Originally posted July 26, 2018.

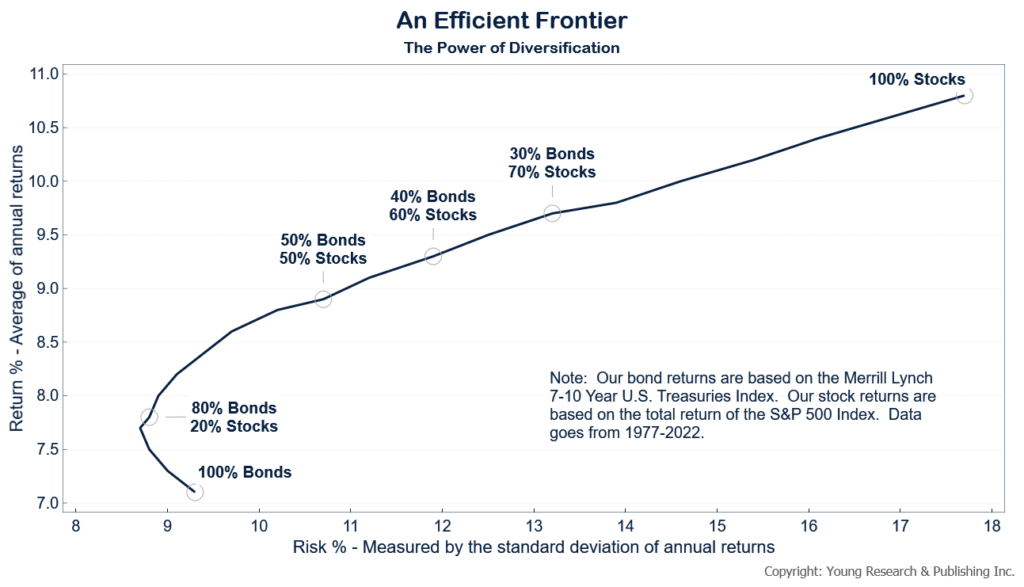

The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Investors must consider the trade-offs between risk and reward in their portfolios. You can see on the chart below an efficient frontier line representing risk vs. reward for a portfolio allocated between different proportions of stocks and bonds using data back to 1977.

On the vertical axis is the return earned by the portfolios, and along the horizontal axis is a measure of how much risk was taken to earn those returns. As you can see by comparing the portfolio of 75% bonds and 25% stocks to the portfolio of just bonds, as portfolios take on a small number of stocks, the benefits of diversification lower risk and increase reward. Anything above the line is unachievable because no portfolios earning those returns are available at the corresponding risk levels. And any portfolios that fall below the line can be outperformed with the same amount of risk or have their returns matched with less risk.

But to achieve higher returns along the line, investors adding more stocks to their portfolios are taking on ever greater amounts of risk. A portfolio of 100% stocks boasts a standard deviation of 17%. With that kind of risk, you can expect the market to lose about 30% of your assets every 20 years or so. That’s being generous given what stock investors have endured in the last decade. Be aware of the risk in your portfolio and manage it wisely.