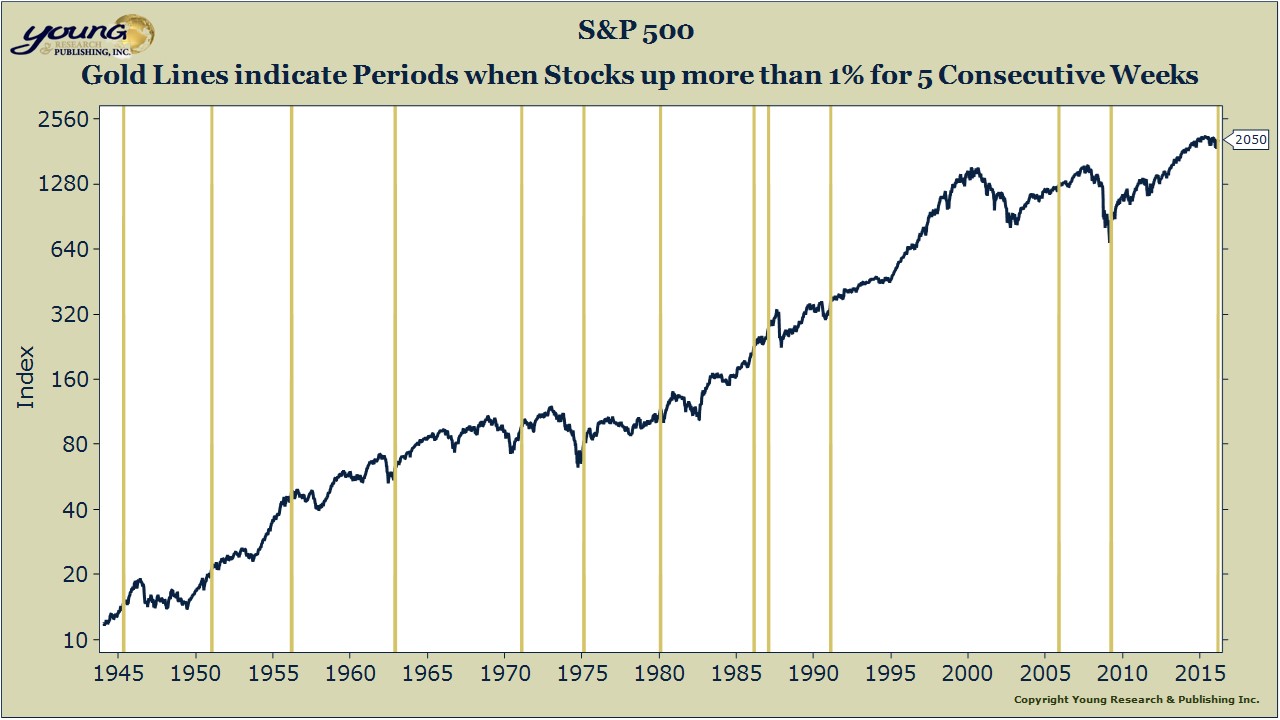

The two-decade bull market in stocks that ended in 2000 convinced a generation of investors that stocks are the best long-term investment. Dow 36,000 and Stocks for the Long Run became cocktail-party fodder. There is no questioning that stocks put up some impressive numbers in the 1980s and 1990s. From year-end 1981 to year-end 1999, the index rose at an 18.5% compounded annual rate. At an 18.5% rate of growth, you double your money every four years. Of course, the last decade hasn’t been as kind to investors, but despite a decade with almost no return, the S&P 500 has still earned a better-than-average compound annual return of 11% since 1981.

Given the impressive performance of stocks over the last three decades, you might be surprised to learn that since 1981, bonds have not only beaten but crushed stocks. My chart below compares a hypothetical investment in 30-year Treasury zero-coupon bonds (rolled annually to maintain a 30-year maturity) to the return on the S&P 500. Since year-end 1981, 30-year zeros are the clear winner. Even at the height of the stock market euphoria in 1999, the gain on a hypothetical 30-year Treasury zero investment (rolled annually) would have earned an investor more than stocks.

That is not a recommendation to buy 30-year zeros. The return in 30-year zeros over the last three decades will not be repeated. Bonds benefited from a one-of-a-kind secular decline in interest rates. Long rates are now flat on their back with nowhere to go but up.

The takeaway here is twofold. First, question the conventional wisdom. Most investors assume that you have to invest in stocks to earn the highest returns. As my chart above shows, the profit opportunities in the bond market can match and even exceed those in the stock market. Second, recognize the role that falling interest rates played in stock-market returns over the last three decades. Just as long zeros benefited from the secular decline in interest rates, so did stocks. Investors crafting all-stock portfolios on the basis of 11% long-term equity returns are likely to be disappointed. To avoid the disappointment, craft a balanced portfolio (stocks and bonds).