Many Americans have wondered why the stock market has bounced so much in the face of an unemployment rate exceeding 20% and economic growth that may fall at the fastest rate on record in the current quarter.

Fiscal stimulus is one reason, but as has often been the case over the last decade a Federal Reserve that views its primary job as supporting asset markets is likely a larger cause.

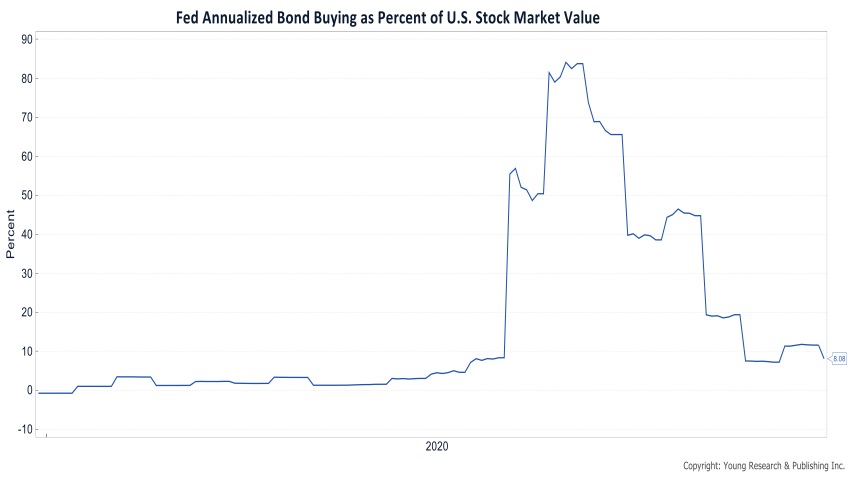

Below we present the annualized weekly increase in the Fed’s debt monetization program as a percent of total stock market value.

The numbers are truly staggering.

In the early weeks of the COVID Crash the Fed was buying Treasury and Mortgage bonds at a rate equal to 80% of the total value of all publicly traded U.S. stocks.

Ponder that for a minute. Fed money printing has completely overwhelmed private investment.

Even today, the Fed is printing at a rate of over $2.5 trillion per year which is double U.S. personal savings.

The stock market is not the economy to be sure, but that seems to be true more now than ever.