Your Survival Guy does not stay awake at night worrying about what the market’s going to do for me. I do not worry about “annual” returns or “comparisons” to benchmarks. These are metrics for those worried about “keeping up with the Joneses.” The more difficult path in this business is to be Your Survival Guy, and follow the Prudent Man Rule and ignore the noise of the markets.

In the September 2015 issue of Richard C. Young’s Intelligence Report, Dick Young wrote:

The Prudent Man Rule is based on common law stemming from the 1830 Massachusetts court formulation Harvard College v. Amory. The Prudent Man Rule directs trustees “to observe how men of prudence, discretion and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital invested.”

Since I started our family investment management firm in 1989, I have operated under the assumption that the Prudent Man Rule to this day carries as much weight as it did in 1830. Common sense and prudence just don’t go out of style—ever.

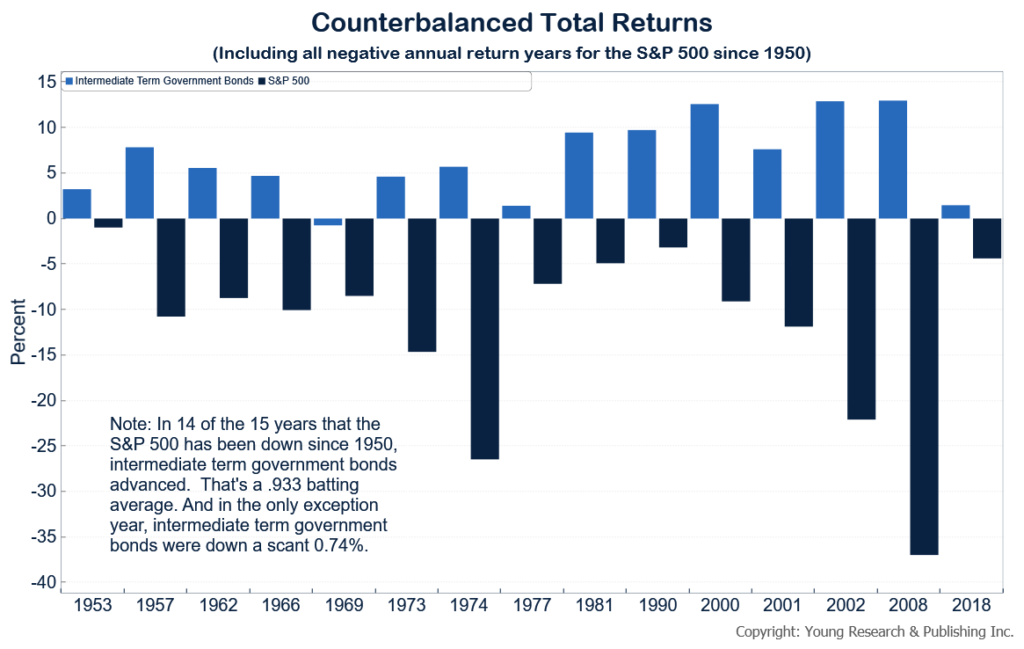

Have a mix in bonds and stocks at 70-30, or 30-70, as advised by Ben Graham and Richard C. Young. Study the display below. (Notice that 2018 was the last down year for stocks. This is up to date.)

Here’s Your Survival Guy’s takeaway: Today, the key is to invest directly in bonds and stocks, so you own your positions outright and not in a mutual fund or ETF. Why? Because when you invest with a group of other investors, they may panic and sell, forcing the fund to liquidate positions like Facebook.

Action Line: Money can bring you happiness ONLY if you can keep it. Investing is hard. Investors tend to learn the hard way. Your Survival Guy is here for a reason.

Originally posted on Your Survival Guy.