A slew of industrial reports were released by the Federal Reserve this week. All of the releases’ headline numbers missed analysts’ estimates. The picture painted by the charts below indicates an uneven recovery hampered by residual weaknesses in certain sectors of the economy.

The Empire State Manufacturing Survey came out Monday. Growth in New York’s manufacturing industry slowed, with prices still climbing. One of the biggest problems New York manufacturers cited for their business was trouble finding skilled employees, especially those with advanced computer skills and those with an understanding of basic mathematics. New York manufacturers noted that growth in new orders and shipments slowed, a sign of future weakness.

Next up on Tuesday was the Fed’s national Industrial Production report, which came in flat for the month. After a strong pickup in an unseasonably warm February, suppliers for the construction industry decreased production by 1.3%. That’s the biggest drop since December 2009. Without sustained growth in the housing market it is unlikely the U.S. will see a rapid recovery. The decline in production of construction materials is not an optimistic sign for the sector.

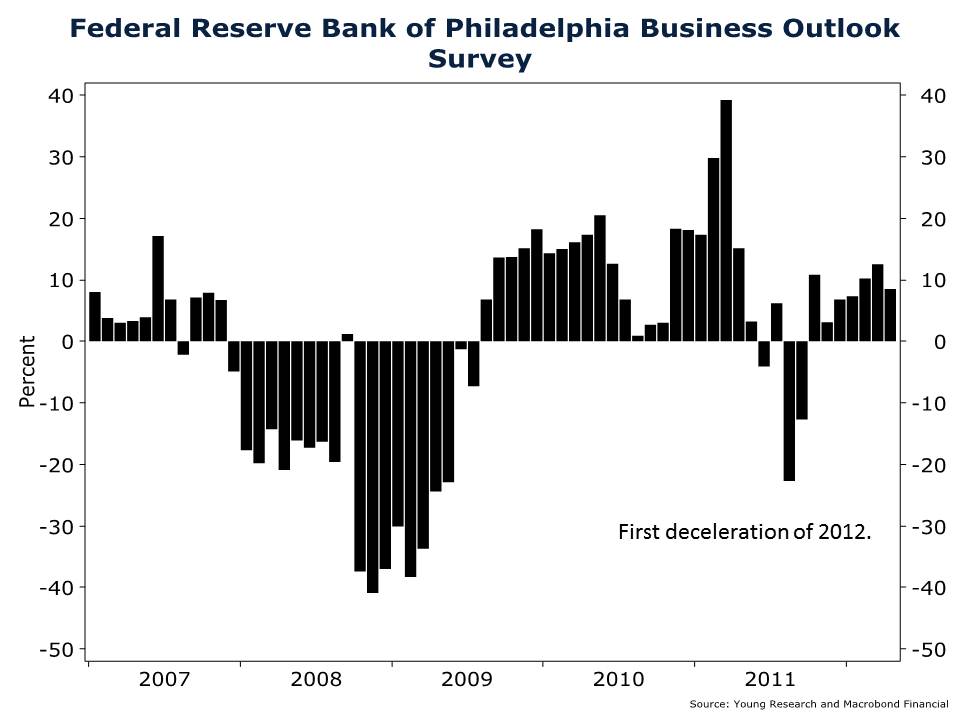

The Federal Reserve Bank of Philadelphia reported its Business Outlook Survey on Thursday. The report continued the theme of mediocre economic recovery. Like the New York report, the Philly Fed reported that growth in New Orders decelerated. Fewer new orders are a sign of reduced future business. All in all, a grim set of numbers for the manufacturing sector.