The Labor Department released July numbers for consumer, producer, and import price inflation this week. The results were troubling. Consumer prices increased 3.6% compared to last year, producer prices increased by 7.6%, and import prices increased by a whopping 14%. Even the Federal Reserve’s preferred measure of inflation (core consumer price inflation, known as core CPI, which is inflation minus food and fuel) came in ahead of expectations. Core CPI increased by 1.8% over the last year. The Fed’s unspoken growth target for core CPI is 2%.

Because the Fed still believes inflation is contained, Mr. Bernanke recently pledged to hold interest rates near zero for another two years. The Fed’s rate commitment has pushed short- and intermediate-term Treasury yields below 1%. A five-year T-note now yields 0.92%—after adjusting for inflation of 3.6%, investors are losing money. The only Treasury security that even comes close to covering inflation is the long bond. Today, a 30-year Treasury security will pay you 3.57% in interest.

Should savers and retired investors take the Fed’s bait and invest in long bonds? Not when you have a Fed chairman with a money-printing habit and prominent economists such as Ken Rogoff, the former chief economist of the International Monetary Fund, calling for a “sustained burst of moderate inflation, say, 4–6% for several years.”

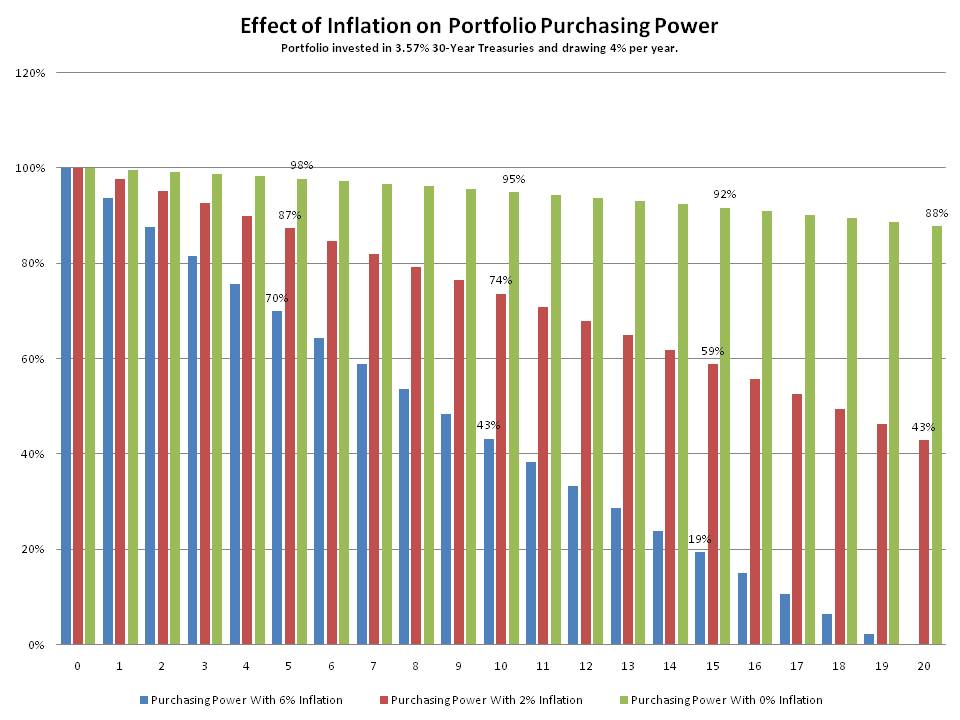

Rogoff’s prescribed dosage of inflation would swiftly decimate a portfolio of long bonds. In the chart below, we show the buying power (as a percentage of initial value) of a hypothetical retired investor’s portfolio of 30-year Treasuries (at a 3.57% yield). We assume our retired investor draws 4% of the initial principal, adjusted for inflation annually.

In blue you can see the effects of Rogoff’s plan of 6% inflation, and in red are the effects of the Fed’s implied inflation target of 2%. In green is a zero-inflation environment.

Both the Fed’s and Rogoff’s plans offer little protection for investors’ wealth, but Rogoff’s plan strips retirees’ buying power at a rapid pace. After five years, Rogoff’s plan cuts the buying power of a portfolio of long bonds in half, and after 20 years the portfolio is depleted.

If you are in need of income, long bonds aren’t the place to look. In our monthly strategy reports, we help subscribers craft portfolios that offer a steady stream of income without the risk of a portfolio of long Treasuries.