As you know from here, here, and here, your investment success may hinge more on how you invest rather than what you invest in. My efficient frontier (EF) series gets to the heart of this. It’s a tool for looking back at the risk/reward relationship between stocks and bonds. What it helps to illustrate is that there can be more risk in having all your eggs in one basket. Easy to understand. Hard to do.

The key to the EF for you is less about understanding stocks and bonds and more about you understanding you. What is your risk tolerance? What can you handle? I can tell you from experience in talking with investors and managing portfolios in the line of fire—one’s risk tolerance becomes intolerance when markets fall. And sometimes they fall hard. That’s just human nature. Everyone likes to win, but they hate losing twice as much.

As I’ve told you before, a common refrain I hear is, “I want preservation of principal and growth.” I hear you. I’d like that for you too. “Well, that’s why I’m hiring you,” they say. And then it hits me. It’s at that moment I realize they don’t read Your Survival Guy, and I have my work cut out for me. Sometimes, it’s better if we go our separate ways. You can’t teach what they refuse to learn.

But learn they do because the school of hard knocks has a perfect graduation rate. And if you thought college was expensive, I can tell you it’s a drop in the bucket when seeing how careless investors are with money.

We’ve lived to talk about three nasty markets so far this century. There will be more, just not on our schedule. It’s been my experience that investors do have a breaking point. It’s when they realize “I can’t afford to lose any more money.” And that’s when the selling takes place. The capitulation. It has less to do with markets and more to do with the emotional and physical cost of losing money.

Action Line: We all want to be self-reliant. To be able to deal with what comes our way. One of the more satisfying tasks of the successful investor is mustering the patience to get through tough markets alive. It just may come down to understanding what you can’t afford to lose before it happens. When you want help, let’s talk.

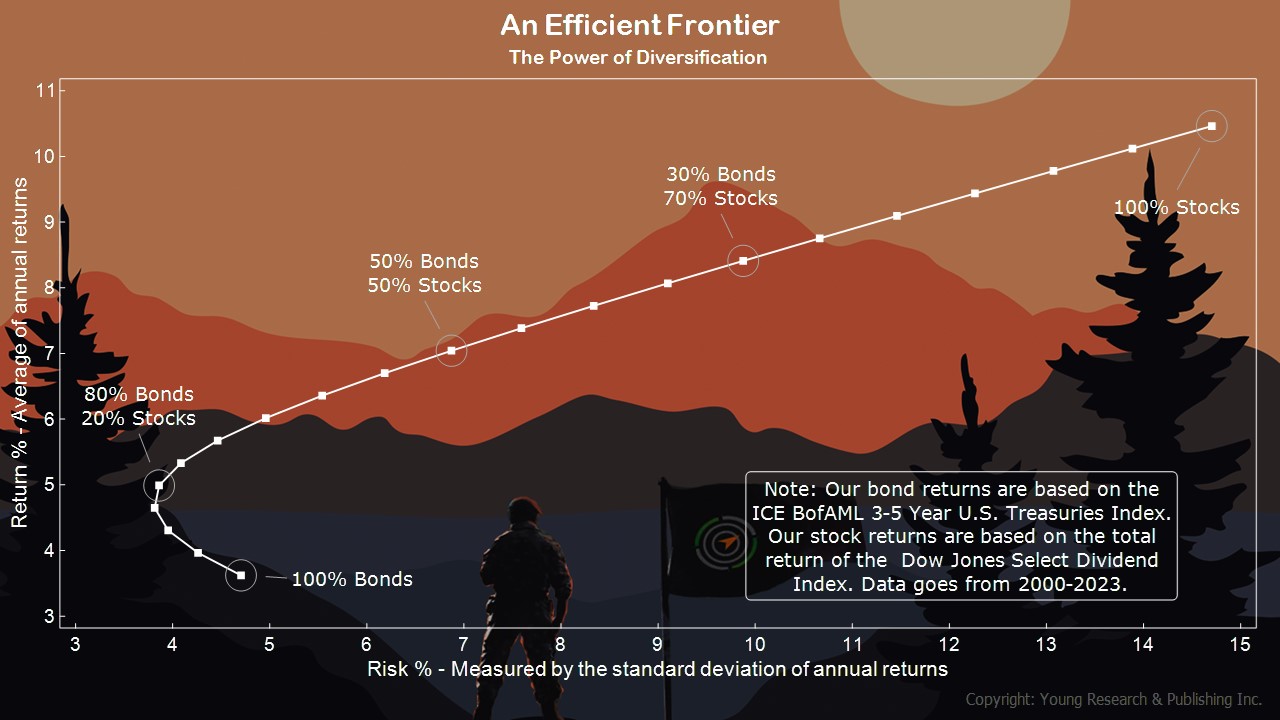

The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Investors must consider the trade-offs between risk and reward in their portfolios. You can see on the chart above an efficient frontier line representing risk vs. reward for a portfolio allocated between different proportions of stocks and bonds.

Originally posted on Your Survival Guy.