Rebecca Elliott of The Wall Street Journal reports that Tesla cited production setbacks for a drop in sales, which was worse than analysts expected. She writes:

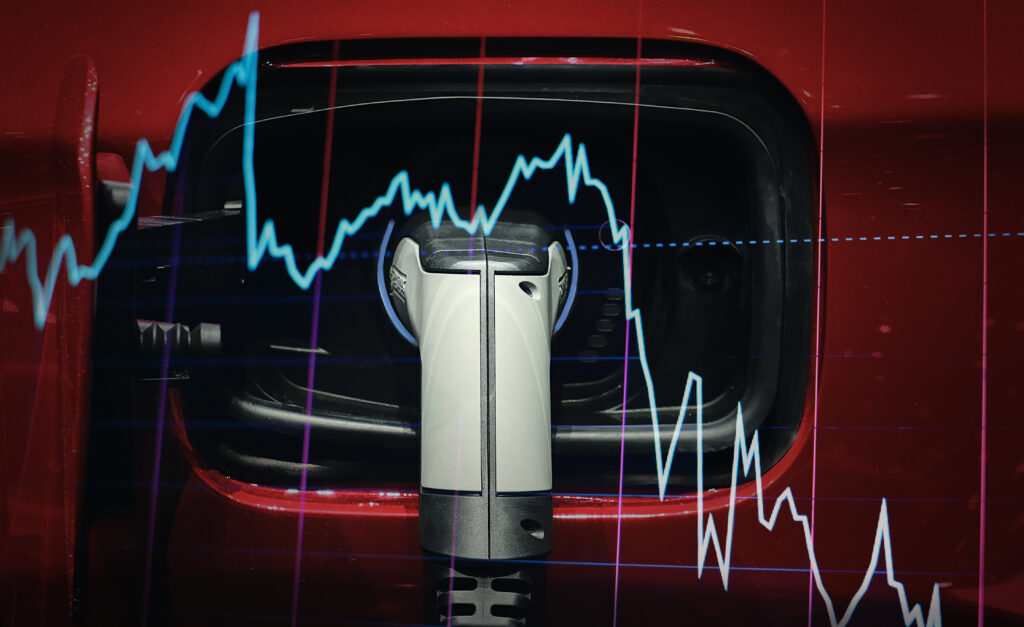

Tesla TSLA reported its first year-over-year decline in quarterly deliveries since 2020, badly missing Wall Street’s expectations and stoking further concern about the company’s growth prospects this year.

Elon Musk’s electric-vehicle maker delivered 386,810 vehicles globally in the first three months of 2024, down 8.5% from a year earlier. It was the company’s lowest quarterly performance since the third quarter of 2022.

The result was enough for Tesla to reclaim the title from China’s BYD as the world’s top electric-vehicle seller on a quarterly basis. Yet, it is a troubling sign for the world’s most valuable automaker and the overall EV market, where growth is slowing and automakers are recalibrating investment plans after finding consumers to be less enthusiastic about going electric than the companies had expected. […]

Revenue is expected to climb some 4% year-over-year to $24.3 billion, according to FactSet.

Morgan Stanley analyst Adam Jonas, who has long been bullish about Tesla, wrote in a recent note to investors that the automaker “may be witnessing price-cut fatigue” as profitability narrows. “Such conditions may not significantly improve near-term given the age of Tesla’s product line-up,” he wrote.

Read more here.