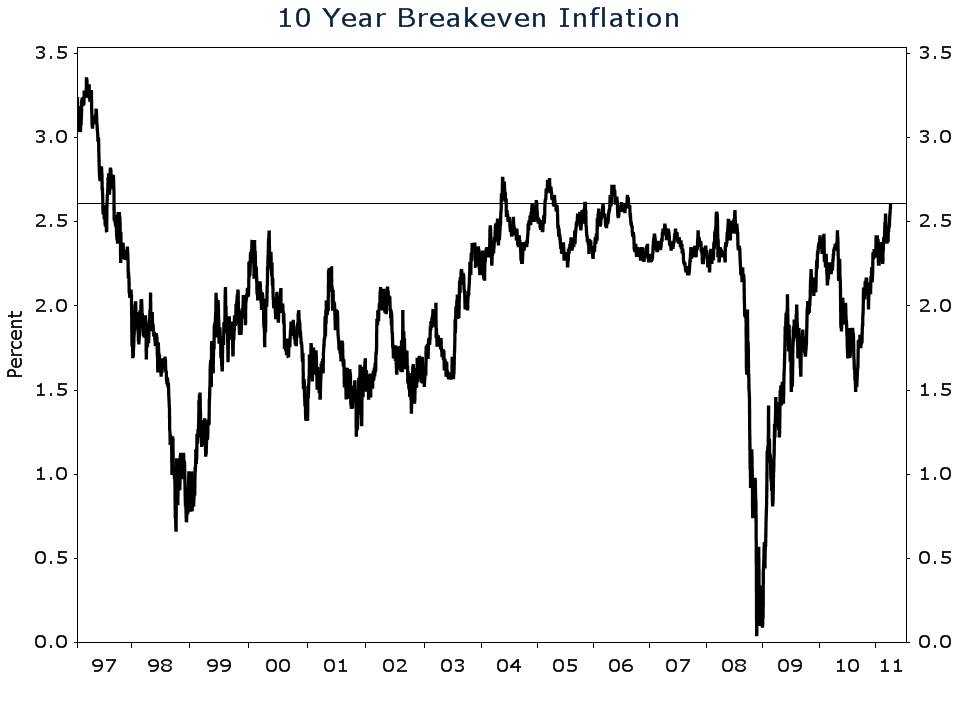

This is a scary looking chart. The chart shows the 10 year breakeven inflation rate. This is the inflation rate that investors are anticipating over the coming ten years. Expected inflation has surged over a full percentage point since the Fed started their second money-printing crusade.

This is unsettling. The central bank is losing credibility by the day. Over the last ten years, inflation expectations have only reached these heights on three other occasions. All three times, the Fed was either tightening monetary policy or on the verge of doing so. Today, the Fed is still easing monetary policy and there are few signs that policy will be tightened anytime in 2011. Will the Fed surprise the markets and turn hawkish, or side with the doves and continue to ease? In either case, things are about to get real interesting real fast. Stay tuned.